Circle’s Stock Skyrockets 50%+ as Senate Greenlights Stablecoin Legislation

Wall Street wakes up to crypto's political coming-of-age story.

Stablecoins steal the spotlight

Circle's USDC issuer saw shares erupt after Washington finally stopped pretending blockchain was a passing fad. The Senate's stablecoin bill—shockingly coherent by DC standards—gave institutional investors the regulatory clarity they've been begging for since 2020.

Market euphoria meets cynical reality

Traders piled into Circle stock like it was 2021 all over again, proving even crypto skeptics can't resist a good old-fashioned FOMO rally. Meanwhile, Bitcoin maximalists grumbled about 'pegged tokens' getting all the love while the SEC keeps playing whack-a-mole with real innovation. The bill's fine print? Probably written by bank lobbyists—but hey, progress is progress.

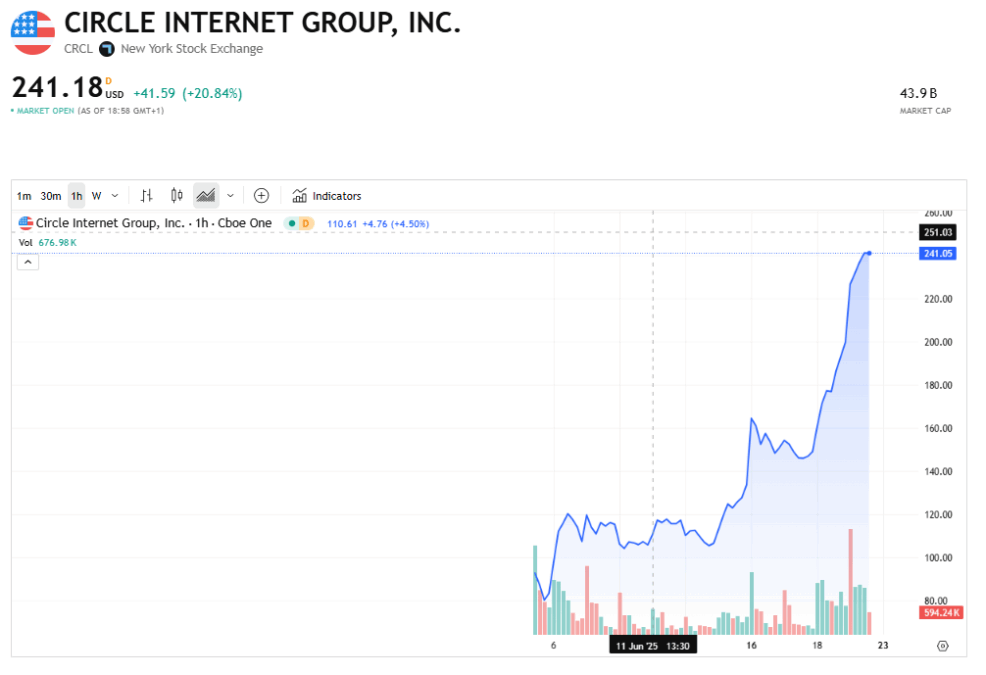

Circle CRCL Price Chart since it started trading | Source: Investopedia

Circle CRCL Price Chart since it started trading | Source: Investopedia

The GENIUS Act is the first big law that is focused on stablecoins. There are digital tokens that stay equal in value to the U.S. dollar. The law says companies must keep full reserves, get monthly audits, and follow anti-money laundering rules.

However, it’s not a law yet. It still has to pass the House of Representatives, but just getting through the Senate caused a big reaction. Circle is the company behind USDC, the second-biggest stablecoin in the world after Tether’s USDT.

It just went public on the New York Stock Exchange earlier this month under the ticker “CRCL.” On its first day, the stock was priced at $31 but opened at $69 and ended the day at $82.23. Since then, it’s gained more than 600%.

Meanwhile, other stablecoins like Coinbase have seen 20% since the Senate vote. The crypto market sees this bill as a green light from Washington. It could bring more businesses and even banks into the stablecoin space.

After the Senate vote on Tuesday, Circle’s CEO, Jeremy Allaire, posted this on X: “History is being made, as the US Senate passes the GENIUS Act, taking us one step closer to breakthrough legislation being signed into law that will drive U.S. economic and national competitiveness for decades to come.”

On Friday, Seaport Global gave Circle its first “buy” rating. Analyst Jeff Cantwell said the stablecoin market could grow from $260 billion today to $2 trillion. He thinks Circle could bring in $3.5 billion in revenue next year, up from $1.68 billion this year. “We view Circle as a top-tier crypto ‘disruptor’ with a sizeable future opportunity,” Cantwell wrote.

Moreover, the bill saw support from U.S President Donald Trump. He recently pushed for Congress to pass it as soon as possible and not to try and make any amendments. “Get it to my desk, ASAP – NO DELAYS, NO ADD ONS,” he wrote in a post on Truth Social shared on X.

Shopify recently announced USDC payments for all its users. Top tech firms like Meta, Google, Airbnb, and X have also reportedly been looking into stablecoins since the bill was passed.

Also Read: Visa Expands Stablecoin Business in Europe, Middle East, Africa