Bitcoin and XRP Surge as Frontrunners for Global Reserve Status—Banks Grumble

Crypto's old guards are flexing new muscle. Bitcoin (BTC) and XRP now lead the pack as top contenders for global reserve assets—while traditional finance scrambles to keep up.

Forget gold or the dollar. Institutional adoption and cross-border liquidity are pushing these digital assets into uncharted territory. Analysts point to BTC's hardening store-of-value narrative and XRP's settlement efficiency as key drivers.

Meanwhile, Wall Street still can't decide whether to fight or join the revolution—classic hedge fund paralysis.

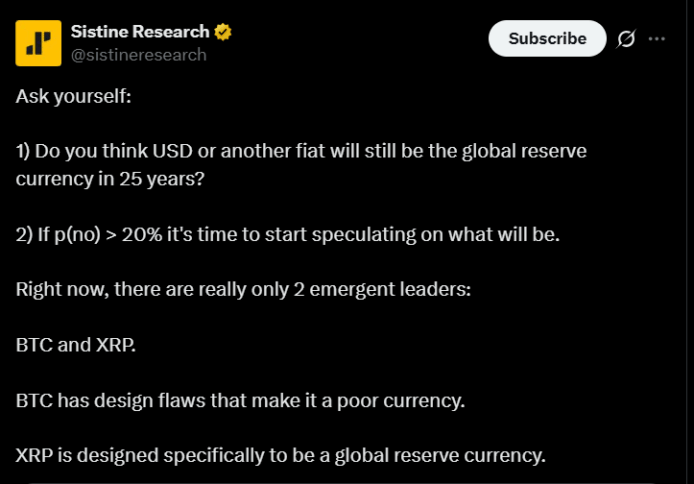

Sistine sees BTC and XRP as future global reserves. | Source: X

Sistine sees BTC and XRP as future global reserves. | Source: X

According to Sistine’s view, only two digital assets are currently standing out: “Right now, there are really only 2 emergent leaders: BTC and XRP.”

However, Sistine explained that while bitcoin is a strong store of value, it’s not ideal for everyday use. “BTC has design flaws that make it a poor currency.” XRP, in contrast, was “designed specifically to be a global reserve currency.”

In short, XRP has the utility needed to serve as a true global currency, unlike Bitcoin even though it is seen more as digital gold.

Meanwhile, Versan Aljarrah, founder of Black Swan Capitalist, recently gave a similar outlook on this issue. In a previous report, he said that XRP could play a big role in fixing the financial system. He believes the answer is to anchor debt to something stronger and more stable.

“If you want to reset a debt-based system without triggering global panic, you need a new anchor,” he wrote. “Gold, repriced and tokenized, is that anchor.”

Aljarrah suggests the U.S. Treasury could tokenize national debt using RLUSD, a Ripple stablecoin backed by gold. XRP would act as the bridge currency to move that value across borders. This model, he believes, could create a more stable and clear financial system.

RLUSD has already been approved by the Dubai Financial Services Authority for use in the Dubai International Financial Centre. This is a step toward international use.

Also Read: xrp price on Risk Losing $2 Support As Trump-Elon Feud Crashes Markets