Bitcoin’s Next ATH? Corporate Holdings at $100B Could Send BTC Price Soaring

Wall Street's latest gold rush? Bitcoin balances sheets.

When corporations pile $100 billion into BTC reserves—like digital-age Scrooge McDucks—the market reacts. Here's how high it could go.

The corporate FOMO effect

Every Fortune 500 CFO suddenly wants a slice of the crypto pie. MicroStrategy's playbook now looks less like outlier behavior and more like mandatory risk management (or reckless gambling, depending who you ask).

Supply shock math doesn't lie

With institutional whales hoarding coins faster than miners produce them, basic economics kicks in. Reduced liquid supply plus relentless demand equals... well, you've seen this movie before.

The cynical take

Of course, this all assumes corporations won't panic-sell at the first 20% dip—like they totally didn't during the 2022 crypto winter (*cough* Tesla *cough*). But hey, maybe this time is different (said every cycle since 2013).

Corporate BTC Holdings Surged To $91 Billion

The corporate adoption of bitcoin has recorded a significant rise, showing strong signs of bullish action. Moreover, the public companies now hold a total of 847,000 BTC, showing a 23.13% quarterly growth. This also accounts for a total of 4% of Bitcoin’s total supply.

Furthermore, the value of these holdings surged to $91 billion, marking a 60.93% increase. Additionally, with the 125 public companies now owning Bitcoin, which is a rise of over 58%, the trend signals growing institutional trust.

Among the top holders, Strategy leads with 597,325 BTC, followed by MARA Holdings and Twenty One. This has boosted the market sentiment and after the entry of GameStop and Metaplanet that have been dominating the Tokyo market.

The Bitcoin holdings chart displays a sharp jump during the second quarter (Q2) as 159,107 BTC were added. If these holdings extend to $100 billion, the supply squeeze and long-term could intensify upward and display a positive price momentum.

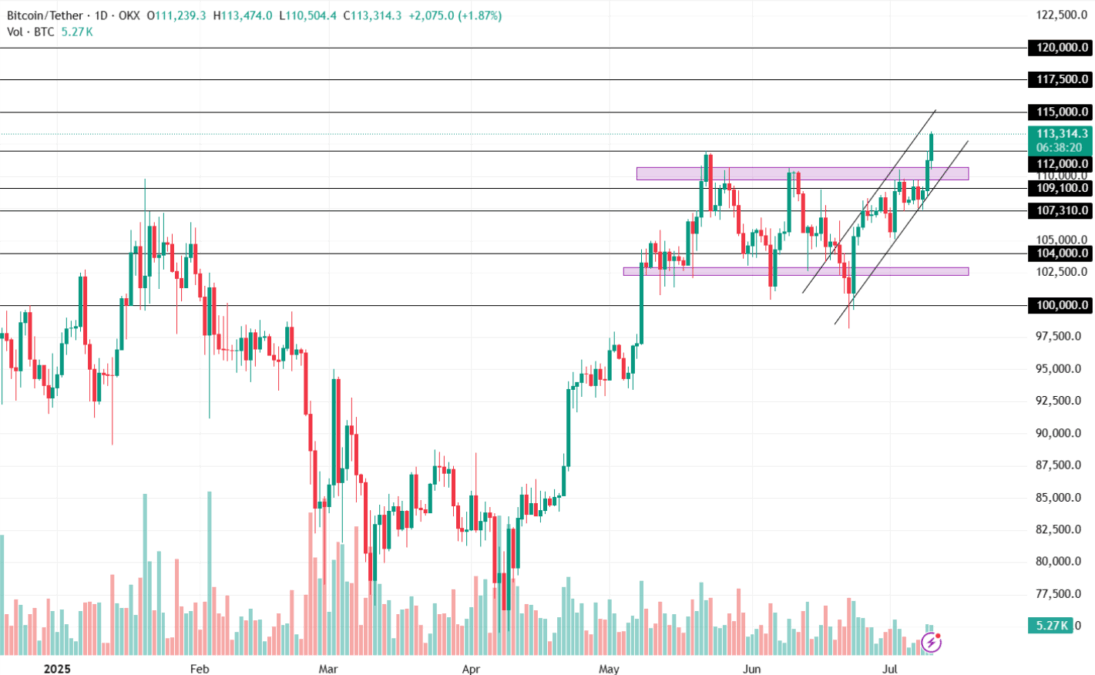

Bitcoin Price Forms Bullish Channel Pattern

The BTC price has recently broken out of the important resistance zone around $110,000. In this bullish scenario, the Bitcoin price has breached the $113,000 mark for the first time ever. Moreover, it has formed an ascending channel pattern in the daily time frame, suggesting increasing buying pressure in the market.

A sustained bullish momentum could push institutional inflows and corporate holdings past $100 billion soon. Thus, the BTC price could head for its next target zones at $115,000 and $117,500, respectively. In an extreme situation, the Bitcoin crypto could hit $120,000 within a short time frame.

Rumble Partners with MoonPay to Launch Crypto Wallet