Crypto Investment Exodus: $352M Flees as ETF Filings Explode - What Wall Street Isn’t Telling You

Digital asset products hemorrhage $352 million in outflows while ETF applications hit unprecedented levels.

The Great Divergence

Institutional money walks out the back door just as ETF hopefuls come knocking at the front. Traditional finance's left hand clearly isn't talking to its right—classic Wall Street coordination.

ETF Gold Rush Meets Investor Cold Feet

Asset managers pile into crypto ETF filings despite massive weekly outflows. Someone forgot to tell investors this was supposed to be a bull market.

The Real Story Behind the Numbers

Short-bitcoin products actually saw inflows amidst the carnage. Seems some smart money is betting against the very assets everyone claims to believe in.

Timing is everything in crypto—and right now, institutions can't decide whether to buy the dip or run for the hills.

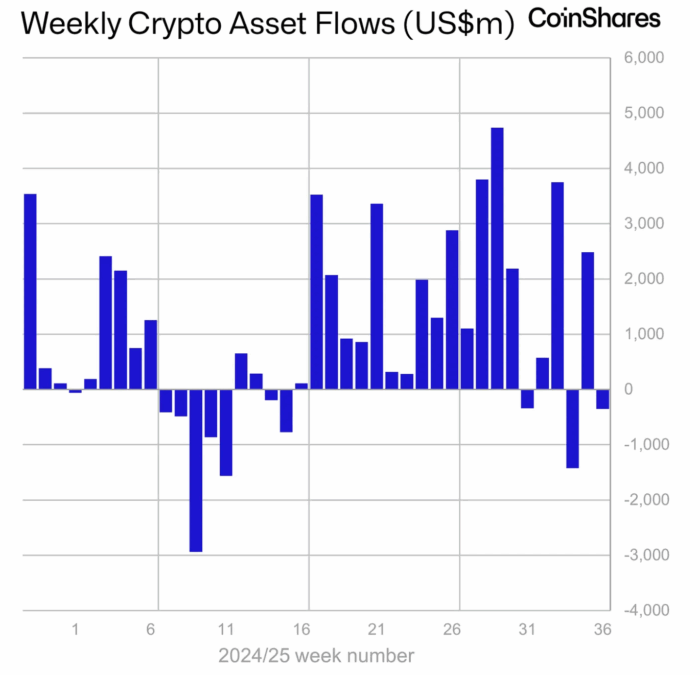

Weekly crypto Asset Flows, Source: Coinshares

Weekly crypto Asset Flows, Source: Coinshares

However, sentiment remains intact. Year-to-date inflows stand at $35.2 billion, which is 4.2% higher on an annualized basis compared to last year’s $48.5 billion.

Bitcoin Leads Inflows as Ethereum Faces Heavy Outflows

With $440 million in outflows, the United States stood out among the other countries. Hong Kong and Germany, on the other hand, maintained their position and brought in new investments of $8.1 million and $85.1 million. Despite the difficulties facing the market as a whole, Bitcoin managed to hold its own, generating $524 million in net inflows.

On the other hand, ethereum faced heavy pressure. It saw $912 million pulled out over seven straight trading days, with withdrawals coming from several different investment products. Despite this, Ethereum’s total inflows for the year remain solid at $11.2 billion.

In the meantime, alternative assets like solana and XRP continued to grow. Solana has seen 21 consecutive weeks of inflows, racking up a total of $1.16 billion, while XRP marked with $1.22 billion during the same timeframe.

Grayscale Pushes for Chainlink ETF as ETF Market Booms

Zach Rynes reported on X that Grayscale has filed an S-1 with the U.S. SEC to launch a spot chainlink ETF. This move would convert the existing Grayscale Chainlink Trust ($GLNK), which has $28 million AUM, into a fully regulated ETF. Bitwise submitted its own S-1 for a LINK ETF in August.

https://twitter.com/ChainLinkGod/status/1965066399971414335Bloomberg analyst Eric Balchunas highlighted the momentum, stating,

“ETFs crack $800b in YTD flows, that’s a breathtaking $5b/day pace… on pace to hit about $1.2T this year, a new record.”

Rising ETF activity shows increasing institutional interest, even as short-term outflows highlight investor caution in volatile crypto markets.

Also Read: