Bitcoin’s June 2025 Showdown: Can BTC Defy Gravity and Crack $120K?

As Bitcoin flirts with all-time highs, the crypto crowd is placing bets—will June 2025 be the month it shatters the $120K barrier? Bulls point to halving mechanics and institutional FOMO, while skeptics whisper about leveraged longs and the ghosts of past bubbles.

Wall Street analysts, suddenly crypto-converted after a decade of disdain, are dusting off their ’to the moon’ price models. Meanwhile, retail traders stack sats between lattes, blissfully ignoring the fact that 90% of price predictions miss harder than a drunk dart player.

One thing’s certain: whether BTC pumps or dumps, the usual suspects will claim they saw it coming all along.

Source: CoinMarketCap

Source: CoinMarketCap

On the other hand, the fear & greed index recorded a 61, indicating a greed in the market. Moreover, the Altcoin Season Index hovers around the 18/100 range, suggesting an ongoing Bitcoin season in the cryptocurrency market. Will Bitcoin continue rising next month? find out the market sentiments, on-chain analysis, and possible BTC price prediction for June 2025!

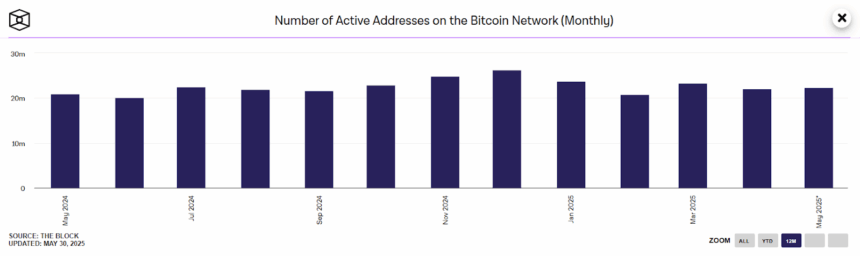

Bitcoin’s On-chain Analysis

As of May 30, Friday, the active address on the Bitcoin Network tallies up to 22.29 million, and is projected to close just above the 23 million mark. When compared, this is a jump of approximately 5% from 21.95 million which was recorded during the month of April.

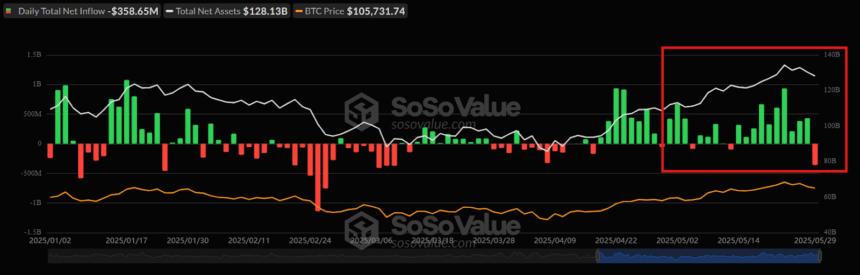

During May, the bitcoin ETF witnessed 20 active trading days out of which it experienced only 3 negative days. On the other hand, it witnessed 16 positive days and one neutral trading day. While the total inflow added to a sum of $10,309.98 million, the total outflow was $540.43 million.

With this, the net FLOW of BTC ETF for the month of May was $9,769.55 million, making it one of the most successful ETF trading month for Bitcoin this year.

Bitcoin Price On Crossroads, What Awaits Ahead?

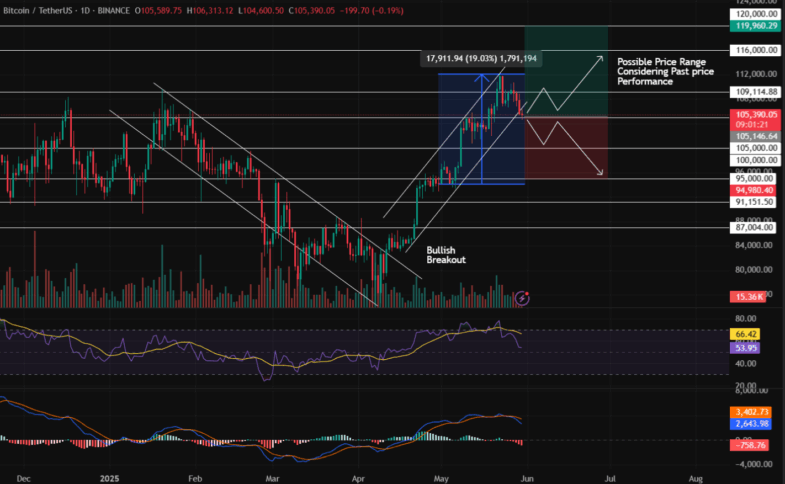

The BTC price had achieved a new all-time high (ATH) on 22nd May of approximately $111,970, resulting in a strong bullish reversal in the crypto community. Moreover, with a market cap of $2.09 trillion, it continues to hold its position among the top 10 world assets. Adding to this, it has a crypto dominance of 63.215%.

The Relative Strength Index (RSI) has failed to hold its value above the overbought range in the daily time frame. Furthermore, the average trendline records a drop toward the neutral point in the bitcoin price chart. By evaluating the chart conditions, the largest crypto hints at a negative outlook.

The Moving Average Convergence Divergence (MACD) indicator, its 12 and 26-day EMAs display an increase in the bearish action, highlighting increased selling pressure in the crypto space. Adding to this, the red histogram is on a constant rise, suggesting a negative trend movement possibility during the first week of June.

Will BTC Price Go Up Again?

Suppose, the bulls gain momentum, this could result in the price of Bitcoin retesting its ATH of $111,970. Furthermore, if the bullish sentiment intensifies, under such a situation the value of this crypto token could prepare to head toward its upper price target of $120,000 during the month of June.

Conversely, if the bears outrun the bulls, the BTC price could retest its immediate support of $100,000 in the upcoming time. If the bulls fail to regain power at that point, the value of this cryptocurrency could plunge toward its monthly low of $95,000.

In an exclusive interview with The Crypto Times founder Hardik Katariya, MEXC COO Tracy Jin has offered a similar prediction. She said, “If the conditions are good, Bitcoin may, I think, reach $120,000 to $150,000. So I think what really matters is the journey — not just, not just a peak, right? So, you believe in very realistic predictions so far, and that’s really great to hear.”

Also Read: China to Buy $300 Million XRP for Crypto Reserve: Fact Check