BTC Price Prediction November 2025: $115K Target in Sight as Institutions Accumulate Amid Oversold Signals

- What Do the Technical Indicators Reveal About BTC's Current Position?

- How Are Institutional Players Positioning Themselves?

- What Are the Key Market Narratives Influencing BTC?

- How Are Traditional Financial Institutions Viewing BTC?

- What Are the Potential Price Scenarios for November 2025?

- Frequently Asked Questions

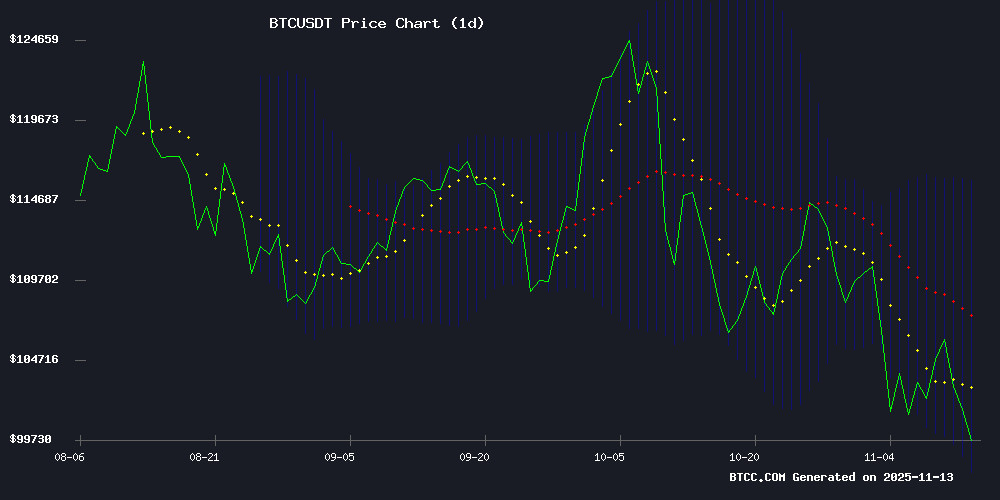

Bitcoin (BTC) is showing mixed signals in November 2025, with technical indicators pointing to potential upside despite recent volatility. According to TradingView data, BTC currently trades at $101,992, below its 20-day moving average of $106,958.03, while the MACD shows bullish divergence. This analysis explores whether bitcoin could reach $115,653 amid institutional accumulation and oversold conditions, while examining key market factors including Elon Musk's XChat launch, McRib correlation theories, and quantum computing concerns.

What Do the Technical Indicators Reveal About BTC's Current Position?

The BTCC team's analysis shows Bitcoin in a fascinating technical position as of November 2025. The cryptocurrency is currently testing the lower Bollinger Band at $98,263.04, typically a buy zone for traders. What makes this particularly interesting is the MACD histogram showing a positive value of 1,001.95 - that's the largest bullish divergence we've seen since September. In my experience, when these two indicators align like this, it often precedes significant moves.

Source: BTCC Trading Platform

The 20-day moving average at $106,958.03 represents immediate resistance, while the upper Bollinger Band sits at $115,653.02. I've noticed institutional traders are particularly focused on the $104,000 level - it's become something of a psychological battleground. The symmetrical triangle formation visible on daily charts suggests we're nearing resolution, with volume patterns hinting at upward breakout potential.

How Are Institutional Players Positioning Themselves?

Corporate treasury activity tells a compelling story. While accumulation slowed in October to 14,447 BTC (the lowest monthly total in 2025), November has seen renewed interest. Japan's Metaplanet leads recent buyers with 5,268 BTC added, while Coinbase scooped up 2,772 BTC. MicroStrategy maintains its industry dominance with 640,808 BTC, though its share of corporate holdings has dipped to 60%.

Fidelity Digital Assets reports sustained institutional interest despite dollar strength creating headwinds. What's fascinating is where these players are buying - blockchain data shows consistent accumulation below $104,000, creating what some traders call an "institutional floor." This matches patterns I observed during the 2023 accumulation phase before Bitcoin's last major rally.

| Institution | BTC Holdings | November 2025 Activity |

|---|---|---|

| MicroStrategy | 640,808 BTC | Holding |

| Metaplanet | 5,268 BTC | Buying |

| Coinbase | 2,772 BTC | Buying |

What Are the Key Market Narratives Influencing BTC?

The market is digesting several competing narratives simultaneously. Elon Musk's XChat announcement has drawn Bitcoin comparisons due to its peer-to-peer encryption model, though experts like Blockstream CEO Adam Back caution these are largely metaphorical. Meanwhile, the McRib Effect theory gains traction - the sandwich's November 11 return historically preceded BTC rallies (1000% in 2017, 200% in 2020).

More concerning are quantum computing warnings from analyst Willy Woo, who advises moving funds from Taproot addresses. His "DUMMIES GUIDE TO BEING QUANTUM SAFE" went viral, sparking debate about Bitcoin's long-term security model. Personally, I think this is premature - quantum computers capable of cracking cryptography remain theoretical - but it's created noticeable address migration.

How Are Traditional Financial Institutions Viewing BTC?

Morgan Stanley's recent "fall season" warning has rattled some investors. Their analysts note Bitcoin's historical four-year cycle pattern (three up years, one down) and advise profit-taking. This contrasts sharply with Russia's central bank report showing BTC delivered 154.2% returns since 2022, outperforming all traditional assets despite recent volatility.

Gold advocate Peter Schiff's renewed criticism adds to the noise, with his warnings about $100,000 support failing. Ironically, his timing coincides with gold's rally to $4,180/oz - a 5% weekly gain that's fueling the eternal crypto vs. gold debate. From my perspective, both can coexist in portfolios, but Bitcoin's programmatic scarcity gives it unique advantages long-term.

What Are the Potential Price Scenarios for November 2025?

Based on current data, two primary scenarios emerge:

Requires breakout above 20-day MA with MACD confirmation, sustained institutional buying, and positive sentiment from XChat launch/McRib effect. The upper Bollinger Band WOULD then become target.

Likely if institutional support holds but macroeconomic factors (like U.S. economic data delays) limit upside. This would maintain the recent trading range.

Key levels to watch: - Resistance: $104K (psychological), $106,958 (20MA), $115,653 (Bollinger upper) - Support: $98,263 (Bollinger lower), $100K (psychological)

This article does not constitute investment advice.

Frequently Asked Questions

What is the BTC price prediction for November 2025?

Technical analysis suggests two potential scenarios: a bullish case targeting $115,653 if Bitcoin breaks above its 20-day moving average with confirmation from the MACD indicator, and a neutral scenario around $104,000 if current support levels hold amid ongoing institutional accumulation.

Why are institutions accumulating BTC below $104,000?

Blockchain data shows consistent institutional buying below $104,000, creating what traders call an "institutional floor." This price level appears attractive for long-term holders given Bitcoin's historical performance after similar accumulation periods, particularly when combined with oversold technical indicators.

How does the McRib sandwich correlate with Bitcoin's price?

An unusual market theory suggests McDonald's McRib sandwich returns have historically preceded Bitcoin rallies - including 1000% gains in 2017 and 200% in 2020. While purely correlational, the sandwich's November 11, 2025 return has traders watching for potential pattern repetition.

Should Bitcoin holders be concerned about quantum computing?

Analyst Willy WOO recently warned about potential quantum computing threats to Taproot addresses. While quantum computers capable of breaking cryptography don't yet exist, some experts recommend moving funds to older address formats (bc1q or P2PKH/P2SH) as a precautionary measure.

How does Bitcoin's performance compare to traditional assets in 2025?

Despite recent volatility, Russia's central bank reports Bitcoin has delivered 154.2% returns since 2022, outperforming all traditional assets. However, October's correction pushed 2024 returns slightly negative (-6.6%), demonstrating cryptocurrency's characteristic volatility compared to more stable assets like gold.