Crypto Rollercoaster: BTC & ETH Stumble While ENA, OKB, WLFI Defy Gravity on September 6

Major cryptos hit turbulence as Bitcoin and Ethereum face headwinds—while select altcoins sprint ahead against market sentiment.

Blue-Chip Blues

Market leaders struggle to maintain momentum, triggering fresh anxiety among traditional portfolio managers—who still can’t decide whether crypto is a hedge or a hazard.

Altcoin Anomalies

ENA, OKB, and WLFU buck the trend, posting notable gains while giants wobble. Are we seeing a rotation—or just speculative froth?

Volatility isn’t a bug; it’s a feature. And today’s action proves once again that while traditional finance sleeps on digital assets, the crypto market never hits the snooze button. Just don’t tell your financial advisor—they’re still trying to short Bitcoin with gold ETFs.

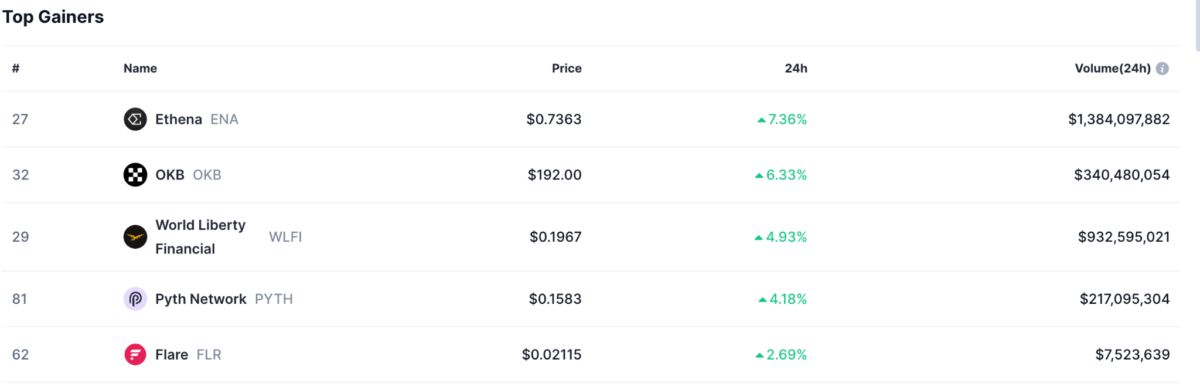

Top Gainers and Losers in the Market

Even though the market as a whole took a hit, a few altcoins managed to shine. Ethena (ENA) led the gainers as of writing, jumping up by 7.36%, hitting $0.7363. The token was backed by a trading volume of $1.38 billion.

OKB wasn’t far behind, climbing 6.33% to reach $192.00 with $340.48 million in trading activity. World Liberty Financial (WLF) followed, gaining 4.93% to $0.1967, thanks to nearly $933 million traded. Pyth Network (PYTH) saw a 4.18% boost to $0.1583, while Flare (FLR) had a smaller uptick of 2.69%.

However, several coins suffered heavy losses. Kaspa (KAS) led declines, plunging 7.90% to $0.07737 with $63.1 million traded. Aerodrome Finance (AERO) dropped 6.55% to $1.15.

Pudgy Penguins (PENGU) slipped 5.21% to $0.02879, with a relatively high $216.5 million turnover. Fartcoin (FARTCOIN) decreased by 4.87% to reach 0.7365, while Lido DAO (LDO) fell 4.84% to $1.16.

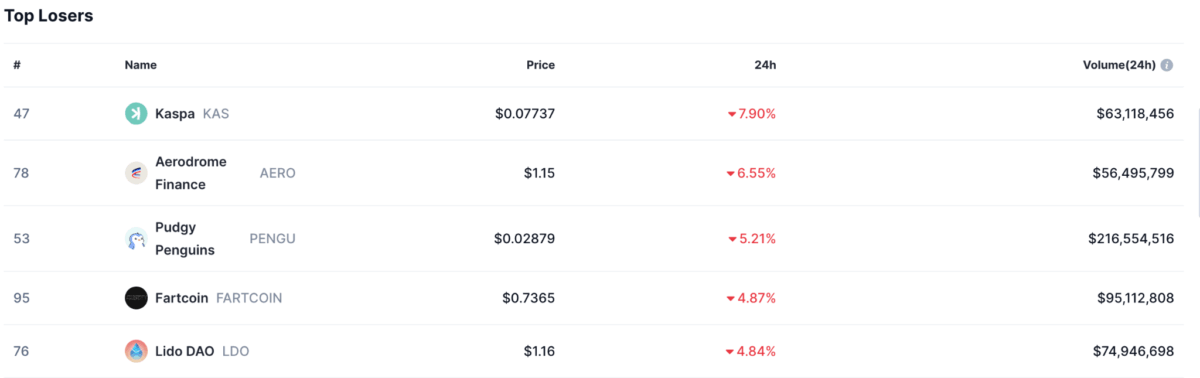

Market Sentiment and Investor Behavior

As for the Market Overview side, according to CoinMarketCap, the Fear and Greed Index is at 41 currently, showing a neutral sentiment. In contrast, the Altcoin Season Index is at 52, signifying a state where Bitcoin’s dominance is balanced with altcoin growth potential.

In the crypto ETF, there were outflows totaling $592.2 million, a sign of investors pulling back from digital assets. Volatility is still quite high, with Bitcoin’s implied volatility at 38.65 and Ethereum’s even higher at 69.24.

Open interest in derivatives has climbed to $937.39 billion in perpetual contracts and $3.83 billion in futures, showcasing high speculative activity.

The crypto market appears to be going through a bit of a rough period. The market’s sharp declines, ETF outflows, and mixed altcoin moves show rising caution.

Also Read: