Ethereum Primed for Historic Breakout as Wall Street Money Floods In

ETH bulls are charging toward uncharted territory—institutional FOMO just lit the afterburners.

The institutional dam breaks

BlackRock's ETH ETF approval last week sent shockwaves through crypto markets. Suddenly every hedge fund manager who mocked 'magic internet money' is scrambling for exposure. The irony? They're buying the very asset their compliance teams blocked them from touching at $200.

Technical fireworks ahead

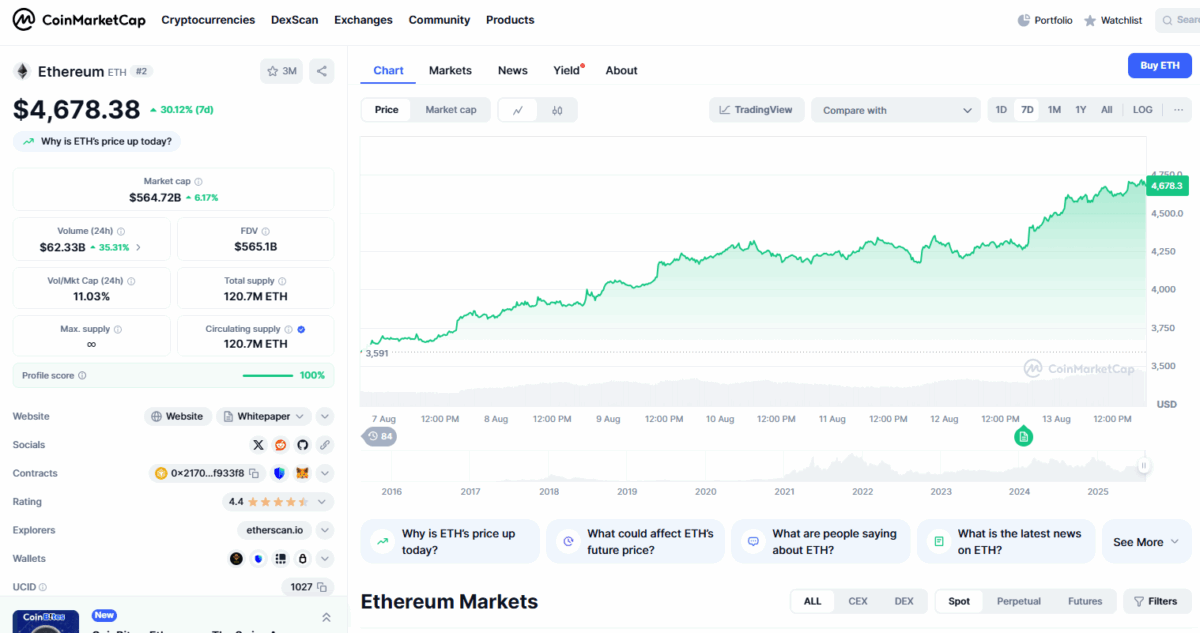

ETH's weekly chart shows a textbook bull flag forming since the 2021 ATH. With RSI holding steady at 65 and volume picking up, traders are betting this isn't another fakeout. The real test comes at $5,000—break that, and we're in price discovery mode.

Meanwhile in TradFi land...

Goldman analysts just upgraded their ETH price target (after quietly accumulating positions for months). Nothing like validating your own thesis with other people's money. The real question: will institutions panic sell at the first 20% dip like retail plebs always do?

ETH Price | Source: CoinMarketCap

ETH Price | Source: CoinMarketCap

As of today, since the Asian trading session began, ETH already hit a daily high of $4734.45, trading volume has also surged 25% as it soared past $61.58B. With all this bullish sentiment breaking the ALL time high seems easy as it’s only $200 away.

ETH has grown strong to become an institutional digital asset with more firms adopting its solution. This has been a major driver of the performance in the last few days.

BitMine Immersion Technologies, one of the ETH treasury firms, has filed with US regulators to lift its share offering to $24.5 billion. The company says it will use the funds to buy more Ethereum. It already holds more than one million ETH and aims to own around 5% of the total supply. This approach is taking a large amount of ethereum out of the market.

SharpLink Gaming has also moved to increase its ETH holdings, raising almost $400 million for fresh purchases. These large treasury buys are adding to the market’s upward push.

ETH Spot ETF Demand Grows

Ethereum spot ETFs have pulled in record amounts of inflow in recent days. Data from SoSoValue shows $1.02 billion came in two days ago. BlackRock’s ETHA fund led with about $640 million, followed by Fidelity’s FETH at $277 million. Over the past week, total ETF inflows have reached more than $2.3 billion. Funds now hold about $27.6 billion worth of ETH which is 4.77% of Ethereum market cap.

“Spot ETH ETFs have pulled in about $2.3 billion over the last five trading days, including one of their top five single-day intakes since launch. Since early July, they’ve attracted roughly $1.5 billion more than spot Bitcoin ETFs,” said Nate Geraci, president of The ETF Store.

Another half bil into spot eth ETFs…

5th best day since launch.

Now $2.3bil over past 5 trading days.

Since beginning of July, spot eth ETFs have taken in nearly $1.5bil more than spot BTC ETFs.

Notable shift.

The price of ETH is now up more than 40% this month after a slow start to the year. A boost has also come from the passing of the GENIUS Act in the US, which sets clearer rules for stablecoins. Many leading stablecoins operate on Ethereum, so the new law could support higher use of its network.

Crypto analyst Michael van de Poppe said on X that ethereum is showing strength similar to the rally that followed bitcoin ETF approvals earlier this year. He added that if the current buying trend holds, ETH could test its record price soon.

Also Read: Nasdaq Listed BTCS Inc. Adds Pudgy Penguins NFTs to Treasury