$1.52B Flees Exchanges—Is Bitcoin Primed for a Surge?

Bitcoin just saw a staggering $1.52 billion exit exchanges in a single move—the kind of capital flight that usually screams ’hodl mode activated.’

When coins vanish from trading platforms, supply tightens. And what happens when demand meets scarcity? Cue the price speculation.

Wall Street analysts would call this ’unprecedented’—right before they try to sell you a Bitcoin ETF with 2% fees.

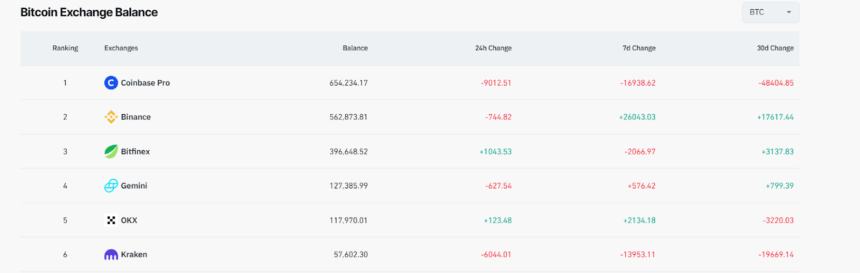

Bitcoin Exchange Balance | Source: Coinglass

Bitcoin Exchange Balance | Source: Coinglass

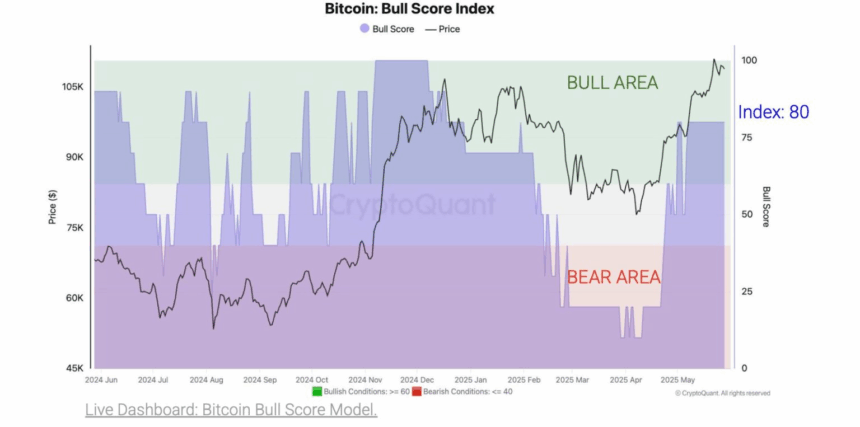

It also means that we might see less selling pressure in the market with more bulls entering the market which could in turn give the price another push. Moveover, the market momentum is picking up steam. According to CryptoQuant, the Bull Score Index for Bitcoin is now at 80, meaning the sentiment is strong and Optimism is increasing.

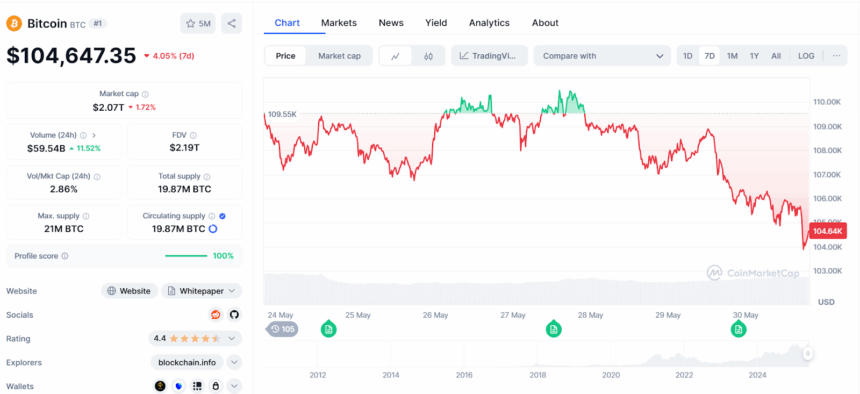

Also, the demand for cryptocurrency is rising quickly. Over the past 30 days, Bitcoin demand increased by 229,000 BTC at a value of more than $23.8 billion. This is almost reaching its peak as of December last year when it reached 279,000 BTC. Bitcoin recently hit its all-time high on May 22 after a massive rally that started in April.

During this rally, Bitcoin price saw a 50% surge but has since dropped by 7%. At the time of reporting, Bitcoin price traded for $104,646, which is down 4% in 7 days. Whilst, it noted a 10% surge in trading volume over the last 24 hours to $60 billion.

Also Read: Bitcoin ETFs Pull $9B Inflows, Outpace Gold: Schiff Silent?