Bitmine Goes All-In: $20B ETH Buying Spree Signals Crypto Confidence

Bitmine just placed the biggest bullish bet in crypto history—and Wall Street's fiat printers are overheating.

The $20B moonshot: The mining giant's immersion cooling division is raising a war chest to hoard Ethereum, doubling down on Proof-of-Stake dominance as institutional FOMO hits escape velocity.

Why ETH? Smart contract platforms are eating traditional finance—and Bitmine's move screams conviction in the flippening. Meanwhile, legacy banks keep minting 'stablecoins' with extra steps (looking at you, JPM Coin).

The bottom line: When miners turn into mega-whales, the market listens. This isn't accumulation—it's a hostile takeover of the old financial system.

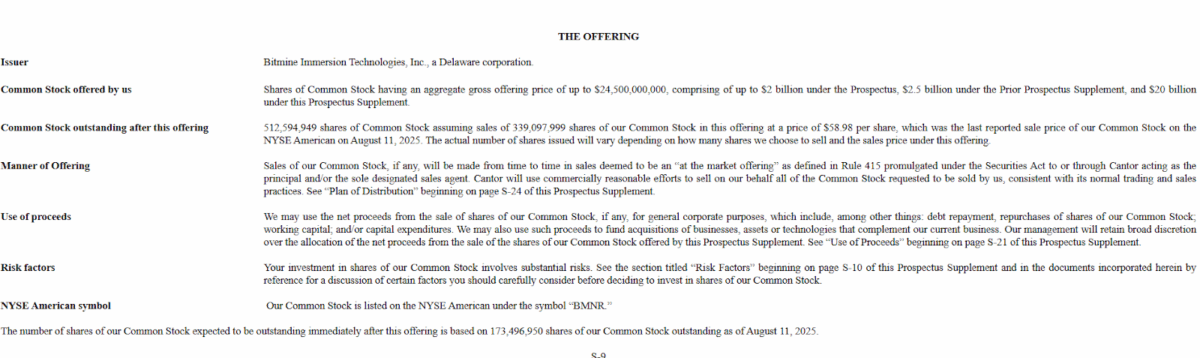

Bitmine $24.5 Billion Plan | Source: SEC

Bitmine $24.5 Billion Plan | Source: SEC

Before the upgrade, Bitmine had already disposed of approximately $4.5 billion of the shares under the old authorization, so it has approximately $723 million of that allocation remaining as well as this new $20 billion capacity.

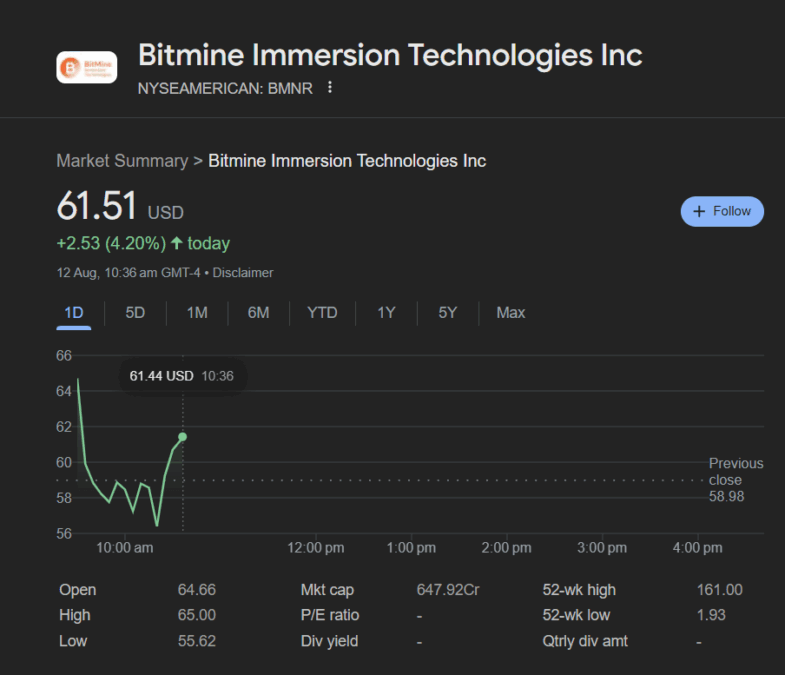

BMNR shares closed on Monday at $58.98. The ATM structure will enable Bitmine to sell stock over time into the market at prevailing prices, through exchanges like the NYSE American or negotiated transactions.

Cantor Fitzgerald and ThinkEquity will serve as sales agents, earning up to 3% in commissions on gross proceeds.

Bitmine has become a leader in blockchain infrastructure and immersion mining high-efficiency technology.The company has recently announced that its plan is to diversify its cryptocurrency positions beyond simple mining rewards.

It is investing some of its capital buying ETH to position itself ahead of network upgrades and to support other activity in decentralized finance.

If it does receive the entire amount, the $20 billion boost would be one of the largest equity financings in the crypto universe.

This WOULD give Bitmine significant power to expand its operations, stockpile more ETH, and become a more formidable force in the digital assets sector.

Also Read: BitMine Builds World’s Largest ETH Treasury in 35 Days