LTC Price Prediction 2025: Oversold Technicals & October ETF Catalyst - Time to Buy Litecoin?

- What Do LTC's Technical Indicators Reveal About Current Market Conditions?

- How Does the SEC's ETF Delay Impact LTC's Short-Term Outlook?

- Where Does LTC Fit in the Current Institutional Crypto Landscape?

- What Are the Key Factors Traders Should Watch for LTC Price Action?

- Is Litecoin a Good Investment in August 2025?

- LTC Price Prediction: Frequently Asked Questions

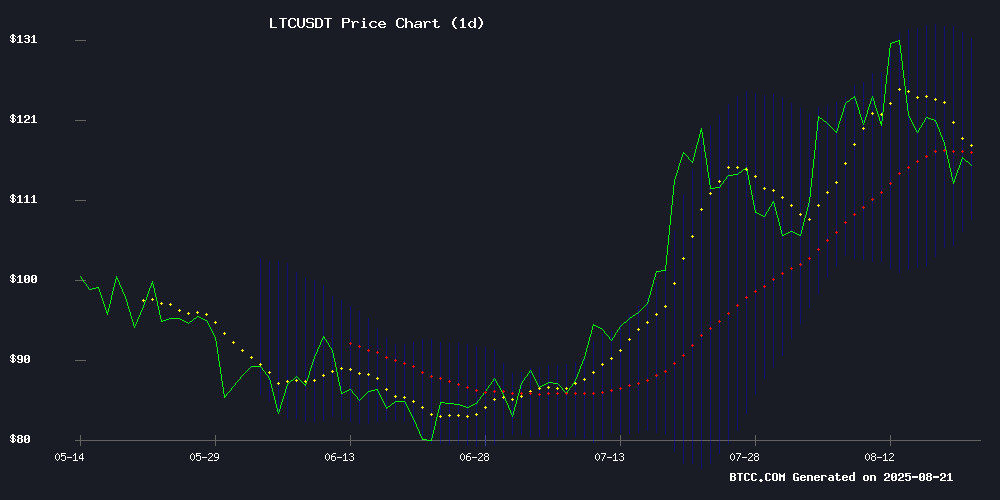

Litecoin (LTC) presents a fascinating case study in crypto markets as we approach August 2025. Currently trading at $114.99, LTC shows classic oversold technical indicators while facing regulatory delays that paradoxically create a clear October catalyst. The SEC's postponement of LTC ETF decisions until October 2025 has created short-term uncertainty but establishes a concrete timeline for institutional adoption potential. Meanwhile, technical analysis reveals improving momentum signals despite the price sitting below key moving averages. This article examines LTC's current technical setup, regulatory landscape, and institutional context to help traders navigate this pivotal moment.

What Do LTC's Technical Indicators Reveal About Current Market Conditions?

Litecoin's current technical picture tells a story of potential reversal brewing beneath surface-level bearish signals. As of August 21, 2025, LTC trades at $114.99 - below its 20-day moving average of $119.64, which typically indicates short-term bearish momentum. However, digging deeper reveals more nuanced signals:

| Indicator | Value | Interpretation |

|---|---|---|

| MACD | -1.61 vs -4.47 signal | Improving momentum despite negative territory |

| MACD Histogram | +2.86 | Positive momentum building |

| Bollinger Bands | Near lower band ($108.21) | Classic oversold condition |

The BTCC research team notes, "LTC's technical setup suggests we may be approaching a potential reversal zone. The MACD divergence combined with Bollinger Band positioning hints at possible upward movement toward the middle band around $119.64 in coming weeks." This technical perspective aligns with historical patterns where LTC has rebounded strongly from similar oversold conditions.

How Does the SEC's ETF Delay Impact LTC's Short-Term Outlook?

The U.S. Securities and Exchange Commission's decision to postpone LTC ETF approvals until October 2025 creates an interesting dynamic for traders. While this represents a near-term headwind, it paradoxically provides clarity about when institutional adoption might accelerate. The delay affects proposals from major asset managers including Bitwise, Grayscale, and CoinShares.

Market analysts draw parallels to Bitcoin and ethereum ETF precedents, suggesting eventual approval remains plausible. Nate Geraci of The ETF Store observes, "The timeline extension reflects standard procedural review rather than outright rejection." This perspective suggests the delay may represent bureaucratic process rather than fundamental opposition to LTC products.

From a trading perspective, this creates a defined catalyst horizon. The BTCC team suggests, "October 2025 now serves as a clear focal point for LTC price action, giving traders a specific timeframe to position around." This differs from the uncertainty surrounding previous crypto ETF approvals where timelines remained vague.

Where Does LTC Fit in the Current Institutional Crypto Landscape?

Litecoin's position within broader institutional flows presents a mixed but ultimately promising picture. Recent data shows staggering $3.75 billion inflows into digital-asset investment products last week, with Ethereum capturing 77% ($2.87 billion) and Bitcoin $552 million. While LTC saw minor outflows, its correlation with major assets suggests potential spillover benefits.

Three key institutional factors affecting LTC:

- Portfolio Diversification: Institutions increasingly view altcoins as portfolio diversifiers beyond just BTC/ETH exposure

- Payment Infrastructure: LTC's established payment network maintains appeal for certain institutional use cases

- Regulatory Clarity: While delayed, the ETF process provides clearer regulatory parameters than many altcoins

Interestingly, Litecoin maintains its position among what analysts call the "highest-ROI cryptocurrencies for 2025," alongside BlockDAG, XRP, and Cardano. Each offers distinct value propositions - from BlockDAG's hybrid technology to LTC's transactional efficiency. This classification suggests institutions may be building longer-term positions despite short-term outflows.

What Are the Key Factors Traders Should Watch for LTC Price Action?

Several critical factors will determine LTC's price trajectory in coming weeks:

- $108 support: A break below could signal deeper correction - $119.64 resistance: 20-day MA represents first major hurdle - $125-130 zone: Previous consolidation area offering next resistance

- ETF-related news flow as October approaches - Broader crypto market sentiment, particularly BTC/ETH correlation - Transaction volume trends signaling network activity

- Regulatory developments beyond just ETFs - Institutional allocation trends - Competitor developments in payment coin space

The BTCC analyst team suggests, "Risk-tolerant traders might view current levels as an attractive entry point with a 6-8 week horizon toward October's ETF decision. However, the $108 support level should be watched closely as a potential stop-loss indicator."

Is Litecoin a Good Investment in August 2025?

LTC presents a compelling but nuanced opportunity at current levels. The combination of oversold technicals and a defined October catalyst creates an interesting risk/reward setup. However, traders should consider several factors:

- Oversold technical conditions suggest mean reversion potential - Clear October ETF catalyst provides timeline for positioning - Established network with strong liquidity and recognition

- Regulatory uncertainty persists until October decision - Competition in payment coin space intensifying - Institutional flows currently favoring other assets

As with any crypto investment, position sizing and risk management remain crucial. The current setup suggests potential for tactical trades rather than passive long-term holds, at least until the October ETF decision provides clearer direction.

LTC Price Prediction: Frequently Asked Questions

What is the current LTC price as of August 2025?

As of August 21, 2025, Litecoin (LTC) trades at $114.99 according to BTCC market data. This positions it below the 20-day moving average of $119.64 but showing improving momentum indicators.

Why are analysts bullish on LTC despite the ETF delay?

Analysts see potential because the delay establishes a clear October 2025 catalyst rather than indefinite uncertainty. Additionally, technical indicators show oversold conditions that often precede rallies.

What's the most important support level to watch for LTC?

The $108 level represents critical support, corresponding with the lower Bollinger Band. A break below this could signal deeper correction potential.

How does LTC compare to other payment coins like XRP?

While both are payment-focused, LTC offers faster transactions and a different regulatory profile. XRP has more institutional backing but faces different legal challenges.

What's the best trading strategy for LTC currently?

Many analysts suggest dollar-cost averaging into positions with tight stop-losses below $108, targeting the $119-125 range ahead of October's ETF decision.