Crypto Stocks Diverge: AI Plays Soar While BTC Holders Drop - 2025 Market Shakeup

Tech investors face split realities as artificial intelligence tokens surge while Bitcoin positions weaken across major exchanges.

The Great Divide

AI-focused cryptocurrencies rocket ahead, capturing institutional interest and retail frenzy alike. Meanwhile, Bitcoin holders continue shedding positions—classic crypto volatility meets algorithmic trading strategies.

Market Mechanics Exposed

Trading volumes tell the story: AI assets see record inflows while Bitcoin experiences net outflows. The pattern suggests sector rotation rather than broad market decline—smart money chasing alpha where it lives.

Wall Street's Latest Plaything

Traditional finance finally figures out how to package AI tokens into ETFs, creating yet another product that'll probably underperform the underlying assets. Because why hold the actual technology when you can buy a fee-laden wrapper?

This divergence spells opportunity for nimble traders and headaches for diversification purists. The crypto market remains ruthlessly efficient at separating vision from vaporware.

Circle (CRCL) chart (TradingView)

Circle (CRCL) chart (TradingView)

Miners Pivot to AI

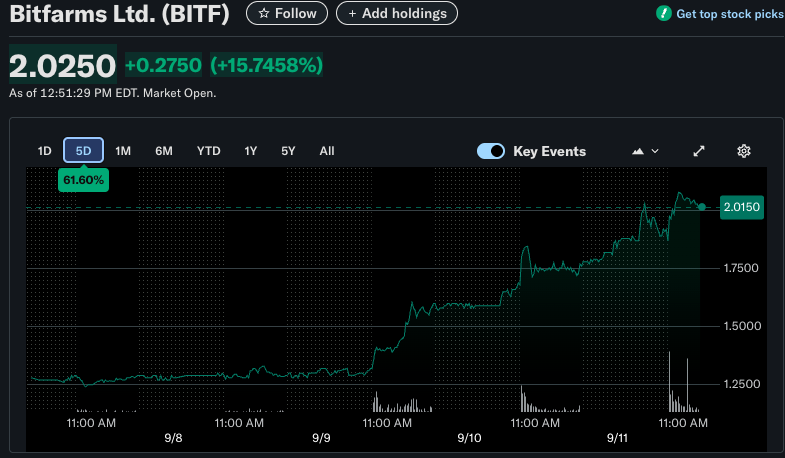

Bitcoin miner Bitfarms (BITF) was among the top performers, rising 18% and capping a weekly gain of over 60%. The company’s surge is linked to its expanding focus on high-performance computing (HPC) for AI applications. Further bolstering investor confidence, Bitfarms appointed Wayne Duso, a former executive from Amazon Web Services, to its board of directors. Brian Howlett, Bitfarms’ Independent Chairman, stated that Duso’s experience “will be an invaluable resource as we pursue aggressive growth in our HPC/AI business.”

In contrast to the rally in tech-focused crypto firms, companies primarily holding bitcoin as a treasury asset saw sharp declines. Japan’s Metaplanet (3355) dropped 10%, and Nakamoto (NAKA) fell 14%, despite Bitcoin (BTC) trading higher around $114,466. The sell-off occurred in a generally positive market environment, with the S&P 500 and Nasdaq 100 gaining 0.82% and 0.69% respectively, following the release of new inflation and jobless claims data.

Why This Matters

This difference shows that the crypto equity market is getting more mature and investors are becoming more picky about which business plans they buy into. Once, only Bitcoin could be a golden snitch. Although the market seems to be recognizing businesses that are expanding their business and capitalizing on bigger tech trends like AI and data infrastructure.

The performance of stocks like Bitfarms and Galaxy Digital suggests that fundamentals, strategic pivots, and ecosystem-specific developments are becoming more critical drivers of value than simply tracking the price of bitcoin.

Also Read: Bitcoin Holds NEAR $114K as US Inflation Hits 2.9% in August