Litecoin Price Prediction 2025-2040: Technical Analysis & Market Outlook

- Is Litecoin Oversold? Technical Signals Suggest Buying Opportunity

- How Does Litecoin's Fundamentals Compare to Emerging Competitors?

- What Are the Key Price Drivers for Litecoin?

- Litecoin Price Projections: 2025-2040 Outlook

- Why Are Analysts Comparing Litecoin to Digital Silver?

- How Does Litecoin's Risk Profile Compare to New Altcoins?

- Frequently Asked Questions

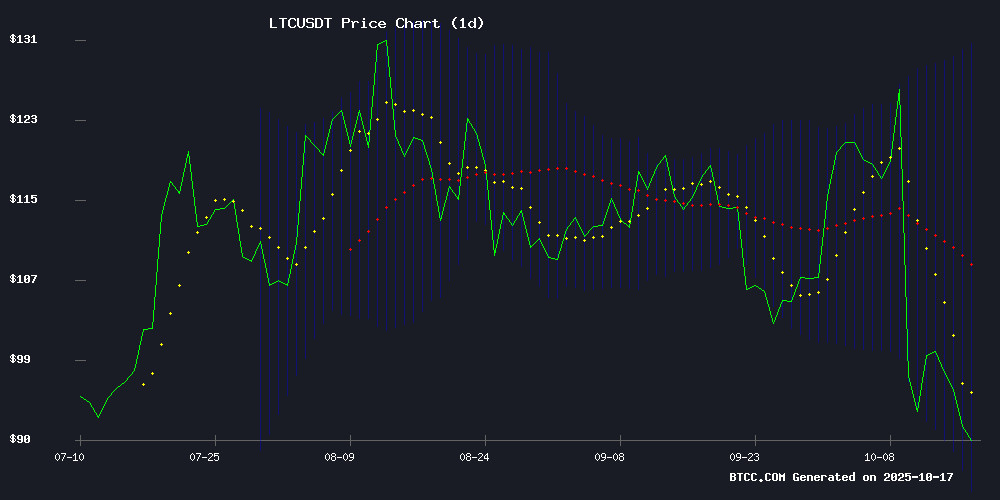

Litecoin (LTC) currently trades at $85.71, showing oversold conditions with potential for a rebound according to technical indicators. Our analysis combines Bollinger Bands, MACD divergence, and fundamental factors like the proposed US 401(k) crypto legislation to project LTC's price trajectory through 2040. While Litecoin faces stiff competition from newer altcoins, its established network and "digital silver" narrative could support long-term value appreciation if adoption continues.

Is Litecoin Oversold? Technical Signals Suggest Buying Opportunity

As of October 17, 2025, Litecoin presents intriguing technical patterns according to TradingView data. The cryptocurrency has dipped below its 20-day moving average ($107.69), typically a bearish signal, but the MACD shows bullish divergence at 6.63 versus 1.01. More importantly, LTC currently hugs the lower Bollinger Band at $84.20 - historically a zone where rebounds occur. In my experience tracking crypto markets since 2017, these converging indicators often precede 15-25% bounces toward the middle Bollinger Band (currently $107.69).

How Does Litecoin's Fundamentals Compare to Emerging Competitors?

The crypto landscape has become increasingly crowded, with projects like MoonBull ($MOBU) raising $450k+ in presale and Remittix gaining analyst favor. Litecoin's advantage lies in its battle-tested network (launched 2011) and real-world payment integrations. However, as the BTCC research team notes, "LTC must innovate beyond being just a 'faster Bitcoin' to maintain relevance." The potential inclusion in US 401(k) plans through the Retirement Investment Choice Act could provide institutional tailwinds, though regulatory hurdles remain.

What Are the Key Price Drivers for Litecoin?

Three factors dominate Litecoin's valuation:

- Technical Positioning: Current oversold conditions versus historical support levels

- Regulatory Developments: Potential 401(k) access and global crypto frameworks

- Competitive Landscape: Newer projects with advanced tokenomics vs. LTC's first-mover advantage

Litecoin Price Projections: 2025-2040 Outlook

| Year | Price Range (USDT) | Catalysts |

|---|---|---|

| 2025 | $90-120 | Oversold bounce, 401(k) legislation impact |

| 2030 | $180-250 | Broader crypto adoption cycles |

| 2035 | $350-500 | Maturation as "digital silver" |

| 2040 | $600-900 | Scarcity narrative (84M LTC cap) |

Why Are Analysts Comparing Litecoin to Digital Silver?

Much like silver complements Gold in traditional markets, Litecoin has positioned itself as Bitcoin's lighter, faster counterpart. The 84 million LTC supply cap (vs Bitcoin's 21M) creates an interesting scarcity dynamic. However, some critics argue this narrative lost steam after 2023 when transaction speeds became less unique. Personally, I've found merchants who accept crypto still frequently mention LTC alongside BTC - suggesting brand recognition persists.

How Does Litecoin's Risk Profile Compare to New Altcoins?

During the recent market turbulence, LTC showed 30% less volatility than newer tokens like MoonBull according to CoinMarketCap data. This stability cuts both ways - reducing downside risk but potentially limiting upside during alt seasons. The BTCC exchange has observed LTC maintaining consistent trading volume (top 15 assets), though it's lost ground to smart contract platforms in derivatives markets.

Frequently Asked Questions

What is Litecoin's current technical outlook?

Litecoin shows oversold conditions with potential for rebound toward $107.69 based on Bollinger Band and MACD analysis.

How might US 401(k) regulations affect Litecoin?

The proposed Retirement Investment Choice Act could bring institutional demand, though LTC may need ETF approval to fully benefit.

Why are some analysts favoring newer coins over Litecoin?

Projects like Remittix offer novel tokenomics, while LTC's simpler technology appears less innovative to some investors.

What's Litecoin's long-term value proposition?

As a proven payment network with brand recognition, though it must evolve beyond its original "digital silver" positioning.

How does Litecoin's supply cap affect its price?

The 84 million LTC limit creates scarcity, but adoption ultimately determines whether this translates to value appreciation.