Bitcoin’s Bull Run Isn’t Over Yet—MVRV Z-Score Points to Explosive Growth Ahead

Bitcoin defies gravity again as on-chain metrics scream buy.

The MVRV Z-Score—a favorite tool of crypto quant traders—flashes green despite BTC's recent rally. Translation: this train hasn't reached the station.

Why the optimism? When this metric stays below a key threshold (like it is now), history shows we're still in 'accumulation' territory. The last time these conditions lined up? Right before the 2021 parabolic move.

Wall Street analysts scrambling to downgrade their 'overbought' calls look increasingly foolish. Meanwhile, crypto natives stack sats with the calm certainty of gamblers who've seen the dealer's cards.

One hedge fund manager sniffed 'it's different this time' while quietly allocating 3% to BTC futures. Classic finance hypocrisy.

The takeaway? Until the MVRV Z-Score hits extreme levels, any pullback remains a buying opportunity. Just don't expect your traditional portfolio manager to admit it.

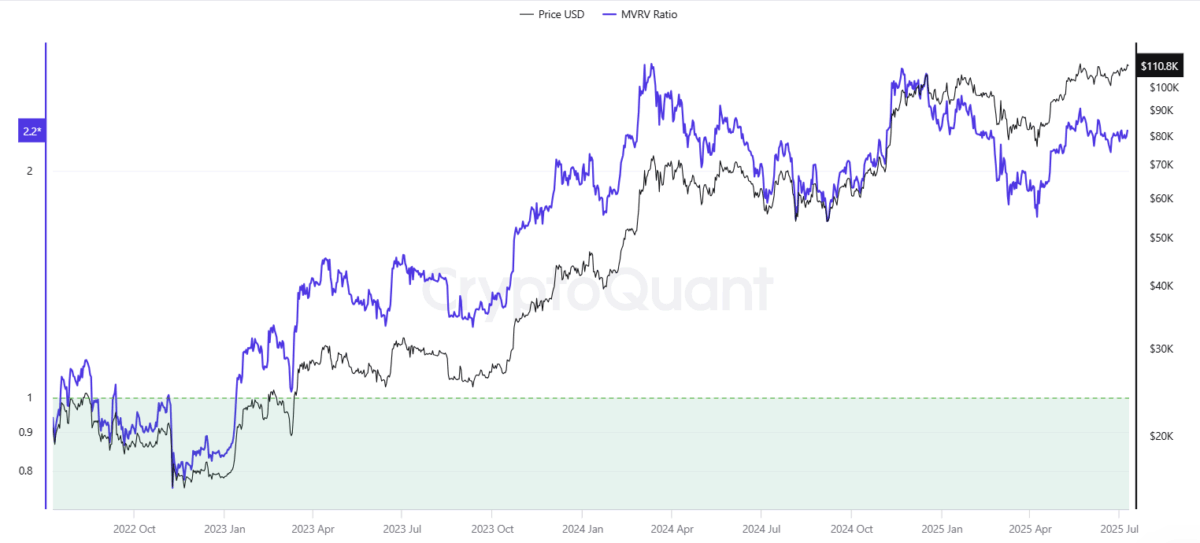

Bitcoin MVRV Ratio, Source: CryptoQuant

Bitcoin MVRV Ratio, Source: CryptoQuant

It seems the current market is a lot more stable compared to past euphoric cycles. On top of that, the MVRV ratio has hit 2.26, which shows long-term holders are bullish. This kind of level usually hints at profit-taking and also indicates there’s a strong demand.

Short-Term Holders Stay Cautious but Hopeful

According to ChainExposed, short-term holders are around the 1.0 MVRV. This break-even point indicates much unrealized profit or loss happening. As a result, there is not much panic selling from newer investors.

Historically, when the MVRV spikes above 1.5 to 2.0, it often signals a correction. However, this current neutral range suggests there’s still some room to grow before it hits another cooling-off period.

The market is hot, with the global crypto market cap reaching $91 billion in a day to reach $3.42 trillion. Besides Bitcoin’s performance, this spike also mirrors strength in tech equities, showing increasing correlation.

Also Read: