LTC Price Prediction 2025: How High Can Litecoin Surge This Year?

- Litecoin’s Current Market Position

- Why Is Litecoin Gaining Traction in 2025?

- Key Factors Driving Litecoin’s Price

- Litecoin Price Forecast: What’s Next?

- FAQs: Litecoin Price Prediction 2025

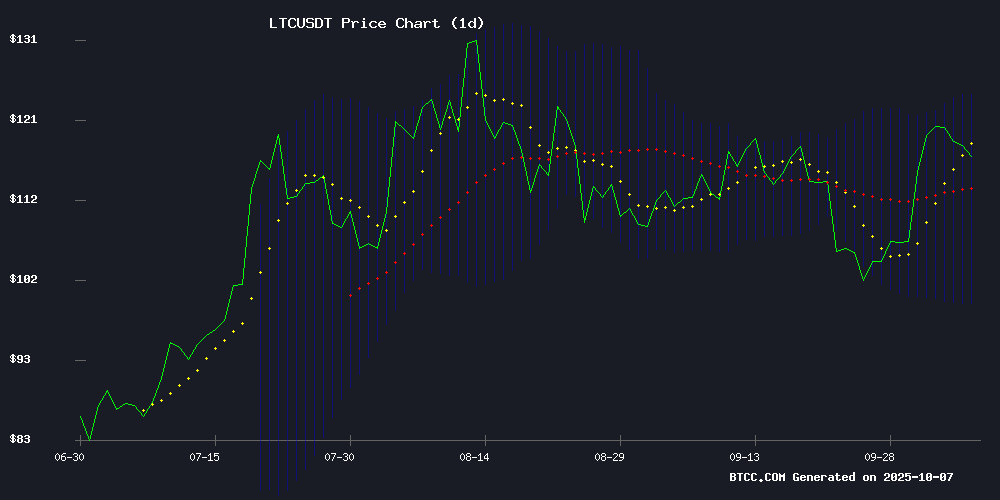

Litecoin (LTC) is showing bullish momentum in 2025, trading above its 20-day moving average with key resistance at $124.44. Analysts speculate that ETF adoption, institutional interest, and technical indicators could push LTC toward $130 in the NEAR term. This article dives into Litecoin’s price trajectory, market sentiment, and the factors influencing its growth this year.

Litecoin’s Current Market Position

As of October 2025, Litecoin (LTC) is trading at $117.05, comfortably above its 20-day moving average (MA) of $111.96—a strong bullish signal. The MACD indicator shows slight near-term weakness at -1.25, but the price holding above the middle Bollinger Band ($111.96) suggests underlying strength. The next major resistance level sits at the upper Bollinger Band of $124.44, a key threshold for further upside.

Why Is Litecoin Gaining Traction in 2025?

Litecoin’s "digital silver" narrative is gaining momentum alongside XRP and Solana, fueled by ETF speculation and institutional adoption. The SEC’s pending decision on crypto ETFs could be a game-changer, potentially unlocking institutional capital. Meanwhile, S&P Global’s new hybrid crypto-equity index signals Wall Street’s growing acceptance of digital assets, further boosting sentiment.

Key Factors Driving Litecoin’s Price

1. ETF Speculation: The XRP, Solana, and Litecoin Race

XRP, Solana, and Litecoin have emerged as frontrunners in the ETF race, with institutional investors eyeing these assets for diversification. XRP recently broke key resistance levels, Solana is testing all-time highs, and Litecoin’s low correlation with bitcoin makes it an attractive hedge. Bloomberg analysts highlight that revised SEC listing standards could be the catalyst for a major altcoin rally.

2. Institutional Adoption: S&P Global’s Crypto-Equity Index

S&P Global’s launch of the Digital Markets 50 Index—a blend of 35 blockchain equities and 15 cryptocurrencies—marks a milestone in crypto’s mainstream integration. Developed with tokenization firm Dinari, this index bridges traditional and decentralized markets, offering institutional investors a regulated gateway into digital assets.

3. Security Trends: Cold Wallet Demand Surges

With crypto adoption accelerating, cold wallets like Ledger Nano X ($149) and Tangem’s card-based storage ($69) are seeing record demand. Security remains a top priority, especially as institutional players enter the space. SafePal S1 ($49) and Keystone Pro ($169) are also gaining traction for their affordability and robust features.

Litecoin Price Forecast: What’s Next?

Based on current trends, Litecoin could test the $124–130 range in the coming weeks. Positive ETF developments, institutional inflows, and strong technicals create a favorable setup. Here’s a quick snapshot of key indicators:

| Indicator | Value | Signal |

|---|---|---|

| Price | $117.05 | Bullish |

| 20-day MA | $111.96 | Support |

| Upper Bollinger | $124.44 | Resistance |

| MACD | -1.25 | Neutral |

FAQs: Litecoin Price Prediction 2025

What is Litecoin’s price prediction for 2025?

Litecoin could test $124–130 in the near term, driven by ETF speculation and institutional adoption.

Is Litecoin a good investment in 2025?

LTC shows bullish momentum, but always conduct your own research before investing.

What are the key resistance levels for LTC?

The upper Bollinger Band at $124.44 is the next major resistance.