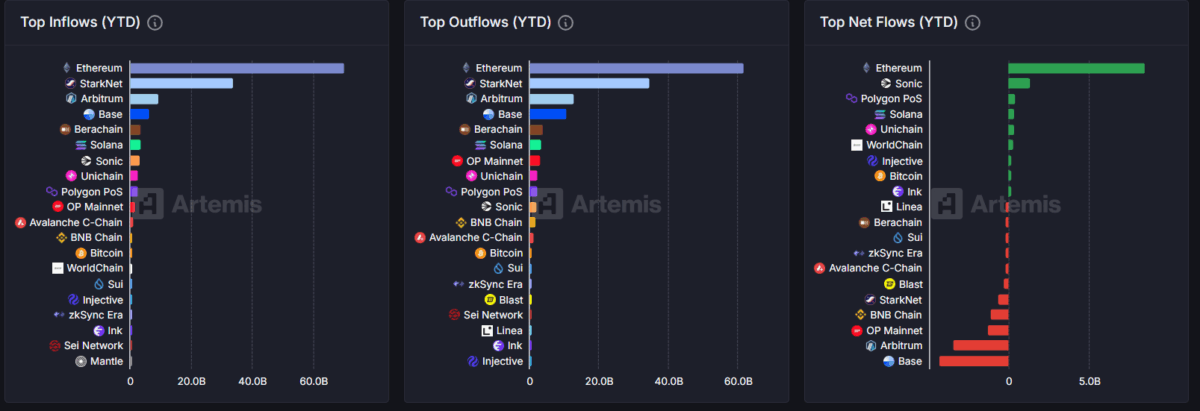

🚀 Ethereum Dominates with $8.4B Cross-Chain Surge as Base Bleeds $4.3B

Ethereum flexes its muscle as the cross-chain king, sucking in a staggering $8.4 billion in inflows—while rival Base gets gutted for $4.3 billion in the same period.

The Layer 2 Shakeout Begins

Money talks, and right now it’s screaming Ethereum’s name. While Base’s outflow raises eyebrows, ETH’s liquidity magnet proves why it’s still the backbone of DeFi. Traders aren’t just voting with their wallets—they’re shouting.

Wall Street’s Still Clueless

Meanwhile, traditional finance ‘experts’ will spin this as ‘volatility’—missing the glaring signal: smart money’s stacking ETH, not flipping it. Same old suits, same old blind spots.

Source: Artemis Terminal

Source: Artemis Terminal

Artemis Terminal lists the decline alongside a flattening in Base’s stable-coin supply, which has held just above $4 billion since mid-May. Activity on decentralized exchanges built on Base has slowed in parallel.

Layer-2 data tracker L2BEAT shows the amount of ether deposited on Base falling from 1.82 million ETH in early June to roughly 835,000 ETH today, a drop of around 54 percent in four weeks. Similar pull-backs are visible on other Layer-2s.

“The vast majority is just Binance withdrawing to L1,” Coinbase protocol specialist Viktor Bunin said on X, adding that the exchange had held “an ungodly amount on the L2s.” He noted it was unclear whether incentives or simple rebalancing drove the move.

Cross-chain bridges let traders MOVE tokens between networks, boosting liquidity but also making capital flows volatile.

Analysts say Base’s early incentives drew funds quickly last year; many of those rewards have now tapered off, while Ethereum’s rest-aking narrative and new spot-ETF demand have pulled liquidity back to LAYER 1.

Stable-coin watchers point out that Circle’s USDC and MakerDAO’s DAI have seen larger net redemptions on Base than on competitors such as Optimism and Arbitrum. If the exodus continues, protocols built on Base could see yields compress as total value locked declines.

Still, developers argue that lower fees and Coinbase’s exchange on-ramps give Base long-term advantages, especially once market incentives reset. For now, the numbers show momentum has swung firmly back to Ethereum.

Also Read: Ripple Valuation at $11.3B by DBS Bank, IPO Possible in 2026