Bitcoin Price Forecast 2025-2040: Expert Analysis & Market Predictions

- Where Does Bitcoin Stand Technically in August 2025?

- Why Are Institutions Buying the Dip?

- What's Suppressing Bitcoin's Price Despite Institutional Demand?

- Global Macro Factors Influencing Bitcoin's Trajectory

- Bitcoin Price Predictions: 2025-2040 Outlook

- Frequently Asked Questions

As we navigate through August 2025, bitcoin continues to dominate crypto discussions with its volatile yet promising trajectory. This comprehensive analysis examines BTC's current technical position at $109,588, institutional accumulation patterns, and long-term price projections through 2040. We'll explore critical support levels, Wall Street's influence on price action, and why major corporations are doubling down on Bitcoin despite recent corrections. From VanEck's bold $180,000 near-term target to potential six-figure valuations by 2040, this report combines on-chain data, technical indicators, and macroeconomic factors shaping Bitcoin's future.

Where Does Bitcoin Stand Technically in August 2025?

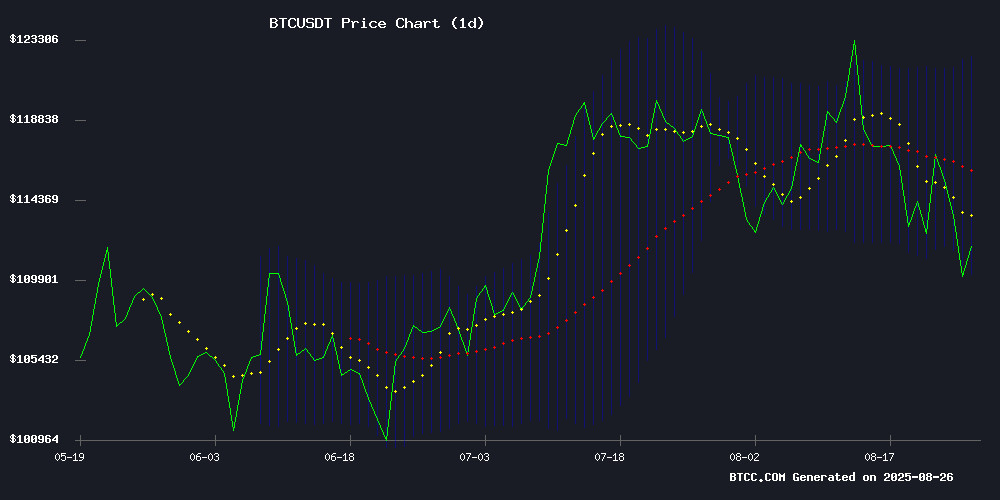

Bitcoin currently tests crucial support at $109,715 after retreating from its $124,000 all-time high. The 20-day moving average at $116,194 suggests short-term bearish pressure, but intriguingly, the MACD reading of 2,198.27 versus its signal line at 496.45 reveals underlying bullish momentum. This creates what traders call a "bull trap" scenario - where price action appears negative but key indicators tell a different story.

Source: BTCC TradingView Data

The Bollinger Bands paint an interesting picture too. With BTC hovering near the lower band at $109,715, we're seeing textbook support testing. As one analyst from the BTCC team noted, "The $105,000-$122,673 range represents a critical consolidation zone. How Bitcoin behaves here could set the tone for Q4 2025."

Why Are Institutions Buying the Dip?

While retail investors panic-sold during recent corrections, corporate treasuries went shopping. Metaplanet expanded its holdings to 19,000 BTC, Strategy Inc. dropped $357 million on 3,081 coins, and MicroStrategy now holds over 214,000 BTC. This institutional accumulation during price dips reveals a fascinating market dynamic.

As Preston Pysh recently explained on Coin Stories, "Smart money views these 15-20% pullbacks as discount opportunities rather than reasons for concern." The numbers support this - exchange-traded products absorbed 54,000 BTC in July alone, while corporate treasuries added 72,000 BTC according to CoinMarketCap data.

What's Suppressing Bitcoin's Price Despite Institutional Demand?

Here's where things get interesting. Despite growing adoption, sophisticated Wall Street strategies are creating artificial headwinds. Delta-neutral volatility harvesting tactics - essentially complex arbitrage plays - are being used by major financial institutions to suppress price volatility while extracting funding premia.

This explains why we're seeing what analysts call "the institutional adoption paradox" - where growing Bitcoin investment doesn't immediately translate to price appreciation. However, as the BTCC research team points out, "These mechanisms create temporary resistance but ultimately can't override fundamental supply-demand dynamics long-term."

Global Macro Factors Influencing Bitcoin's Trajectory

Japan's Finance Minister recently endorsed cryptocurrencies as portfolio diversifiers, a significant development given Japan's 200% debt-to-GDP ratio. Meanwhile, growing concerns about CBDC surveillance capabilities (a UK think tank compared them to Orwellian overreach) are driving interest in decentralized alternatives like Bitcoin.

The Federal Reserve's dovish pivot has accelerated capital rotation into crypto, with Bitcoin now representing 1.7% of the global money supply. River's research highlights this milestone as institutional and retail investors increasingly view BTC as a hedge against monetary debasement.

Bitcoin Price Predictions: 2025-2040 Outlook

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $135,000 | $160,000 | $180,000 | ETF inflows, halving effects |

| 2030 | $300,000 | $450,000 | $600,000 | Institutional adoption, regulatory clarity |

| 2035 | $800,000 | $1,200,000 | $1,800,000 | Global reserve asset status |

| 2040 | $1,500,000 | $2,500,000 | $4,000,000 | Mass adoption, scarcity premium |

VanEck recently reaffirmed its $180,000 year-end target, while other analysts suggest we could see $300,000 by 2030 if current adoption trends continue. The most bullish scenarios envision Bitcoin reaching $4 million by 2040 as it potentially becomes a global reserve asset.

Frequently Asked Questions

What's the most realistic Bitcoin price prediction for 2025?

Most analysts cluster around $135,000-$180,000 for 2025, with VanEck's $180,000 target being particularly noteworthy given their research depth. The conservative estimate accounts for potential macroeconomic headwinds, while the bullish scenario assumes continued strong institutional inflows.

Why are corporations buying Bitcoin during market corrections?

Corporate treasuries view these 15-20% pullbacks as strategic accumulation opportunities. Companies like MicroStrategy and Metaplanet have institutionalized dollar-cost averaging into their treasury strategies, recognizing Bitcoin's long-term scarcity value proposition.

How reliable are long-term Bitcoin price predictions?

While historical models have been surprisingly accurate over 4-year cycles (matching halving events), predictions beyond 2030 become increasingly speculative. They're useful for understanding potential upside scenarios but should be weighed against Bitcoin's inherent volatility and unpredictable macroeconomic factors.

What's the biggest risk to Bitcoin's price growth?

Beyond technical factors, regulatory uncertainty remains the wild card. While Japan's progressive stance is encouraging, inconsistent global regulation could temporarily suppress price discovery. However, the fundamental adoption trajectory appears robust despite these potential speed bumps.