Gemini Space Station IPO Priced at $28 Per Share - Space Meets Wall Street in Historic Debut

Space infrastructure meets public markets as Gemini Space Station sets its IPO price at $28 per share, marking one of the most anticipated public offerings in the commercial space sector.

The orbital outpost project—backed by venture capital and aerospace veterans—aims to capitalize on the growing space economy, though skeptics question whether Earth-bound investors truly understand orbital revenue models.

Market analysts project strong initial demand, drawing parallels to early satellite and telecom IPOs, while crypto traders watch closely for any blockchain or digital asset integration announcements.

With commercial space stations poised to replace the aging ISS, Gemini's public debut could set the tone for the entire sector—assuming they don't crash back to Earth like so many SPACs before them.

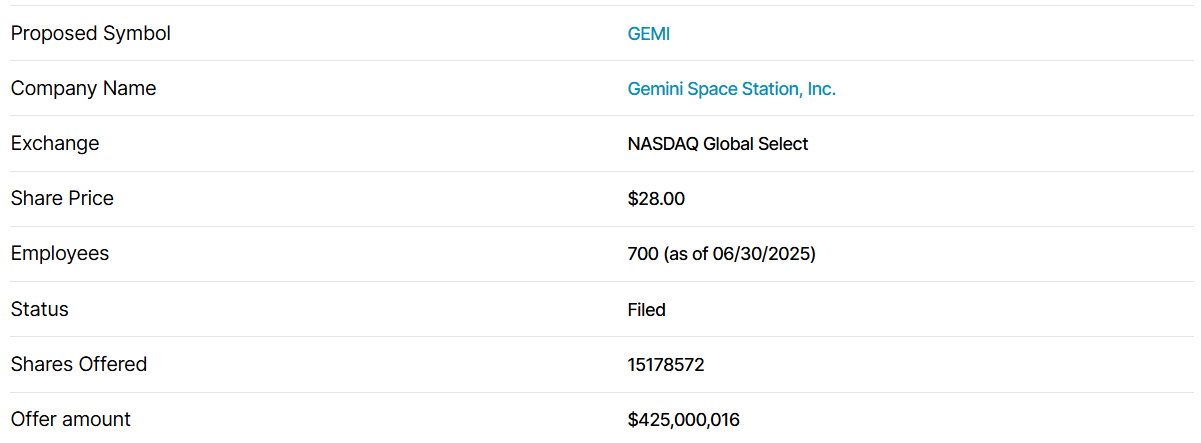

Gemini IPO Details | Source: Nasdaq

Gemini IPO Details | Source: Nasdaq

According to a press release, Gemini and the selling stockholders intend to grant the underwriters a 30-day option to purchase up to an additional 300,565 and 458,364 shares of Class A common stock, respectively, to cover over-allotments. Gemini will not receive any proceeds from any sale of shares by the selling stockholders.

Goldman Sachs & Co. LLC, Citigroup, Morgan Stanley and Cantor are acting as lead bookrunners. While Evercore ISI, Mizuho, Truist Securities, Cohen & Company Capital Markets, Keefe, Bruyette & Woods, A Stifel Company, Needham & Company, and Rosenblatt are acting as bookrunners. Academy Securities, AmeriVet Securities, and Roberts & Ryan are acting as co-managers.

A New Chapter for Crypto on Wall Street

Traditional financial players are not only accepting but actively investing in crypto ventures which is a powerful sign of the times. This was made even more evident by Nasdaq’s $50

million private placement investment in Gemini, a clear endorsement from one of the world’s leading stock exchanges.

While the IPO’s prospectus showed a net loss for the company, the overwhelming demand suggests that investors are looking beyond short-term financials. They’re betting on the future of cryptocurrency and Gemini’s position as a well-regulated, secure, and user-friendly platform in a rapidly evolving market.

Also Read: Gemini Sets $425 Million Cap After IPO Oversubscribed 20 Times