Galaxy Digital Makes Massive $536M Solana Purchase From Binance and Bybit

Galaxy Digital just dropped half a billion on Solana—snagging it straight from Binance and Bybit in one of the year's boldest crypto moves.

Why This Trade Matters

This isn't just another OTC deal. Galaxy's grabbing SOL from two of the biggest liquidity hubs in crypto, signaling serious institutional confidence—or maybe just a well-timed bet before the next ETF wave hits.

Timing, Liquidity, and Big Moves

Buying $536 million worth in one go? That's not dipping a toe—that's diving in headfirst. Shows how deep the institutional pools have gotten, even if traditional finance still thinks 'blockchain' is a brand of luxury watch.

What It Says About Solana’s Momentum

Solana’s been grinding back from the FTX collapse, and moves like this don’t happen in a vacuum. Galaxy doesn’t throw half a billion at dead chains—even if some Wall Street veterans still think 'DeFi' stands for 'definitely fraudulent investing'.

Bottom line: When players like Galaxy make moves this size, they’re not just betting on a token—they’re betting on an entire ecosystem’s comeback. And honestly, it’s a lot more interesting than watching the S&P do nothing for another quarter.

Corporate Treasuries and Market Momentum

The private investment comes amid a growing trend of corporate digital asset treasuries, where companies acquire publicly traded firms and convert them into crypto treasury companies; public Solana treasuries now hold 4.67 million SOL.

Galaxy CEO Mike Novogratz stated that the crypto market is entering a “season of Solana,” citing strong momentum and favorable regulations.

Bitwise CIO Matt Hougan would also say that the coin is being driven towards a bullish direction by corporate treasury buys and future spot Solana ETFs. The fact that Solana is faster and cheaper than ethereum also contributes to its popularity.

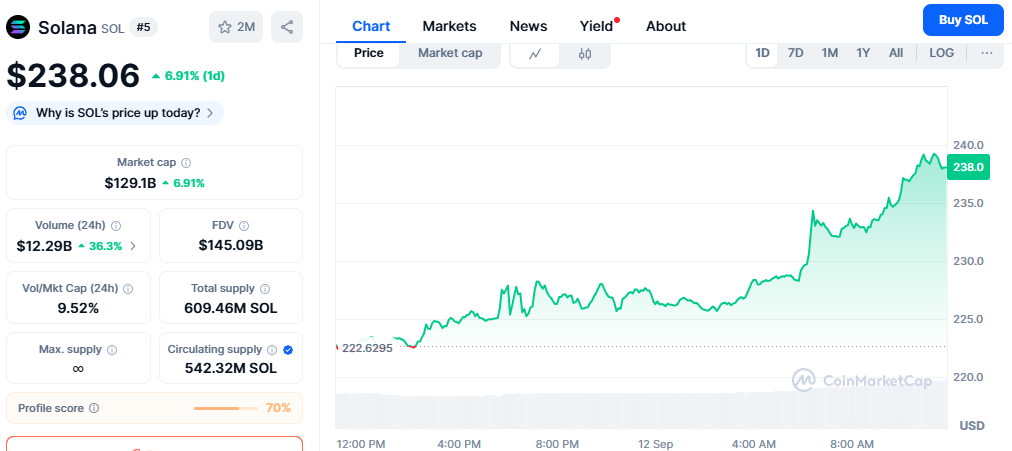

Solana has increased by 6.91% in the last 24 hours, and it is trading at $238.06, overtaking BNB as the fifth-largest cryptocurrency with a market cap of $129.1 billion.

Also Read: BIT Mining Boosts Solana Holdings Ahead of Potential Year-End Rally