Crypto Bloodbath: $750B Wiped Out—Bitcoin, Ethereum, XRP Take Brutal Hit

Market carnage strikes as leveraged positions explode—liquidation tsunamis rarely discriminate between blue-chip coins and shitcoins.

Here’s the damage report: $750 billion evaporated faster than a meme trader’s attention span. Bitcoin? Mauled. Ethereum? Gutted. XRP? Left for dead alongside the rest of the altcoin graveyard.

Why now? Blame the usual suspects: over-leveraged degens, whale-sized sell orders, and that one hedge fund manager who still thinks ’blockchain’ is a type of ski binding.

Silver lining? At least the liquidation bots got fed—bon appetit, you cold-hearted algorithms.

Here’s Why the Crypto Market Is Crashing Today

$750 Million in Crypto Liquidations

Crypto liquidations crossed $750 million in the last 24 hours, with $380 million liquidated within just 4 hours, as per Coinglass data. Over 196K traders were liquidated in the past 24 hours, with the largest single liquidation order of on crypto exchange OKX.

Notably, $660 million in longs and $90 million in shorts were liquidated in the last 24 hours. BTC, ETH, SOL, XRP, DOGE, and sui saw massive liquidations, triggering a broader crypto market crash today.

Hyper Trader 0x5078c2fbea2b2 comes within $27 of full liquidation on #Binance flush. Closes 1000 BTC – still open long 1687 $BTC 40x liquidation level $104600. pic.twitter.com/aalAJXigMh

— MartyParty (@martypartymusic) May 30, 2025$11.6 Billion Bitcoin and Ethereum Options Expiry

The primary reason behind the crypto market crash is $11.6 billion in Bitcoin and ethereum monthly options expiry on Deribit today. Traders were expecting a pullback in prices amid uncertainty in the market in anticipation of the significant market events.

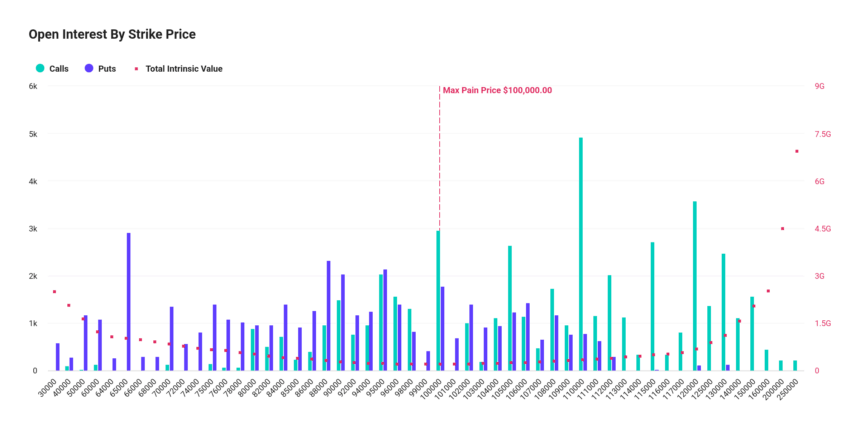

As per Deribit data, 93K BTC options with a notional value of almost $10 billion are set to expire on Friday, with a put-call ratio of 0.88. The max pain point is $100,000, indicating that traders still have room to bring further downside in BTC price.

Moreover, 624K ETH options with a notional value of over $1.62 billion are set to expire, with a put-call ratio of 0.81. Also, the max pain point is $2,300, which is higher than the current price of $2,630.

According to Greeks.live, ETH is witnessing an upward shock to slow down, and the market has recalibrated the price and volatility, which has risen slightly overall. It added that deliveries are less than 8% of total positions and are declining, with crypto institutions not showing much reaction to new highs. The expectation for a near-term surge is low, and the crypto may see a steady, moderate rise.

US PCE Inflation Data Release

Meanwhile, the traders also assessed the US PCE inflation data release due today. The annual PCE is expected at 2.2%, down from 2.3% last month. Also, the month-over-month inflation is expected to rise 0.1%.

Whereas, the annual Core US PCE inflation is expected to fall to 2.2%. The monthly core PCE is expected to rise 0.1%, up from 0% last month.

At the time of writing, Bitcoin (BTC) price was trading at $106,146 and Ethereum (ETH) price was changing hands at $2,638. The market witnessed a slight rebound due to factors including buy-the-dip by investors and the US SEC’s decision to end long-running lawsuit against Binance.