$42B Bitcoin Gamble: How One Strategy’s High-Stakes Bet Defies Risk for Record Profit

Bitcoin's volatility just became someone else's problem—and payday. A single $42 billion position in the flagship cryptocurrency is printing profits despite flashing every risk warning in the book. Here's how the high-wire act works.

The Contrarian Playbook

While institutional investors hedge and regulators wring hands, this strategy doubles down on crypto's wildest swings. No stop-losses, no apologies—just raw exposure to Bitcoin's make-or-break momentum.

Risk? What Risk?

Analysts see red flags: liquidity crunches, exchange failures, even old-fashioned government meddling. The counterargument? A smirk and a screenshot of the balance sheet—for now.

The Cynic's Footnote

Wall Street spends millions on 'risk management' consultants. Crypto whales? They just HODL through the apocalypse—and somehow keep winning. Until they don't.

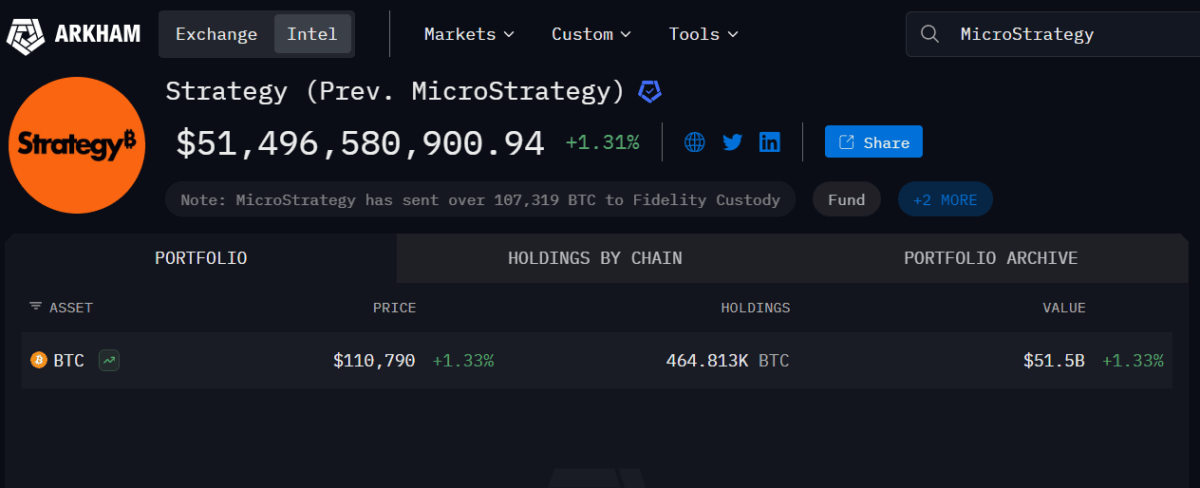

Strategy’s bitcoin Holding | Source: Arkham

Strategy’s bitcoin Holding | Source: Arkham

What Risks Did Strategy Overcome to Maintain Its Bitcoin Reserve?

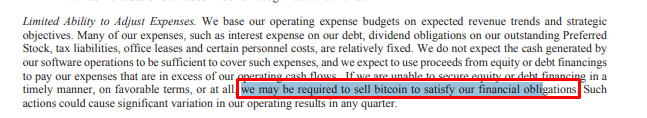

But the full story is not that simple. Behind this gain, there are some risks that the company itself admitted in a filing with the U.S. Securities and Exchange Commission (SEC) on July 7, 2025. This has been closely examined by the on-chain data firm CryptoQuant, which posted a summary thread on X.

One of the issues listed was the U.S. accounting rule called ASU 2023-08, which says companies must show Bitcoin’s current value on their books, even if they haven’t sold it. That is called fair value accounting.

Because of this, Strategy may have to pay taxes based on unrealized profits. Starting in 2026, Strategy could face a 15% Corporate Alternative Minimum Tax (CAMT). The company said, “We may need to liquidate some of our bitcoin holdings or issue additional debt or equity securities to raise cash sufficient to satisfy our tax obligations.” This simply means Bitcoin could be sold just to pay taxes, even if the company didn’t plan to sell.

In addition to this, there’s also a risk with how the Bitcoin reserve is stored. Strategy uses custodians to store its coins. These are third-party companies that manage and protect Bitcoin holdings. But if any custodian goes bankrupt, Strategy could lose its Bitcoin. The company explained that in such a case, they might be seen as a “general unsecured creditor.” That’s a legal term that means they might not get their Bitcoin back.

CryptoQuant also mentioned that the company’s software business does not make enough cash to pay off its debts or dividends to investors. As of now, the company already owes $8.2 billion in convertible debt and has $3.4 billion in preferred stock. Each year, it pays over $350 million to cover for the interest and dividend payments.

If it is not able to raise new funds by selling shares or getting loans, Strategy may be forced to sell from its Bitcoin Holding. In the company’s words, “If we are unable to secure equity or debt financing… we may be required to sell bitcoin.” This could happen even when Bitcoin prices crash or when the market is unstable.

Stock Structure Could Lead to Penalties

Furthermore, the way the company’s stocks are structured adds some stress to it. According to CryptoQuant research, STRK shares pay 8% and can be paid in stock or cash. STRF pays 10% in cash and the amount grows if unpaid. STRD also pays 10% and requires regular payments. If the company misses any of these payments, it could lead to penalties or even loss of board control.

Strategy is also exposed to changes in the economy. In the filing, it listed a couple of events like changes in the price of Bitcoin, cuts in interest rates, rules, and liquidity conditions in things that could make the whole investment go sideways. If any of these go wrong, the company’s Bitcoin plan could be affected.

To simplify, Strategy’s Bitcoin plan is no doubt a phenomenal move. Owning 3% of the supply is a huge flex, but in reality, it is not risk-free. However, CryptoQuant noted that the thread “is not intended to FUD Strategy or Bitcoin.” This is simply what the company reported in its filing.

Also Read: Bitcoin Still Has Room to Run; MVRV Z-Score Signals Upside