Justin Sun vs. WLFI: Is the ’D’ in DeFi for Decentralization or Dictatorship?

Crypto's power struggle erupts into public view as Justin Sun locks horns with WLFI—raising fundamental questions about who really controls decentralized finance.

The Governance Showdown

WLFi's community accuses Sun of manipulating governance mechanisms to consolidate power rather than distribute it. Token holders allege voting processes favor whale interests over grassroots participation.

Protocol Politics

At stake: whether DeFi's flagship projects operate through transparent community governance or backroom influence. The conflict exposes how code-based rules can be gamed by those with sufficient capital and technical leverage.

The Irony of 'Decentralized' Control

Sun's defenders claim he's exercising legitimate influence as a major stakeholder—the same argument traditional finance uses to justify shareholder supremacy. Plus ça change, plus c'est la même chose—just with blockchain buzzwords.

DeFi's defining paradox: the louder someone proclaims decentralization, the more central power they usually wield. The space keeps proving that human nature writes smarter contracts than any programmer.

Trigger point: Volatility around WLFI

WFLI was launched in 2024 by the family of the U.S. President Donald Trump, and it debuted its $WLFI governance token on September 1, 2025. It was launched at the market price of $0.2 per token. The launch was announced by Donald TRUMP Jr. on X, calling it the “governance backbone of a real ecosystem changing how money moves.”

Big day – @WorldLibertyFi just launched the $WLFI token. This isn’t some meme coin, it’s the governance backbone of a real ecosystem changing how money moves. Freedom + finance + America FIRST. Home Team. 🦅

— Donald Trump Jr. (@DonaldJTrumpJr) September 1, 2025The protocol said during the launch that it will have a maximum supply of 100 billion. The company had made 1 billion tokens on Ethereum, 285 million on Solana, and 50 million on BNB Chain during the launch. A blog post on Medium said that there will be about 24,669,070,265 tokens in circulation at the time of launch.

They also announced that the initial offering will include 10 billion tokens to help the ecosystem grow. Alt5 Sigma Corporation will get almost 7.78 billion, which is about 8% of the total token supply. This funding is part of its Treasury Strategy. About 2.88 billion will go to marketing and liquidity, and about 4 billion will go to people who buy tokens in public sales.

The non-circulating supply also includes 19.95 million tokens in the protocol treasury, 33.507 million for the team, 16 million for public sale, and 5.85 million for strategic partnership. And the most important point to note is that it had not mentioned blacklistings in its contracts.

Many crypto experts had high expectations around the token, but it left them high and dry. There was high volatility around the token, and it dropped from over $0.40 to $0.20 or by 40%.

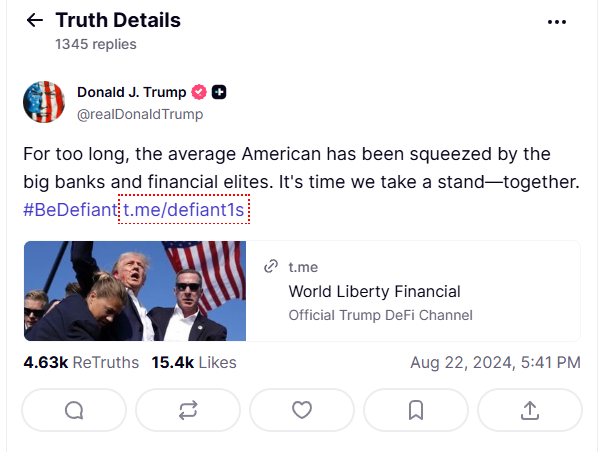

What many crypto users find hypocritical is that during his presidential campaign, Donald Trump called out banks and financial institutions for “blacklisting, freezing, and controlling the big banks.” The Trump family is doing the same thing now on WLFI.

This is where Justin Sun enters the picture. The TRON Founder transferred $9 million worth of WLFI tokens across various crypto exchanges. This move was followed by a rather drastic step by WFLI. The crypto protocol put Justin’s blockchain address on a blacklist.

Action by WLFI: Barking up the wrong tree

The action began on September 4, when WLFI effectively froze 595 million unlocked WLFI tokens, worth about $107 million, of its second-largest investor, Justin Sun.

Blockchain records from Aarkham Intelligence showed that Sun’s wallet (0x5AB) sent the $8.89 million transfer to ‘0xbdF…74B0’ at 09:18 UTC. The address of the recipient was put on a blacklist soon after, which raised red flags. The blacklist function means that the assets can’t be moved or sold as long as the restriction is active, even though they are still visible in the wallet.

Later on Friday, World Liberty said in a statement on X that they had heard “community concerns” about wallet blacklists. It didn’t name SUN or say anything about his tokens, though.

The blacklisting comes as a surprise, and not in a pleasant way, for obvious reasons. First, the blacklist wasn’t in the original contract, but was instead added through a proxy contract upgrade just a week before the token became transferable. Also, World Liberty had said before that early investors could sell up to 20% of the tokens they owned.

Was Justin Sun sold down the river?

An analyst from Nansen reported that Sun transferred 50 million tokens to a different address prior to the blacklisting. While responding to the blacklisting, Sun said on X that the transfers were not for selling purposes in response to the news.

Our address only carried out a few general exchange deposit tests with very small amounts, followed by an address dispersion. No buying or selling was involved, so it could not possibly have any impact on the market.

— H.E. Justin Sun 👨🚀 (Astronaut Version) (@justinsuntron) September 4, 2025He explained that the activity consisted of “a few generic exchange deposit tests involving very low amounts, which then created address dispersion.” He said that the deals didn’t involve “any buying or selling” and “couldn’t possibly have any effect on the market.”

In the second message, Justin Sun asked the WLFI team to unfreeze his tokens so that they could all work together to achieve success. He stood up for the premise that a real financial brand had to be based on strong values like fairness, openness, and trust. He thinks that suspending investors’ assets is a hazardous unilateral MOVE that violates the rights of holders and could damage faith in World Liberty Financial as a whole.

Critics contend that internal control was the sole justification for WLFI’s blacklisting of wallets because it was not required by external regulations to do so. And if so, why was Justin Sun’s account abruptly frozen after he had already completed KYC, unlocked and invested his tokens, and even made a few small transfers, when WLFI, clearly states on its website that “$WLFI token holders do not owe any duties to each other or to the Company

This case is not isolated—yet it is unique .”

WFLI is not the first protocol to blacklist wallets or tokens. In fact, the last five years have seen the most infamous cases of such blacklisting. Tether, USDC, and Tornado Cash have had their shares of sanctions and blacklistings.

USDC (Circle) and Tether (USDT) have blacklisted wallets tied to hacks, frauds, or sanctions many times.Tether froze $35 million in stolen USDT after the KuCoin hack in 2020.

It was meant to safeguard victims, but it showed how much influence stablecoin issuers had over assets that are supposed to be permissionless.

But the fundamental difference between these cases and WLFI is that USDC and Tether are centralized. These stablecoins’ smart contracts have a built-in way to blacklist wallets. Because they are centralized issuers, Circle and Tether have a “blacklist” database and can use a function in their smart contract to add an address to this list.

There are several reasons for this, such as demands from law enforcement, sanctions like those from the U.S. Office of Foreign Assets Control, or the Office of Foreign Asset Control (OFAC), and freezing money that was taken in cyberattacks or scams. Their control is built into their centralized business model, which is meant to keep a stable peg to a fiat currency and obey all the rules that are already in place for financial transactions. But in WFLI, the development team of a DeFi project blacklisted WLFI.

WLFI is a governance token that follows the principle of decentralized finance (DeFi); however, its smart contract gives the team “guardian” or “admin” rights that let them blacklist wallets on their own. Unlike stablecoins, this step is not due to external regulatory requirements. Instead, the project’s internal governance and security issues drive this action. That’s why Justin Sun was blacklisted; due to claims of token dumping and market manipulation. Whereas in the case of USDC and USDT, the reasons were law enforcement and regulatory compliance.

The question remains: Is WLFI really decentralized?

The grapple between WLFI and Justin Sun goes beyond just frozen tokens. It shows whether politically branded, high-profile crypto projects can keep their beliefs while still gaining influence. Tether and USDC freezes were justified as compliance with regulators, but WLFI’s choice to freeze its funds against an ally goes against its story of being decentralized and could turn off investors.

If WLFI can freeze even its biggest donors at random, it raises a serious question for the whole industry: is WLFI really decentralized, or is it just “decentralized finance” for namesake when only a few people have control?

Also Read: Musk vs Altman: The Silicon Showdown