ETH Price Prediction 2025: Will Ethereum Hit $5,400 This Month? Expert Analysis

- What Do Ethereum's Technical Indicators Reveal?

- How Is Institutional Adoption Impacting ETH?

- What Are the Key Resistance Levels to Watch?

- Is Ethereum's Staking Situation Affecting Price?

- What Do On-Chain Metrics Suggest?

- Could ETH Really Reach $10,000?

- Frequently Asked Questions

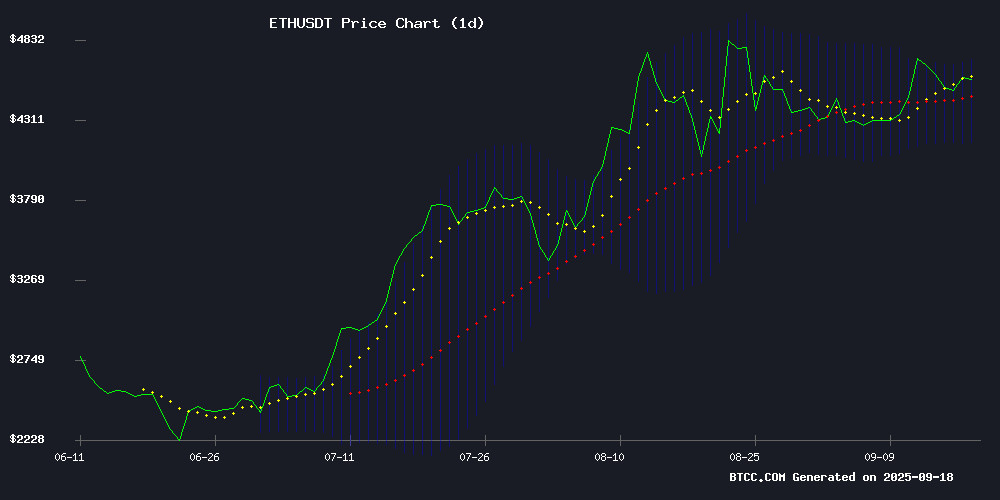

Ethereum is showing bullish momentum as we approach the end of September 2025, with technical indicators suggesting potential upside toward $5,400 and beyond. The cryptocurrency currently trades at $4,604.21, holding firmly above its 20-day moving average while institutional adoption accelerates through moves by American Express and Grayscale. Our analysis combines chart patterns, on-chain data, and market developments to assess whether ETH can break through key resistance levels in the coming weeks.

What Do Ethereum's Technical Indicators Reveal?

Ethereum's price action presents a compelling technical picture as of September 19, 2025. The asset trades comfortably above its 20-day moving average ($4,433.44), which now serves as dynamic support. The MACD, while still negative at -40.08, shows signs of convergence that typically precede bullish momentum shifts.

Looking at Bollinger Bands, the upper band sits at $4,707.07 with price action testing this resistance zone. "When we see ETH hugging the upper Bollinger Band like this after a period of consolidation, it often signals an impending volatility expansion," notes the BTCC research team. The weekly chart reveals an even more promising 'cup and handle' formation that projects toward $5,430 if completed.

Source: BTCC TradingView

How Is Institutional Adoption Impacting ETH?

The institutional landscape for ethereum has transformed dramatically in recent months. Grayscale's potential staking of its 1.5 million ETH holdings could generate 45,000-60,000 tokens annually, creating significant buying pressure in the market. Meanwhile, American Express has quietly integrated Ethereum blockchain technology into its travel app, using NFTs as digital passport stamps.

These developments follow The Ether Machine's SEC filing for a public listing via SPAC merger, which would bring its $2.16 billion ETH treasury onto regulated markets. "Institutional players aren't just buying ETH - they're building infrastructure around it," observes crypto analyst Stefan Bratanov from Consensys. "This creates network effects that retail investors often underestimate."

What Are the Key Resistance Levels to Watch?

Ethereum faces several critical technical thresholds in its path upward:

| Level | Price | Significance |

|---|---|---|

| Immediate Resistance | $4,707.07 | Upper Bollinger Band |

| Psychological Barrier | $4,750 | Previous rejection point |

| All-Time High | $5,000 | August 2025 peak |

| Projected Target | $5,430 | Cup and handle measurement |

Is Ethereum's Staking Situation Affecting Price?

The staking landscape presents both opportunities and challenges for ETH. With 35.6 million ETH currently staked across 1 million validators earning 2.87% APR, the network remains secure but faces criticism about its 43-day unstaking delay. Vitalik Buterin defends this as necessary for security, comparing staking to "military service" in recent statements.

Interestingly, the staking queue has created an artificial supply constraint - about 2.49 million ETH remains trapped in the exit process. "This effectively removes liquidity from the market," explains developer Robert Sags. "While it may support prices short-term, the friction concerns some institutional players."

What Do On-Chain Metrics Suggest?

On-chain data reveals several bullish signals:

- Spent Coins Age Band shows only 42,700 ETH moved for sale - an 83.5% drop since mid-September

- Exchange reserves continue declining as accumulation increases

- NUPL (Net Unrealized Profit/Loss) indicates most holders remain in profit but aren't selling

The reduction in selling pressure coincides with Binance's ETH open interest dropping from $11.39 billion to $10.4 billion in early September - a pattern that historically precedes upward moves. "When futures cool off while spot prices hold steady, it often sets the stage for the next leg up," notes analyst burakkesmeci.

Could ETH Really Reach $10,000?

While $5,400 appears achievable in the NEAR term, some analysts project even more ambitious targets. Trader Cantonese Cat points to monthly chart breakouts above key Fibonacci levels, with expanding Bollinger Bands suggesting potential moves toward $7,752 or even $14,011 in an extended bull market.

However, the BTCC team cautions that such projections require perfect alignment of technical, fundamental, and macroeconomic factors. "The $5,400 target seems reasonable based on current patterns," they note, "but investors should watch for confirmation at each resistance level rather than assuming parabolic moves."

Frequently Asked Questions

What is Ethereum's current price?

As of September 19, 2025, Ethereum trades at $4,604.21 according to CoinMarketCap data.

What is the 20-day moving average for ETH?

ETH's 20-day moving average currently sits at $4,433.44, serving as important support.

How much ETH does Grayscale hold?

Grayscale Investments holds approximately 1.5 million ETH, with recent movements suggesting they may begin staking portions of this reserve.

What is the upper Bollinger Band for ETH?

The upper Bollinger Band currently sits at $4,707.07, representing near-term resistance.

How many validators does Ethereum have?

The network currently has about 1 million validators securing 35.6 million staked ETH.

What is the ETH staking APR?

The current staking reward rate stands at approximately 2.87% annually.