StanChart’s Venture Arm Targets $250M Crypto Fund - Banking Giant Doubles Down on Digital Assets

Traditional finance meets digital frontier—StanChart's venture division makes its biggest crypto play yet.

The $250M Gambit

While legacy banks hedge their bets, StanChart's venture arm goes all-in with a quarter-billion dollar fund dedicated exclusively to cryptocurrency and blockchain investments. This isn't dipping toes—it's cannonballing into the deep end of digital assets.

Institutional Momentum Builds

The move signals growing confidence among traditional financial institutions that crypto isn't just surviving—it's becoming unavoidable. When banks start raising dedicated crypto funds, the 'phase' argument starts looking pretty phase-y itself.

Because nothing says 'we believe in this technology' like a quarter-billion dollars of other people's money—banking's version of putting your money where your mouth isn't.

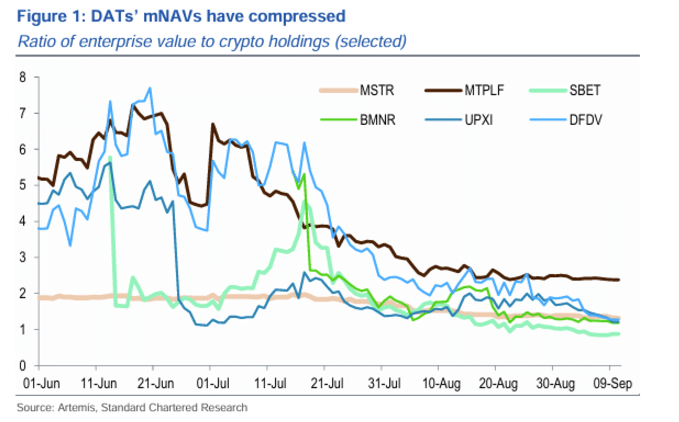

“The recent collapse in DAT mNAVs will likely drive differentiation and market consolidation,” the firm said, predicting advantages for top performers with low funding costs and staking yields, such as MicroStrategy and Bitfarms.

Also Read: Hyperscale Invests $100M in Bitcoin, Expands Michigan AI Campus