SharpLink’s Bold 1M Share Buyback as ETH Treasury Soars to New Heights

SharpLink just dropped a power move—snapping back 1 million shares while its Ethereum treasury balloons.

Strategic Pivot or Desperate Gambit?

The buyback signals confidence, or maybe just clever optics—because what better way to distract from traditional finance's slow decay than flashing some crypto muscle?

Ethereum Stack Growing

No new numbers here, just the original 1 million shares and a swelling ETH stash. They're betting heavy on digital gold while old-school portfolios bleed.

Timing the Market—Or Timing the Narrative?

Let's be real: in a world where 'fundamentals' often mean 'follow the hype,' SharpLink's play feels almost poetic. Another day, another trad-fi firm trying to crypto-wash its balance sheet.

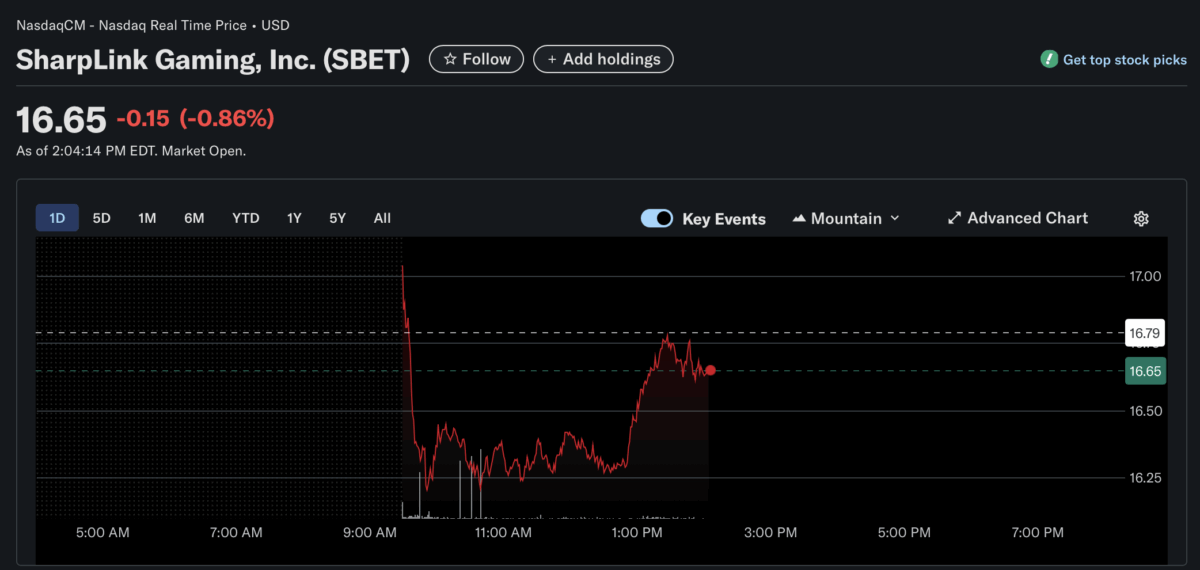

SBET Price Chart | Source: Yahoo Finance

SBET Price Chart | Source: Yahoo Finance

The company disclosed its first buyback on September 9 and said it will only purchase shares when its net asset value (NAV) falls below 1, which it considers a signal of being undervalued. Its current NAV stands at 0.91x, which shows that the stock price is underperforming compared to the Ethereum it holds.

“The Company continues to believe its common stock is significantly undervalued in the market, and that stock repurchases represent the best method to maximize stockholder value under current market conditions,” SharpLink said.

SharpLink is the second-largest Ethereum treasury among publicly traded firms, behind BitMine Immersion Technologies, which holds more than 2.1 million ETH valued at about $9.3 billion.

The repurchase program is funded with cash on hand, income from staking, and other financing options. Other firms are also moving in a similar direction. For instance, Ethereum treasury ETHZilla authorized a $250 million buyback in August, while Bitcoin treasury firm Strive announced a $500 million repurchase plan earlier this week.

Also Read: Binance Token BNB Reaches $957 All-Time High. $1000 Next?