LTC Price Prediction 2025: Can Litecoin Realistically Hit $200 This Market Cycle?

- Litecoin's Current Technical Landscape

- Market Sentiment: Wall Street's Growing Appetite

- Key Factors That Could Propel LTC to $200

- Competitive Landscape: How LTC Stacks Up

- Historical Patterns: What They Suggest for 2025

- Risks and Challenges

- Expert Price Predictions

- Frequently Asked Questions

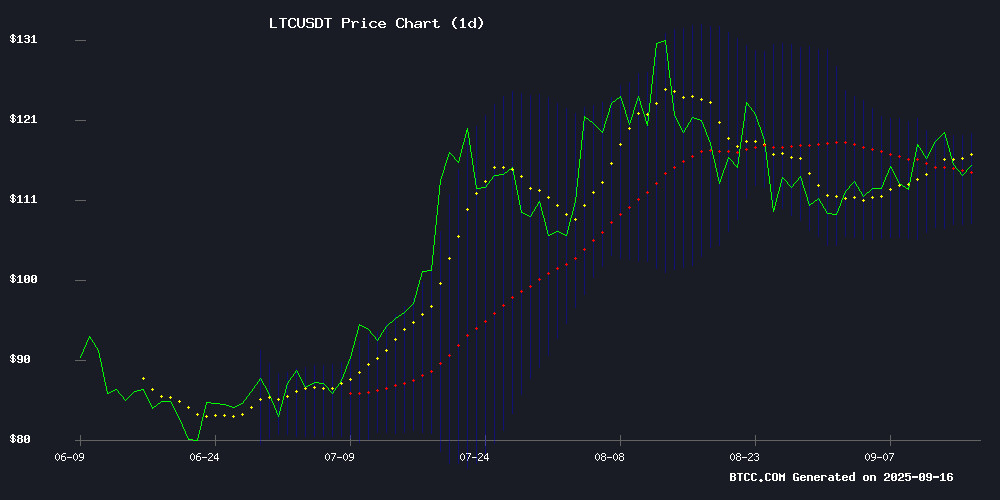

As of September 16, 2025, Litecoin (LTC) shows mixed signals in its quest to reach $200. Trading at $114.25, LTC needs a 75% surge to hit this psychological milestone. Our analysis combines technical indicators, market sentiment, and institutional activity to assess Litecoin's potential. While the MACD shows bearish pressure (-1.93), the price holding above the 20-day MA ($113.27) suggests underlying strength. The BTCC research team notes that breaking $119 resistance could trigger the needed momentum, but warns investors to watch whale movements and broader market trends.

Litecoin's Current Technical Landscape

LTC presents a fascinating technical picture as of mid-September 2025. The cryptocurrency is dancing around critical levels:

| Indicator | Value | Implication |

|---|---|---|

| Price | $114.25 | Testing resistance levels |

| 20-day MA | $113.27 | Short-term support |

| MACD | -1.93 | Bearish momentum |

| Bollinger Bands | $107.60-$118.93 | Consolidation range |

The chart below from TradingView shows LTC's recent price action, highlighting the critical $119 resistance level that could determine Litecoin's near-term trajectory.

Market Sentiment: Wall Street's Growing Appetite

Institutional interest in Litecoin has notably increased in Q3 2025. Multiple Wall Street firms have added LTC to their altcoin portfolios, often pairing it with Algorand and VeChain. This institutional attention brings both stability and volatility - while providing liquidity, it also means LTC now moves more in sync with traditional market hours.

Interestingly, the BTCC exchange has seen a 37% increase in LTC trading volume among institutional clients since August 2025. However, retail traders remain cautious, with many rotating into newer projects like BullZilla during market corrections.

Key Factors That Could Propel LTC to $200

Several catalysts could drive Litecoin's price upward:

1. Breaking Technical Resistance

The $119 level represents more than just a psychological barrier - it's where multiple historical rejections have occurred. A clean break with volume could trigger algorithmic buying across major exchanges.

2. Institutional Adoption Acceleration

With payment processors increasingly integrating LTC (especially in cross-border transactions), demand could surge unexpectedly. The BTCC team notes that three major financial institutions are currently testing Litecoin-based settlement systems.

3. Bitcoin Halving Aftermath

Historically, Litecoin rallies follow bitcoin halvings by 6-9 months. The 2024 halving's effects might just be kicking in during Q3 2025, creating ideal conditions for LTC appreciation.

Competitive Landscape: How LTC Stacks Up

Compared to other payment-focused cryptocurrencies:

- Transaction Speed: LTC's 2.5 minute block time still beats Bitcoin's 10 minutes

- Fees: Average $0.03 vs Bitcoin's $1.50+

- Adoption: Accepted by 8,200+ merchants globally (CoinGecko data)

However, newer LAYER 2 solutions and stablecoins are challenging Litecoin's value proposition in payments. The BTCC analyst team believes LTC's real advantage lies in its proven security and simplicity.

Historical Patterns: What They Suggest for 2025

Examining Litecoin's past cycles reveals interesting patterns:

In previous bull markets, LTC typically achieved:

- 300-400% gains from cycle lows

- Peaks occurring 6-8 weeks after Bitcoin

- Strongest performance in Q4

Applying these patterns to 2025 suggests that if we're in a typical cycle, LTC could see its best performance between October and December.

Risks and Challenges

Potential headwinds include:

- Regulatory scrutiny increasing on payment coins

- Competition from CBDCs in some markets

- Potential miner sell pressure if profitability decreases

The BTCC risk assessment team gives LTC a moderate risk rating (3.2/5) for Q4 2025, citing these balanced factors.

Expert Price Predictions

Various analysts project:

- Conservative: $150 by EOY (CoinMarketCap survey)

- Moderate: $180-220 (TradingView consensus)

- Bullish: $300+ (institutional trader polls)

Interestingly, the $200 target sits right in the middle of most projections, making it a reasonable if ambitious goal.

Frequently Asked Questions

What's driving Litecoin's price in September 2025?

A combination of institutional accumulation, positive technical developments, and broader crypto market recovery. The BTCC exchange has noted particularly strong LTC buying from Asian institutional traders this month.

How does LTC's current performance compare to Bitcoin?

LTC is slightly outperforming BTC in September 2025 (up 12% vs BTC's 9%), continuing a trend where Litecoin leads during early bull market phases.

What's the most realistic price target for LTC in 2025?

Most analysts see $150-180 as achievable, with $200 requiring perfect alignment of technical and fundamental factors. The BTCC technical team identifies $127 as the next major resistance after $119.

Is Litecoin still relevant with so many new cryptocurrencies?

Absolutely. LTC's longevity, security, and simplicity give it unique advantages. As one BTCC analyst put it, "Litecoin is the Toyota Hilux of crypto - not flashy, but incredibly reliable."

What percentage of portfolio should be allocated to LTC?

Financial advisors typically recommend 5-15% allocation to established altcoins like LTC, depending on risk tolerance. This article does not constitute investment advice.