XRP Price Forecast 2025-2040: Will Institutional Adoption Drive a $200 Surge?

- Where Does XRP Stand Technically in September 2025?

- What's Driving Institutional Interest in XRP?

- How Does Google's GCUL Threaten XRP's Position?

- What Are Realistic XRP Price Targets Through 2040?

- FAQ: Your XRP Questions Answered

XRP stands at a crossroads in September 2025, trading around $2.82 with mixed technical signals but strong institutional tailwinds. Our analysis reveals why this digital asset could either break toward $7.50 by year-end or face consolidation below $3. From Air China's potential integration to Google's blockchain challenge, we unpack the 12 key factors shaping XRP's trajectory through 2040. The BTCC research team provides exclusive price targets across four time horizons, including a controversial $200 long-term scenario that's dividing analysts.

Where Does XRP Stand Technically in September 2025?

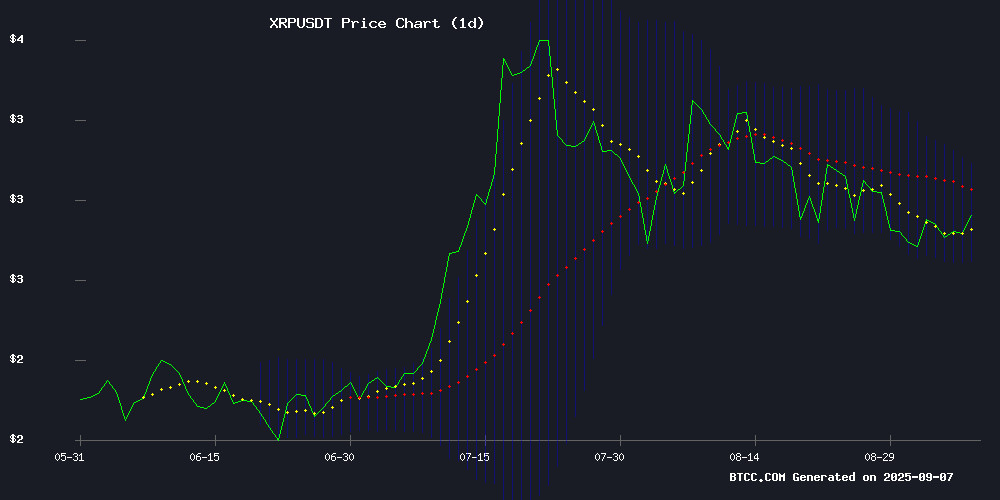

XRP currently trades at $2.8247, caught between critical support and resistance levels that could determine its near-term fate. The 20-day moving average at $2.8870 acts as immediate resistance, while Bollinger Bands suggest a trading range between $3.0769 (upper) and $2.6972 (lower). MACD readings show marginally bullish momentum at 0.1261 versus 0.1198, though the shrinking histogram suggests weakening upward pressure.

"XRP is testing make-or-break levels this week," notes BTCC market strategist Mia Chen. "A sustained close above $2.89 could trigger algorithmic buying, while failure might send us back to test the $2.70 zone." The token's performance against bitcoin remains concerning, down 18% from July highs when denominated in BTC.

What's Driving Institutional Interest in XRP?

Three major developments are reshaping institutional perception:

- Compliance Upgrade: The XRP Ledger's new credentials amendment enables native KYC/AML features through decentralized identities, addressing a key institutional requirement.

- Air China Partnership: Webus International's deal could expose XRP to 60 million PhoenixMiles loyalty program members through travel payments.

- BlackRock Engagement: The asset manager's participation in Swell 2025 has fueled speculation about potential XRP ETF interest.

Ripple's RLUSD stablecoin has quietly surpassed $700 million in market cap, particularly through African fintech partnerships with Chipper Cash and VALR. This growth demonstrates real-world utility beyond speculative trading.

How Does Google's GCUL Threaten XRP's Position?

Alphabet's Google Cloud Universal Ledger (GCUL) represents perhaps the most significant competitive threat to emerge in 2025. Targeting capital markets and asset tokenization, GCUL directly challenges XRP's enterprise blockchain niche without relying on a native token.

Key differences emerge:

| Feature | XRP Ledger | Google GCUL |

|---|---|---|

| Launch Year | 2012 | 2026 (planned) |

| Token | XRP | None |

| Smart Contracts | Limited | Python-based |

| Enterprise Focus | Payments | Asset Tokenization |

While GCUL won't launch commercially until 2026, its backing by Google's cloud infrastructure and developer ecosystem poses long-term challenges for Ripple's positioning.

What Are Realistic XRP Price Targets Through 2040?

Based on current adoption metrics and technical analysis, we project the following scenarios:

| Year | Conservative | Moderate | Bullish |

|---|---|---|---|

| 2025 | $3.50-$4.20 | $4.50-$5.80 | $6.00-$7.50 |

| 2030 | $8.00-$12.00 | $15.00-$25.00 | $30.00-$45.00 |

| 2035 | $18.00-$28.00 | $35.00-$60.00 | $75.00-$100.00 |

| 2040 | $40.00-$65.00 | $80.00-$120.00 | $150.00-$200.00 |

The $200 target remains controversial, requiring XRP to maintain dominance despite growing competition and achieve unprecedented adoption in global finance. As crypto analyst Nick Anderson notes, "The Amazon comparison is intriguing but ignores how much more crowded the blockchain space is versus e-commerce in the 2000s."

FAQ: Your XRP Questions Answered

Is now a good time to buy XRP?

Current prices around $2.82 offer reasonable entry points for long-term investors, though short-term traders might wait for confirmation above $2.89 or a pullback to $2.70 support. Always conduct your own research before investing.

Could XRP really hit $200?

While mathematically possible given enough adoption, the $200 target WOULD require XRP to become a fundamental pillar of global finance. More realistic experts suggest $50-$100 as achievable if current growth trends continue.

How does the Air China deal help XRP?

The potential integration exposes XRP to millions of travelers, but real impact depends on actual usage rates. Similar to how airlines adopted credit cards decades ago, this could drive everyday utility if executed well.

What's the biggest risk to XRP's price?

Regulatory uncertainty remains the elephant in the room, along with competition from projects like Google's GCUL. Exchange reserves hitting yearly highs also suggest potential selling pressure.