XRP Price Prediction 2025: Bullish Breakout or Bearish Trap? Key Levels to Watch

- XRP Technical Analysis: Make or Break Levels

- Market Sentiment: Bulls vs Bears

- Critical Factors Influencing XRP's Price

- XRP Price Predictions: Expert Views

- Is XRP a Good Investment in August 2025?

- XRP Price Prediction FAQ

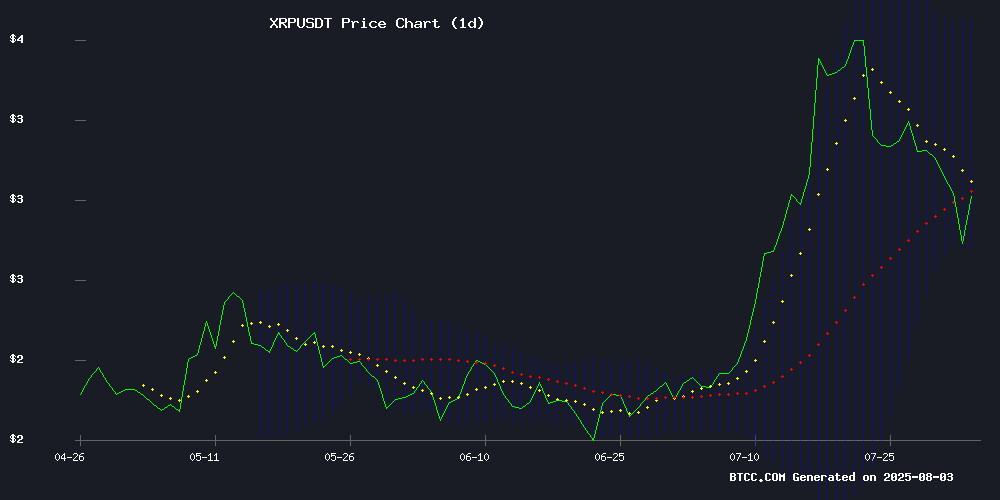

XRP sits at a critical juncture in August 2025, trading at $2.7968 amidst conflicting technical signals and market sentiment. The cryptocurrency shows oversold conditions near Bollinger Band support at $2.7221 while facing resistance at the 20-day MA ($3.1802). This analysis examines 8 key factors influencing XRP's price trajectory, from technical patterns to institutional developments, helping traders navigate the current market uncertainty. Data from TradingView and CoinMarketCap reveals a 20% pullback from July highs, with the MACD histogram suggesting potential short-term upside at 0.2790 despite bearish volume trends.

XRP Technical Analysis: Make or Break Levels

According to the BTCC research team, XRP's current price action presents both opportunity and risk. The daily chart shows:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $2.7968 | Below key moving averages |

| 20-Day MA | $3.1802 | Potential resistance zone |

| Bollinger Bands | $2.7221-$3.6383 | Price near lower band suggests oversold |

| MACD Histogram | 0.2790 | Short-term bullish momentum |

Market Sentiment: Bulls vs Bears

The current market narrative around XRP resembles a tug-of-war between opposing forces. On the bearish side, we're seeing:

- 17% drop in trading volume signaling weakening participation

- $222 million in outflows since July 29 (CoinMarketCap data)

- Inverted Cup and Handle pattern suggesting potential 13% correction

Countering this, bullish developments include:

- Ripple's OCC banking license application progress

- Institutional partnerships reported by Barron's

- Positive MACD divergence hinting at momentum shift

Critical Factors Influencing XRP's Price

1. The Inverted Cup and Handle Pattern

This bearish technical formation has traders watching the $2.95 support level closely. A breakdown could see XRP test $2.60, with $2.55 and $2.40 acting as subsequent support zones. The pattern's validity depends on whether buying pressure emerges at current levels.

2. Institutional Developments

Ripple's strategic moves are creating waves. Their OCC banking license application (Volume 1 submitted) and plans for a national trust bank could provide regulatory clarity. As CTO David Schwartz deploys a high-performance XRPL hub in NYC, institutional confidence appears to be growing despite retail trader caution.

3. The $1,000 Price Target Debate

Fintech analyst Armando Pantoja's controversial projection sparks discussion about valuation frameworks. While traditional metrics make this target seem unrealistic, parallels to early-stage tech giants suggest crypto assets might require different valuation approaches.

4. Gold Tokenization Potential

Versan Aljarrah's analysis of XRP's role in gold-pegged stablecoin movement presents an intriguing use case. As Meld Gold prepares to launch gold-backed tokens on XRPL, XRP could become crucial infrastructure for commodity tokenization.

5. Legal Developments

The aftermath of Ripple's $125 million SEC settlement continues to influence market psychology. With an August 15 status report deadline looming, traders are watching for signs of case resolution that could remove regulatory uncertainty.

XRP Price Predictions: Expert Views

AI platforms offer divergent perspectives on XRP's trajectory:

- ChatGPT: Bullish if $2.80-$3.00 support holds

- Grok: Cautious about extended consolidation

- Gemini: Neutral with upside potential contingent on institutional flows

Human analysts are equally divided. StephisCrypto sees parallels to 2017's parabolic rise, while others warn of "XRP killer" narratives gaining traction as capital rotates to newer tokens like PayFi.

Is XRP a Good Investment in August 2025?

The BTCC analysis team suggests XRP presents a classic high-risk, high-reward scenario. Key considerations include:

- Oversold technical conditions vs. bearish chart patterns

- Institutional adoption progress vs. retail trader exodus

- Regulatory clarity vs. competitive threats

This article does not constitute investment advice. Always conduct your own research before trading.

XRP Price Prediction FAQ

What is the current XRP price?

As of August 3, 2025, XRP trades at $2.7968 on major exchanges including BTCC, down 20% from its July high of $3.65.

What are the key support and resistance levels for XRP?

Immediate support sits at $2.7221 (Bollinger lower band), with resistance at $3.1802 (20-day MA). A break above $3.30 could signal bullish reversal potential.

Can XRP reach $5 in 2025?

While some analysts project $4.50-$5 targets based on institutional adoption, the path remains uncertain. Technical indicators suggest $3.65 as the next major resistance to watch.

Is the inverted cup and handle pattern concerning for XRP?

The pattern suggests potential downside to $2.60 if $2.95 support fails. However, oversold conditions and positive MACD divergence could counter this bearish signal.

How does Ripple's OCC application affect XRP?

The banking license could enhance regulatory clarity and institutional adoption, though the trust bank structure deliberately avoids direct XRP integration in its current form.