Crypto Exchange Aims for $4.8B Valuation in Blockbuster Expanded IPO—Bullish Momentum Builds

Another day, another crypto unicorn charging toward Wall Street.

The $4.8B Gamble:

A major crypto exchange is doubling down on its IPO ambitions—expanding its offering while markets froth. Because nothing says 'trust us' like a nine-figure valuation during peak volatility.

Why It Matters:

This isn’t just another listing. It’s a litmus test for crypto’s staying power in traditional finance. Spoiler: Institutional money’s already salivating.

The Punchline:

Will this be the listing that finally makes crypto 'respectable'? Or just another exit for early bagholders? Place your bets—the house always wins.

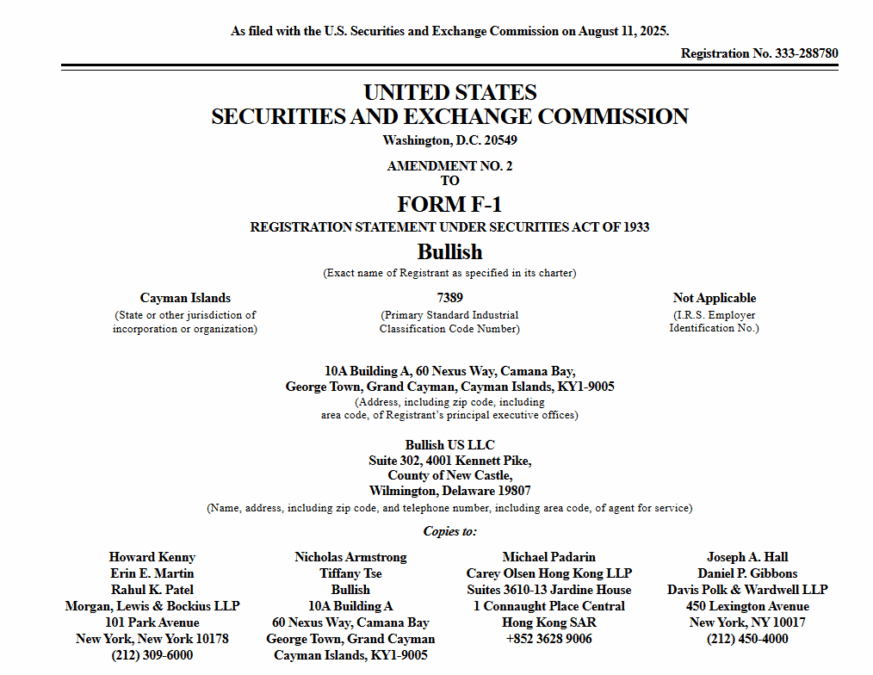

Bullish Targets $4.8B Valuation | Source: SEC

Bullish Targets $4.8B Valuation | Source: SEC

This is a big leap from last week’s proposal of selling 20.3 million shares in the $28 to $31 range with a target of $629 million and a valuation of $4.2 billion.

The IPO will have a Bullish list on the New York Stock Exchange under the symbol BLSH. Underwriters, led by JPMorgan, Jefferies, and Citigroup, have a 30-day option to buy another 4.5 million shares.

Institutional appetite for the offering looks robust. BlackRock and Cathie Wood’s Ark Investment Management have agreed to buy up to $200 million worth of stock at the IPO price.

Bullish, is headed by Tom Farley, the ex-president of the New York Stock Exchange. The site emphasizes regulated, liquidity-based trading for institutions and professional investors.

The company posted estimated net income of $106 million to $109 million in Q2 2025, by following losses earlier in the year.

The offering arrives in the middle of a new cycle of cryptocurrency-linked IPOs, because of increasing digital asset values and clear U.S. regulatory guidelines.

Recent notable market entrants include stablecoin creator Circle (CRCL), which has appreciated more than 90% since it started trading in June, and Mike Novogratz’s Galaxy Digital, which uplisted to Nasdaq in May.

If successful, Bullish’s IPO might rank among the biggest for a crypto-native company in the year, reflecting robust investor demand for blockchain-based financial platforms amid earlier market turmoil.

Also Read: Bullish Exchange Targets $4.23B Valuation in US IPO Push