Crypto Markets Surge: MYX, WLD, PENGU Post Major Gains While ETFs Stumble on September 8

Digital assets defy traditional finance trends as select cryptocurrencies rocket upward while exchange-traded funds face unexpected pressure.

MYX leads the charge with explosive momentum, showcasing decentralized finance's relentless innovation cycle. WLD follows closely, demonstrating artificial intelligence tokens' growing dominance in speculative portfolios.

PENGU tokens waddle into impressive gains, proving meme coins still pack serious profit potential when traditional markets waver.

Meanwhile, cryptocurrency ETFs experience notable declines—because why settle for synthetic exposure when you can own the actual digital gold?

The divergence highlights crypto's maturing independence from conventional financial products. While Wall Street plays with paper derivatives, blockchain natives stack genuine digital assets.

Today's action proves once again: if you want real crypto exposure, buy crypto—not some banker's watered-down interpretation of it.

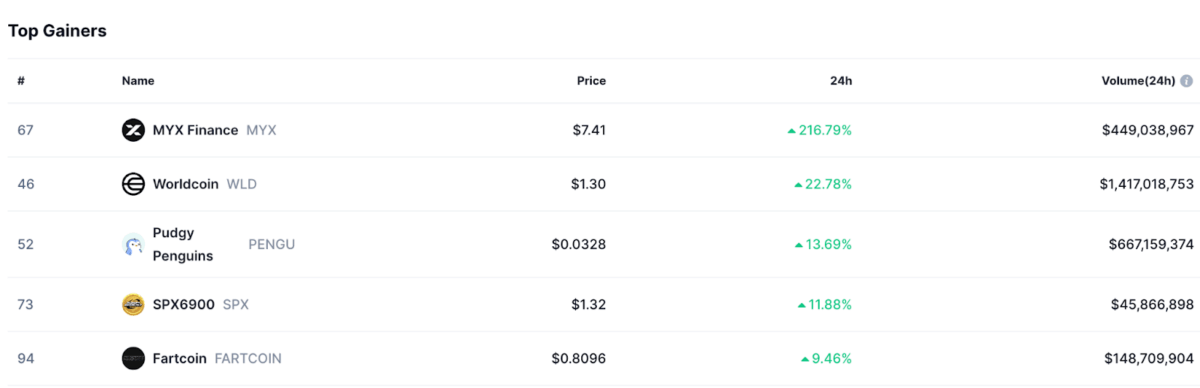

Top Gainers and Decliners

Several altcoins have seen gains lately. MYX Finance (MYX) skyrocketed by 216.79%, hitting $7.41 with a trading volume of $449.03 million. Worldcoin (WLD) also had a great day, climbing 22.78% to reach $1.30, backed by $1.41 billion in daily trading activity.

Pudgy Penguins (PENGU) jumped 13.69% to $0.0328, while SPX6900 (SPX) added 11.88%, bringing it to $1.32. Fartcoin (FARTCOIN) rounded out the top performers with a 9.46% increase, now priced at $0.8096.

On the losers’ side, MemeCore (M) fell by 7.97%, landing at $1.76, and World Liberty Financial (WLFI) dropped 7.44% to $0.2107, despite a trading volume of $1.45 billion.

OKB slipped 4.41% to $189.58, while Cronos (CRO) decreased by 3.71%, now at $0.2516. Bitcoin Cash (BCH) experienced a smaller decline of 2.26%, settling at $592.40.

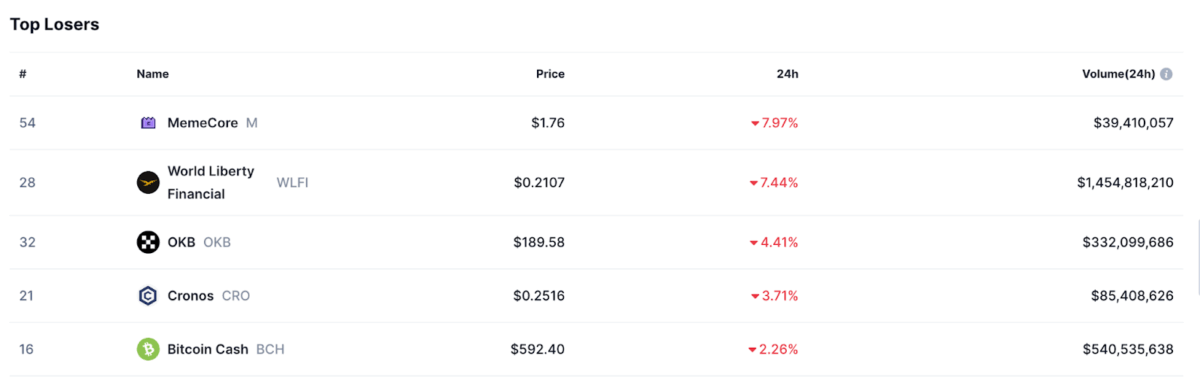

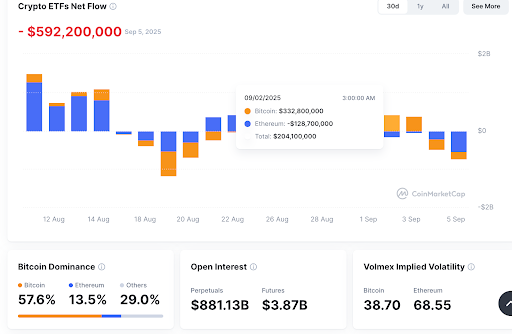

ETFs and Market Sentiment

The Fear and Greed Index was at 42, showing Market sentiment is neutral. Bitcoin dominated altcoins, as evidenced by the Altcoin Season Index, which was at 51.

However, there were signs of caution when it came to ETF flows. On September 2, bitcoin ETFs experienced inflows of $332.8 million, while Ethereum ETFs faced outflows of $128.7 million. This resulted in a net positive flow of $204.1 million.

As per the data, on September 5, the outflows surged to $592.2 million. Bitcoin’s implied volatility stood at 38.70, suggesting moderate price fluctuations. Ethereum on the other hand, had a higher figure of 68.55, indicating a bit more uncertainty. Open interest stood at $881.13 billion for perpetual contracts and $3.87 billion for futures.

The rising trading volume and ETF outflows show a volatile phase where Optimism clashes with cautious selling.

Also Read: USDD Stablecoin Officially Launches on Ethereum Blockchain