KULR Secures $20M Bitcoin-Backed Loan from Coinbase—Doubles Down on BTC Accumulation

Bitcoin hodling just got a corporate upgrade. KULR Technology Group—best known for its thermal management solutions—just pulled off a crypto power move: a $20 million BTC-collateralized loan from Coinbase Prime. The goal? Buy even more Bitcoin. Because when your collateral moons, why not lever up?

The playbook: Borrow against your stack, deploy fresh capital into more BTC, repeat until… well, until the SEC starts asking questions or the cycle turns. Classic reflexive leverage—what could go wrong?

Why it matters: Institutional crypto debt markets are heating up, and Coinbase’s lending arm is happy to fuel the fire. Meanwhile, traditional banks still treat Bitcoin like a radioactive asset. Irony tastes better with 100x leverage.

Closing thought: If this feels like 2021’s ‘rehypothecation party’—complete with the same ‘number-go-up’ theology—you’re not wrong. But hey, at least the bags are digitally sustainable.

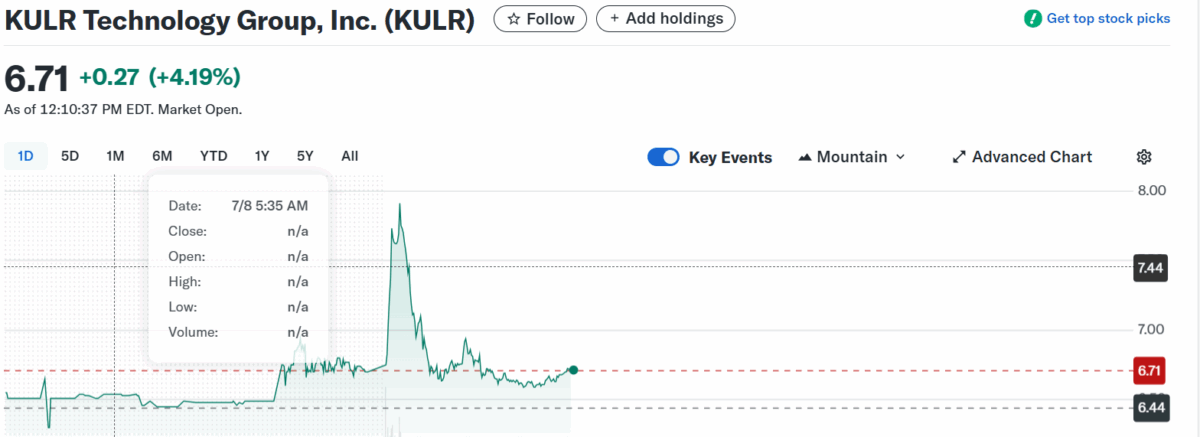

KULR stock price | Source: Yahoo Finance

KULR stock price | Source: Yahoo Finance

Shortly after the announcement, the company’s stock jumped as much as 23% on Tuesday trading morning, reaching $7.94, before dropping down to $6.73. Over the past year, KULR’s shares have more than doubled in value.

Also Read: ReserveOne to Build Crypto Reserve with BTC, ETH, XRP, SOL