Ethereum Whale Cashes Out $8.97M Profit After Kraken Deposit - Smart Money Moves

Whale makes waves with nearly $9 million profit grab.

The Strategy Behind the Exit

Timing everything perfectly—because even crypto whales watch charts. Deposited to Kraken at just the right moment to capture maximum gains without triggering panic. Classic smart money maneuver while retail investors were still deciding whether to HODL or fold.

Market Impact & Ripple Effects

Large moves like this don't go unnoticed. Creates immediate selling pressure but also signals confidence in taking profits at these levels. Other whales watching closely—might trigger copycat behavior if ETH shows any weakness.

The Psychology of Profit-Taking

Nobody goes broke taking profits, as the old trading saying goes. This whale clearly understands that paper gains mean nothing until converted back to cold, hard fiat—or at least stablecoins that won't crash 20% before breakfast.

Why This Matters for Ethereum

Healthy profit-taking actually strengthens long-term prospects. Shows the ecosystem supports real wealth creation, not just hypothetical gains. Plus, let's be honest—someone just made nearly $9 million while traditional finance was busy charging 2% management fees for mediocre returns.

Next moves? Watch whether this whale re-enters on any dip or takes the money and runs. Either way, it's a masterclass in executing when opportunity strikes.

Traders Face Heavy Liquidations

Coinglass data shows Ethereum’s total open positions at $9.04 billion, with short positions slightly dominating at 52.86%, totaling $4.78 billion. Long positions make up 47.14%, valued at $4.26 billion.

Margins are still balanced, with a $1 billion total margin split between longs at $473.25 million and shorts at $527.97 million. Losses are severe, reaching $237.29 million, with short positions down $215.31 million and longs down $21.99 million.

Funding fees highlight demand for shorts. Long traders paid $39.46 million, while shorts earned $138.86 million, showing stronger pressure from bearish bets.

High Volatility Despite Bullish Ratios

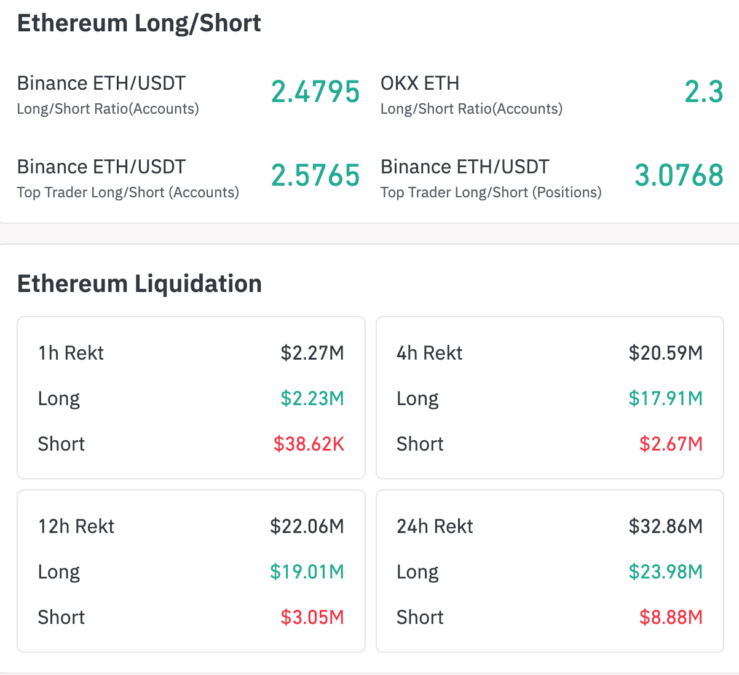

Even with bearish positions, sentiment on exchanges is bullish. According to the platform data, ETH/USDT long-to-short ratio on Binance is at 2.48, and among the top traders, it climbs to 3.07. OKX is showing a similar level of Optimism with a ratio of 2.3.

That said, over the last day, with $23.98 million coming from the long liquidations and $8.88 million from the shorts, approximately $32.86 million in liquidations were recorded amid high volatility.

Most of these $20.59 million liquidations occurred within the span of approximately four hours, punishing the long traders the most.

Ethereum’s market is volatile at the moment. Big whale moves, heavy betting with leverage, and sudden liquidations are creating wild swings, bringing chances to profit but also big risks.

Also Read: