BitMine Now Controls 2% of All Ethereum, Secures $365M War Chest for Massive Expansion

Digital asset giant BitMine just became Ethereum's whale—and it's hungry for more.

The Strategic Move

BitMine's treasury now holds a staggering 2% of all circulating Ethereum. That's not just a position—it's a statement. The company essentially bought an entire mid-sized bank's worth of ETH in a single strategic accumulation.

The Funding Firepower

Fresh off raising $365 million from institutional investors, BitMine's war chest signals serious conviction. While traditional finance debates ETF approvals, crypto natives are building positions that would make central banks nervous.

The Institutional Shift

This isn't retail speculation—it's calculated institutional deployment. BitMine's move demonstrates how crypto-native firms are outpacing traditional asset managers in digital asset adoption. They're not waiting for permission; they're building the future.

Market Implications

With $365 million ready for deployment, BitMine could single-handedly impact Ethereum's liquidity dynamics. The move comes as Wall Street finally wakes up to crypto—about five years late to the party, as usual.

When the suits finally arrive at the crypto revolution, they'll find the pioneers already own the building.

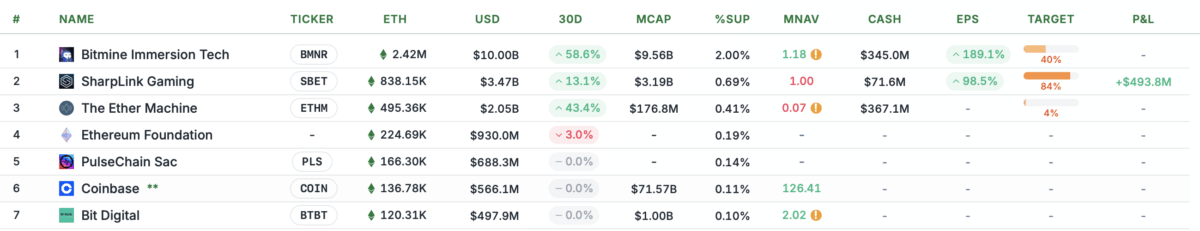

Bitmine Holding surpass other cooperate holding | Source: Strategic ETH Reserve

Bitmine Holding surpass other cooperate holding | Source: Strategic ETH Reserve

BitMine’s combined assets, including its cash, equity, and crypto combined, now total $11.4 billion. This places the firm as one of the biggest crypto treasuries, along with Strategy, which owns 639,835 coins worth over $74 billion.

Meanwhile, the company started buying ETH aggressively earlier this month, when it purchased 46,255 ETH for $200 million. It added $65 million more shortly after which increased its share of total supply to 1.5%.

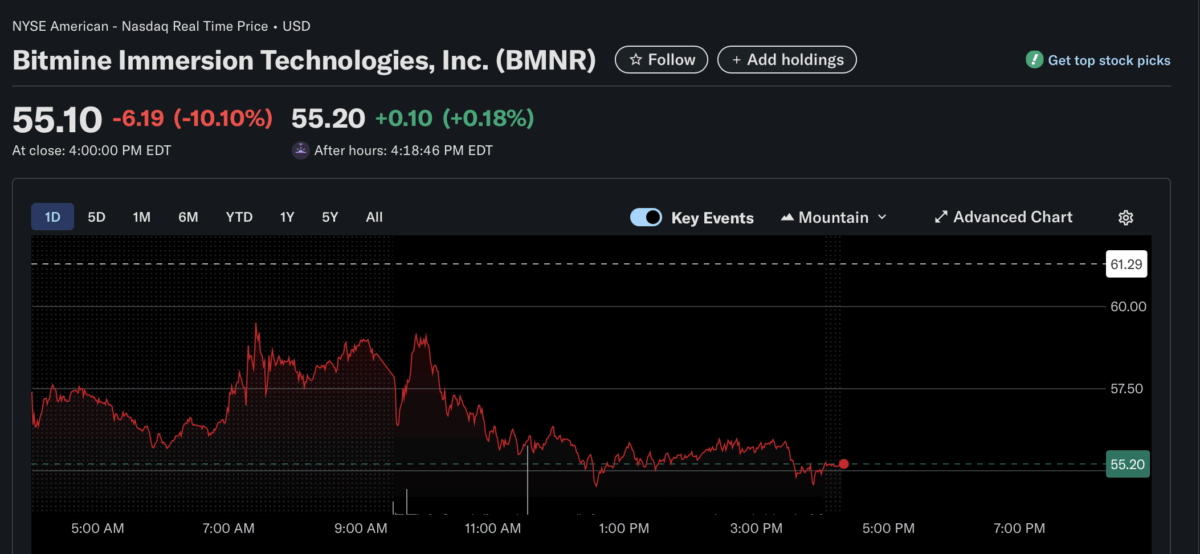

To raise more money, BitMine sold 5.22 million shares at $70 each on September 22, which is a 14% premium compared to the September 19 closing price of $61.29. The company also issued 10.4 million warrants that can be used to buy shares later at $87.50 each. From the share sale alone, BitMine raised $365 million. If all warrants are used, it could collect as much as $913 million more.

But, despite this, BitMine stock (NYSE: BMNR) is down 10% in pre-market trading today. At the time of writing, it has dropped under $55 as Ethereum also slipped 7.42% on the same day, according to CoinMarketCap.

Also Read: Low-Risk DeFi Can Lead Ethereum, How Search Did For Google: Buterin