Dogecoin Whales Hold Strong Despite Mounting Market Pressure - Is a Sharp Drop Imminent?

While retail investors panic-sell, Dogecoin's heavyweight holders aren't flinching—even as the meme coin teeters on the brink of a significant correction.

Market whales dig in

Major holders continue accumulating DOGE positions instead of dumping, betting against the prevailing bearish sentiment. Their conviction stands in stark contrast to the broader market's nervous energy.

Pressure builds

Technical indicators flash warning signs as trading volume stagnates and support levels weaken. The token faces its toughest stress test since last year's rally—proving once again that crypto markets love nothing more than testing diamond hands.

Will the whales' gamble pay off, or are we witnessing the calm before another crypto bloodbath? Only time will tell if their stubborn hold turns genius or just another expensive lesson in hodling.

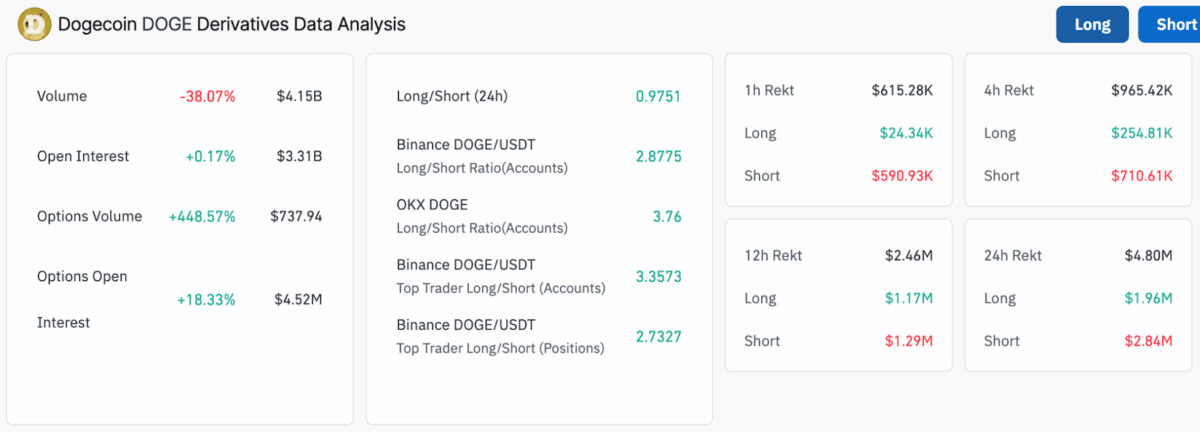

Dogecoin Derivatives data, Source: Coinglass

Dogecoin Derivatives data, Source: Coinglass

Additionally, trading in options has increased by 450% to $738 million, while the open interest has risen modestly by 18% to $4.52 million. This implies that there is likely a decrease in overall trading activity, but there is a very definite increase in the inclination for Leveraged bets on Dogecoin’s future.

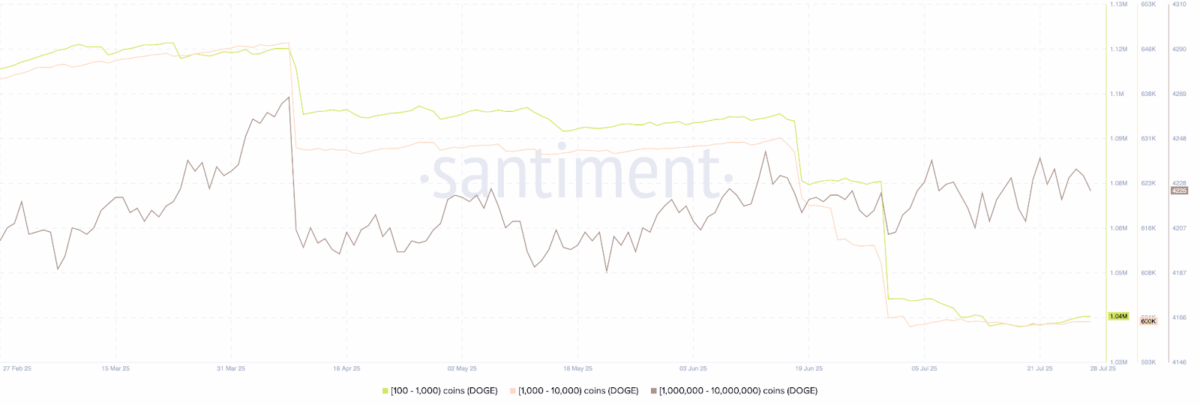

Retail Retreats, Whales Hold Firm

Wallet behavior is showing a divide. According to Santiment, the balances for addresses holding between 100 and 10,000 Doge have been on the decline since mid-June. This suggests that retail and mid-tier traders are pulling back on their investments.

Besides, Whale Alert earlier flagged a massive 900 million DOGE transfer to Binance worth more than $200 million. That move raised concerns of possible sell pressure in the NEAR term.

In July, whales holding between 1 million and 10 million DOGE maintained their positions and slightly increased them as per the data. These bigger players seem to have confidence in the market’s fluctuations.

As a result, the way supply is being redistributed looks to be favoring these whales, shifting the power into the hands of fewer but more influential holders.

Analysts Track Technical Indicators

On X, analyst Kevin highlighted a familiar setup that often preceded dogecoin rallies. He explained: “Anytime we saw Monthly Stoch RSI crosses on Dogecoin outside of the bear market along with an uptrending Monthly RSI it ultimately lead to massive rallies to the upside.”

Anytime we saw Monthly Stoch RSI crosses on #Dogecoin outside of the bear market along with a uptrending Monthly RSI it ultimately lead to massive rallies to the upside. The goal is to get the StochRSI to cross the 20 level and show follow through as anything below that level is… pic.twitter.com/FxrohrzlXo

— Kevin (@Kev_Capital_TA) August 27, 2025Currently, the indicator is crossing upward at the 13 level. However, Kevin noted Dogecoin needs Bitcoin strength and ethereum price discovery for confirmation. Hence, broader market support is critical for the next big move.

Dogecoin stands at a tipping point. Retail investors are retreating, whales are holding, and derivatives traders are betting big. The next weeks may decide its cycle-defining move.

Also Read: Numeraire (NMR) Price Surges 107% as JPMorgan Invests $500M