Advisors Surpass Hedge Funds as Leading Ethereum ETF Holders - A Strategic Shift in Crypto Investment

Financial advisors just flipped the script on Wall Street's traditional players.

ETHEREUM ETF SHOWDOWN

Investment advisors now hold more Ethereum ETF assets than hedge funds—a stunning reversal of conventional wisdom. They're allocating client portfolios toward crypto exposure while hedge funds remain cautious.

WHY ADVISORS ARE LEADING

Registered investment advisors and wealth managers are building long-term crypto positions rather than chasing short-term gains. They're bypassing hedge fund hesitation and directly embracing Ethereum's institutional potential.

THE NEW INSTITUTIONAL LANDSCAPE

This isn't speculative gambling—it's calculated portfolio diversification. Advisors recognize what many funds missed: crypto isn't going away, and clients demand exposure. They're building positions while Wall Street still debates whether to even enter the game.

Of course, this sudden advisor enthusiasm might just be another case of financial professionals discovering an asset class right after their clients already did—but at least they're finally catching up.

Major Players Step In

Additionally, Bloomberg’s breakdown highlights Goldman Sachs as the largest disclosed holder with $721 million in Ethereum ETFs. The bank boosted its position by more than 160,000 ETH.

In a follow-up post, Seyffart revealed Jane Street and Millennium Management ranking next, with exposures of $190 million and $187 million. Other big firms such as Capula Management, DE Shaw, and HBK Investments also had notable stakes.

Here's the top holders of the ETH ETFs according mostly to 13F data as of 2Q.

Full report can be read here for Bloomberg customers: https://t.co/Zr9t8OuE9Z pic.twitter.com/MxpAM27mhk

As most firms increased their exposure, a few made cuts. Schofield Strategic Advisors trimmed its holdings by over 16,000 ETH, and Van Eck Associates reduced its stack by approximately 2,700 ETH.

ETF Market Momentum Builds

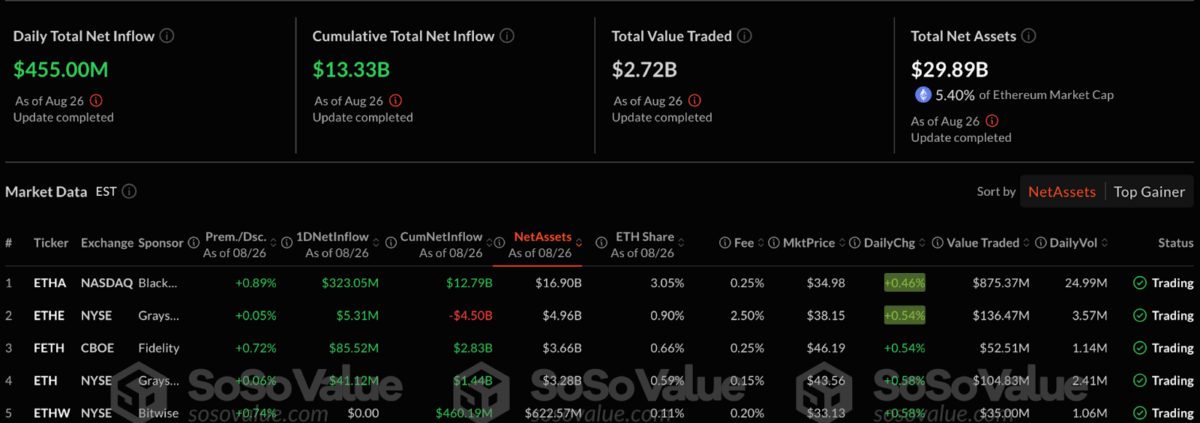

Furthermore, recent data from SoSoValue indicates that inflows are holding strong. On August 26, Spot Ethereum ETFs saw $455 million in net inflows. Since their launch, cumulative inflows have reached $13.33 billion, while total assets have moved to $29.89 billion, making up 5.4% of Ethereum’s market cap.

BlackRock’s ETHA was leading with $323 million in daily inflows, which supported its assets to $16.9 billion. Following closely was Fidelity’s FETH, which attracted $85.5 million in inflows and now has $3.66 billion in assets. Grayscale ETHE on other side faces challenges, whereby it experienced $4.5 billion in outflows, despite seeing a slight daily inflow.

Demand for Ethereum ETFs from both retail and institutional investors is on the rise. Alongside continued inflows and growing holdings, it bolsters Ethereum’s standing as the largest cryptocurrency following Bitcoin.

Also Read: Investors Shift $900M Daily from Bitcoin to Ethereum: Analyst