Ethereum Rockets Toward $4,811 as ETF Demand Explodes and Inflation Fizzles

ETH's bull run just got jet fuel—ETF inflows hit record highs while macro headwinds vanish.

Wall Street's new crypto crush

Institutional money floods ETH ETFs as traders ditch 'safe' bonds for asymmetric bets. Who needs 2% yields when DeFi offers 10x upside?

Inflation? More like deflating concerns

Cooling CPI data gives the Fed cover to keep rates low—paving the way for risk assets to moon. Even gold bugs are rotating into digital gold.

The cynical take

Watch traditional finance 'discover' ETH's utility just as retail FOMO peaks. Same playbook as Bitcoin 2021—but this time with actual cashflows.

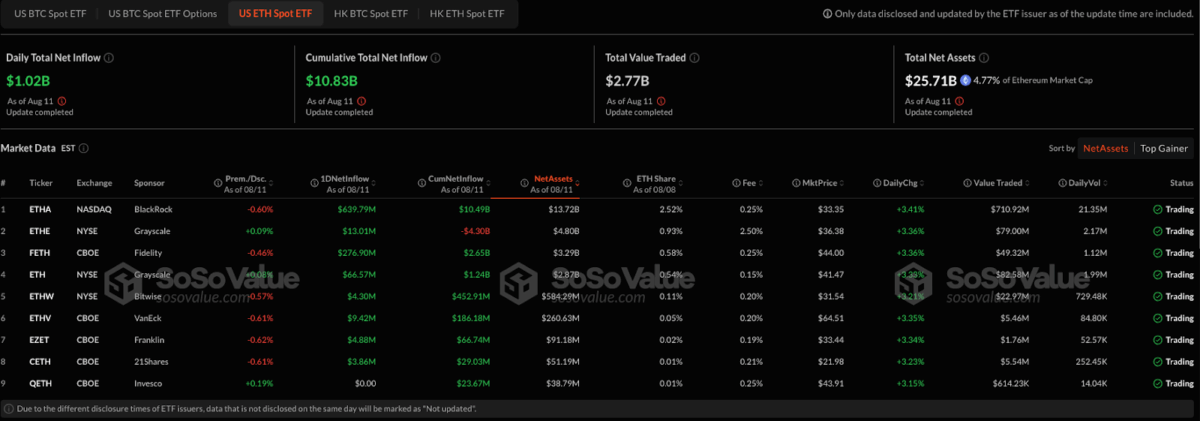

Ethereum Spot ETH ETFs, Source: Sosovalue

Ethereum Spot ETH ETFs, Source: Sosovalue

Technical Momentum Builds

According to Crypto analyst Javon Marks, Ethereum has rallied nearly 261% since breaking a long-term resistance trend. The cryptocurrency has moved past $4,400 and is targeting $4,811.71, just under 10% higher as per the analysis.

After climbing ~261% since breaking out of the displayed resisting trend, $ETH has broken $4,400 and is now starting to approach its target at the $4811.71 level!

Ethereum has just under +10% to go before reaching this target and has made monumental progress towards doing so! https://t.co/EeC4Y7RiMf pic.twitter.com/Cbix7GN6T8

The chart indicates that there was a recovery from a prolonged 2022-2023 downtrend, with prices pushing through resistance levels in 2024 before the breakout happened.

However, Ethereum now trades more than 8.9 million units every day. As shown by Ssovalue, ETF products like FETH have also ha with noting activity, with $9.62 million traded in just one day. The fee structures are quite competitive, ranging from 0.25% to 2.50%.

Market Risks Emerge

The rally seems to have caught the attention of hackers. According to the on-chain tracker Spot On Chain, the Infini Exploiter managed to sell off 1,771 ETH for $7.44 million in DAI at a price of $4,202.

Hackers are capitalizing on the $ETH price surge to liquidate stolen assets.

1️⃣ Infini (@0xinfini) Exploiter sold 1,771 $ETH for 7.44M $DAI at $4,202 yesterday.

The neobank was hacked for $49.5M in Feb 2025, and the exploiter still holds 9,154 $ETH ($39.2M).

2️⃣ Radiant Capital… pic.twitter.com/zjint8abHF

Meanwhile, the Radiant Capital Exploiter liquidated 3,091 ETH, raking in $13.26 million in DAI at $4,291. Both of these groups still have a hefty stash of stolen ETH in their possession.

Ethereum is rising, thanks to favorable macroeconomic conditions and a strong interest from institutions through ETFs. The technical indicators suggest there could be more gains to be expected, possibly reaching $4,811. However, large-scale hacker liquidations might bring some volatility into the mix.

Also Read: U.S. Spot Ethereum ETFs Hit $1 Billion Daily Inflows for First Time