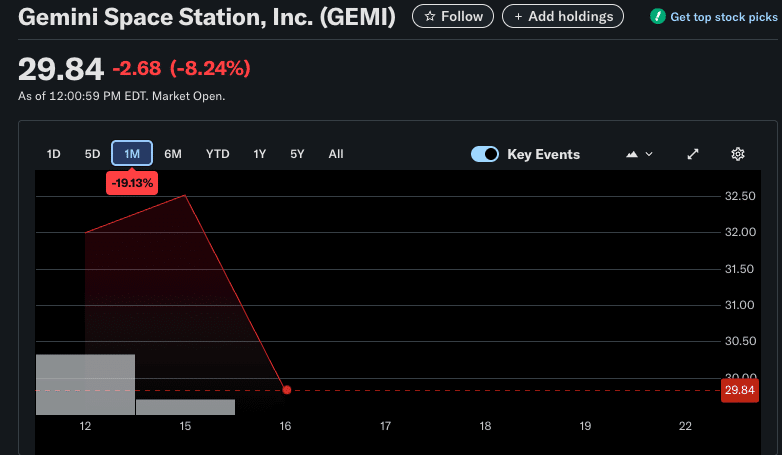

Gemini Stock Plunges 24% Post-IPO as Profitability Concerns Mount

Just days after its market debut, Gemini's shares nosedive—wiping nearly a quarter of its value as investors question its path to profits.

Market Reality Bites

The post-IPO glow didn’t last. Gemini’s 24% drop signals more than just a bad day—it’s a brutal reminder that public markets have zero patience for 'growth over profits' fairy tales. Wall Street’s playing for keeps, not promises.

Behind the Numbers

No revenue magic, no profit sleight-of-hand—just a stark 24% correction. Traditional investors aren’t buying the 'we’ll monetize later' crypto narrative. When the ticker tape stops, the balance sheet speaks.

Finance’s Cold Shower

Another tech darling learns the hard way: profitability isn’t optional. Maybe next time try selling something besides hype? Gemini’s dip isn’t a blip—it’s a lesson.

Gemini Price Chart, SOURCE: Yahoo Finance

Gemini Price Chart, SOURCE: Yahoo Finance

While Gemini successfully raised $425 million from its public offering, its subsequent market performance underscores the intense scrutiny that crypto-native firms face on Wall Street. The swift downturn suggests that investors are increasingly prioritizing a clear path to profitability over brand recognition and growth projections alone.

Gemini’s experience may serve as a cautionary tale for other crypto companies considering an IPO, indicating that public markets demand sustainable financial models, even from the most established digital asset brands.

Also read: SEC, Gemini Reach Tentative Settlement in Crypto Lending Case