BTC Price Prediction 2025: Is Bitcoin Consolidating Before Its Next Major Rally?

- What's the Current Technical Picture for Bitcoin?

- Why Are Institutional Investors Sending Mixed Signals?

- How Are Fundamental Developments Impacting BTC's Price?

- What Are the Potential Price Scenarios for Bitcoin?

- What Do On-Chain Metrics Reveal About BTC's Future?

- Bitcoin Price Prediction FAQ

Bitcoin (BTC) finds itself at a critical juncture in November 2025, trading below key moving averages but showing signs of potential rebound. This comprehensive analysis examines the mixed signals in BTC's technical indicators, institutional flows, and fundamental developments that could determine its next major price movement. We'll explore the current market structure, analyze conflicting signals from whales and institutions, and provide three potential price scenarios for the coming months based on technical analysis from the BTCC team.

What's the Current Technical Picture for Bitcoin?

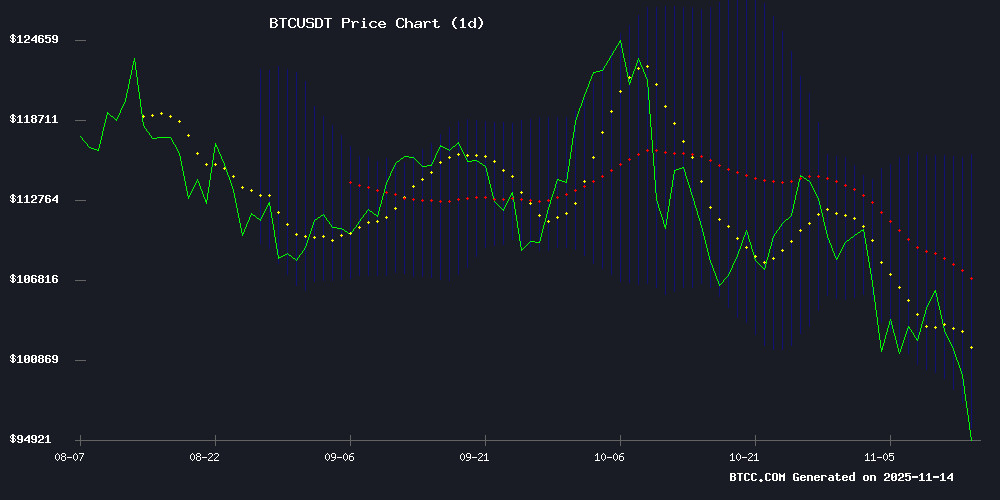

As of November 14, 2025, Bitcoin presents a fascinating technical setup that has traders divided. The cryptocurrency is currently trading below its 20-day moving average of $106,080.24, which typically suggests short-term bearish pressure. However, several indicators hint at potential upside:

Source: BTCC Trading Platform

The MACD histogram shows bullish momentum at 1,325.18, while the price hovers NEAR the lower Bollinger Band at $96,387.62 - a level that often precedes mean reversion. "We're seeing classic signs of both exhaustion and accumulation," notes a BTCC market analyst. "The $96K-$98K zone appears to be forming a local bottom, but confirmation requires a break above $106K."

Why Are Institutional Investors Sending Mixed Signals?

The institutional landscape presents a fascinating dichotomy in Q4 2025. On one hand, we're seeing significant outflows from bitcoin ETFs and whale selling, including a notable $600 million liquidation by early adopter Owen Gunden after 13 years of holding. On the other, we're witnessing growing institutional adoption:

- The Czech National Bank allocated $1 million to a test portfolio including Bitcoin

- Cash App integrated Bitcoin Lightning Network payments

- Michael Saylor continues advocating for Bitcoin surpassing gold by 2035

This institutional tug-of-war creates what some analysts call a "reaccumulation phase" before another potential leg up. The market's resilience at the $100,000 support level despite the selling pressure suggests there's substantial demand at current prices.

How Are Fundamental Developments Impacting BTC's Price?

Several fundamental factors are influencing Bitcoin's price action in late 2025:

Cash App's Lightning Network Integration

Jack Dorsey's Cash App made waves in November with its significant crypto upgrade, introducing Bitcoin Lightning Network payments with zero fees for eligible users. The update includes over 150 refinements and cleverly allows routing through USD balances, eliminating the need to hold BTC for Lightning access. This move could significantly boost Bitcoin's utility as a payment method.

Central Bank Crypto Experiments

The Czech National Bank's $1 million "test portfolio" marks growing institutional curiosity, even among traditionally conservative monetary authorities. While Governor Aleš Michl framed this as an operational test rather than a policy shift, it follows similar exploratory moves by the Swiss National Bank and Bank for International Settlements.

Mining Industry Developments

The Bitcoin mining sector shows both challenges and resilience. Bitdeer Technologies announced a $400 million convertible notes offering just days after a fire destroyed its Ohio facility, demonstrating continued institutional confidence. Meanwhile, Bitfarms reported disappointing Q3 earnings with a 16.7% revenue miss, highlighting the sector's volatility.

What Are the Potential Price Scenarios for Bitcoin?

Based on technical analysis and market structure, the BTCC team outlines three potential scenarios for Bitcoin's price movement:

| Timeframe | Bull Case | Base Case | Bear Case |

|---|---|---|---|

| 1 Month | $115,772 (Upper Bollinger) | $106,080 (20MA) | $96,387 (Lower Bollinger) |

| 3 Months | $138,900 (2024 ATH +20%) | $120,000 | $85,000 (2025 Support) |

Key factors that will determine which scenario plays out include:

- MACD momentum confirmation

- Institutional flow reversal patterns

- Lightning Network adoption metrics

- Long-term holder behavior

What Do On-Chain Metrics Reveal About BTC's Future?

On-chain data presents a nuanced picture of Bitcoin's supply dynamics. While long-term holders have accelerated their sell-off (approximately 815,000 BTC sold in the past 30 days), over 68% of Bitcoin's supply hasn't moved in over a year. This suggests that while some early investors are taking profits, the majority remain committed.

CryptoQuant's Bull Score Index reflects the market's dramatic sentiment shift - from 80 during Bitcoin's October all-time high of $126,000 to just 20 in mid-November. However, whale accumulation has reached levels not seen in months, indicating strong conviction from major investors despite the price volatility.

Bitcoin Price Prediction FAQ

Is Bitcoin expected to rise in 2025?

Bitcoin's 2025 outlook remains mixed. While technical indicators suggest potential for upside, particularly if it can break through the $106,080 resistance level, macroeconomic uncertainty and institutional outflows create headwinds. The BTCC team's base case suggests a potential MOVE to $120,000 in the next three months if current support levels hold.

Why is Bitcoin's price struggling in November 2025?

Bitcoin faces several challenges in November 2025 including institutional ETF outflows, long-term holder distribution, and macroeconomic uncertainty regarding Federal Reserve policy. The US government shutdown's aftermath has also contributed to fragile market sentiment despite the resolution.

What's the best-case scenario for Bitcoin's price?

The bullish scenario suggests Bitcoin could reach $138,900 in the next three months (a 20% increase from its 2024 all-time high) if institutional flows reverse positively and Lightning Network adoption accelerates significantly.

How reliable are Bollinger Bands for Bitcoin predictions?

Bollinger Bands have historically been effective in identifying potential reversal points for Bitcoin, especially when combined with other indicators like MACD. The current position near the lower band suggests potential for mean reversion, but requires confirmation from other factors.

Should I buy Bitcoin now?

This article does not constitute investment advice. However, the current technical setup shows both risks and opportunities. Some analysts view the $96K-$98K zone as an attractive accumulation area, but investors should conduct their own research and consider their risk tolerance.