Bitcoin & Ethereum ETFs See Surging Inflows—So Why Are Prices Stalling?

Wall Street's crypto love affair hits a snag as ETF cash floods in while prices lag. What gives?

The ETF Paradox

Record-breaking inflows for Bitcoin and Ethereum ETFs suggest institutional frenzy—yet both assets trade sideways. Either smart money knows something we don't, or this is another case of 'sell the news' dressed in a three-piece suit.

Market Mechanics at Play

Liquidity providers are having a field day arbitraging the spread between ETF demand and spot prices. Meanwhile, retail traders watch their portfolios do the cha-cha: two steps forward, three steps back.

The Cynic's Corner

Nothing warms a banker's heart like collecting 2% fees on assets that go nowhere. Maybe those 'digital gold' pitches need a refresh—how about 'digital treadmill'?

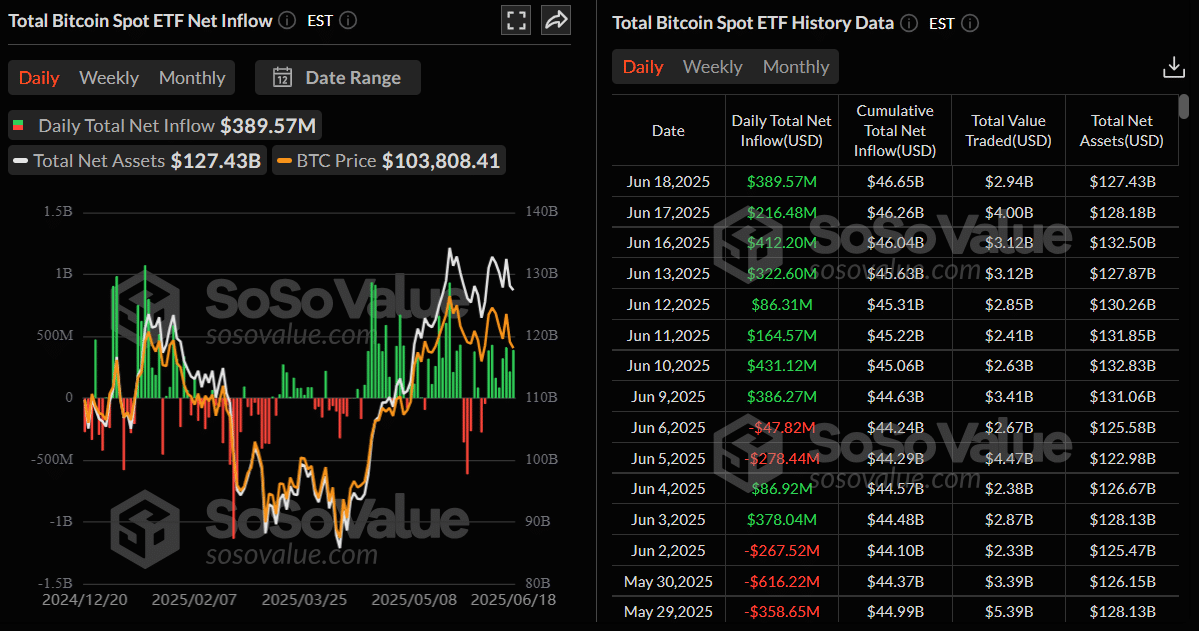

Spot Bitcoin (BTC) ETF Inflow — Source: Sosovalue

Spot Bitcoin (BTC) ETF Inflow — Source: Sosovalue

This $8 billion influx into Bitcoin ETFs underscores growing institutional interest, with major players—including Strategy (MicroStrategy) in the U.S., Remixpoint from Japan, and The Blockchain Group (TBG) of France—reportedly doubling down on their Bitcoin acquisition strategies. However, bitcoin price has upset the market by not showing such traction despite ever-increasing institutional push.

For Ethereum, a smaller but significant ETF inflow of $580 million signals Optimism in the DeFi sector. Yet, ETH’s price remains stagnant near $2,500, nowhere close to its peak of $4,000 in late 2024.

What are the Reasons?

This disconnect between the robust inflows into bitcoin and Ethereum ETFs and their relatively stagnant price action has gained notable attention from market speculators, analysts, and seasoned traders.

Giving theoretical reasons for this scenario, some attribute it to tactical repositioning by investors. This follows a usual strategic MOVE where large institutional players adjust their portfolios in anticipation of future market shifts, as hinted by the brief outflows observed earlier this year. On the other hand, market optimists connect it to profit-taking as a significant factor, driven by external macroeconomic pressures that are influencing investor behavior on a broader scale.

Besides, the exit of profitable investors and, conversely, the entry of new investors amid a notable market shift might also be a reason behind Bitcoin and Ethereum’s stealth price actions. This aspect points towards a scenario where ETF inflows do not translate into immediate price surges.

However, this complex interplay of market forces has left many observers intrigued, as they closely monitor whether this trend signals a deeper market correction or merely a temporary adjustment phase in the ever-evolving cryptocurrency landscape.

Also read: Circle Stock Surges 31% to New ATH, What’s the Reason?