Wall Street’s New Darling: BlackRock’s Bitcoin ETF Rakes in $6.2B in May—Mainstream Money Floods Crypto

Forget tulips—2025’s hottest asset is a ticker symbol. BlackRock’s Bitcoin ETF just posted a staggering $6.2 billion inflow month, proving even boomer capital can’t resist crypto’s siren song.

The institutional stampede is here

Pension funds and hedge funds—once crypto’s biggest skeptics—are now elbowing each other to buy the dip through Wall Street’s shiny new wrapper. Who needs private keys when you’ve got a 401(k) option?

Liquidity tsunami or smart money trap?

While purists sneer at ’neutered Bitcoin,’ these flows reveal an uncomfortable truth: the suits want exposure without the hassle. Cue eye-rolls from Bitcoin OGs as the ETF becomes the gateway drug for traditional finance.

One thing’s clear—when the world’s largest asset manager turns crypto cheerleader, the game changes. Just don’t ask Jamie Dimon for comment.

Day After Day, Money Keeps Pouring In

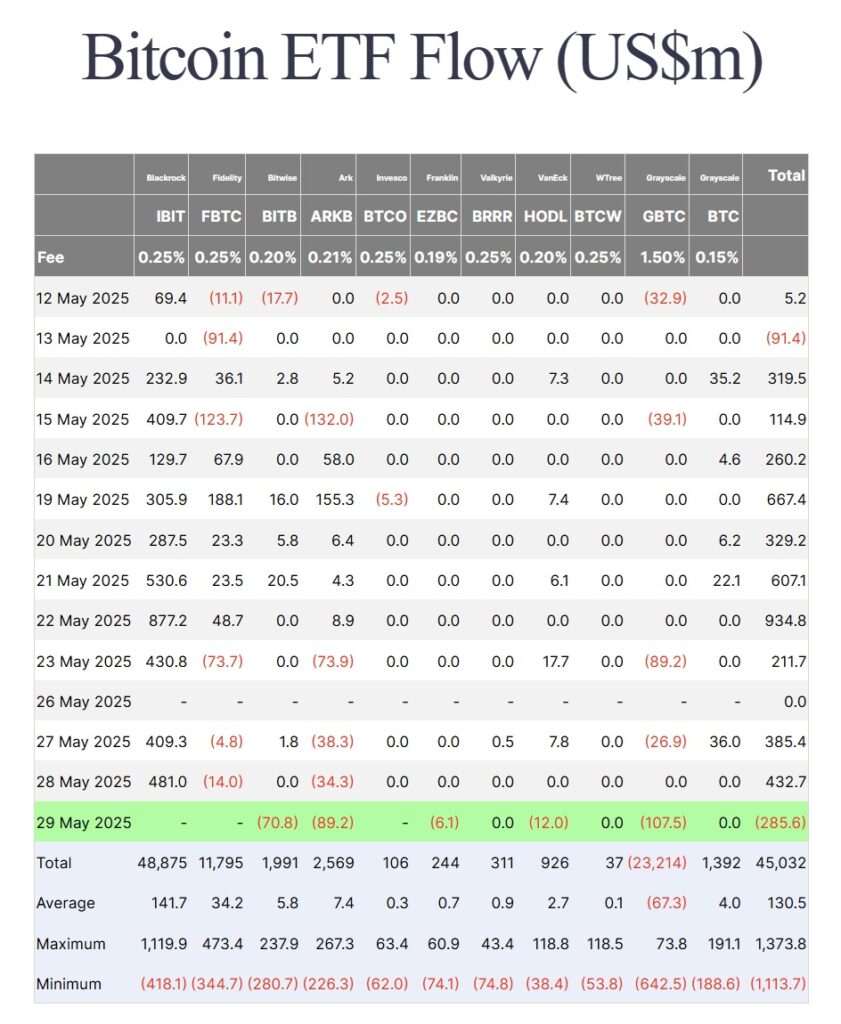

If you looked at IBIT’s inflows recently, you’d think someone left the faucet running. The fund saw net inflows on 30 out of 31 trading days in May. Just on May 28, it pulled in $481 million. That kind of consistency is rare in any investment space, especially one known for its volatility like crypto.

Since its debut in January 2024, IBIT has moved fast. It now holds more than $72 billion in assets, placing it among the top 25 largest ETFs in the world. To put that in perspective, the next youngest fund in that top group has been around for more than a decade. IBIT just passed its first birthday.

Why Is Everyone Jumping In?

Several things are working in IBIT’s favor right now. For one, institutional investors have finally warmed up to crypto in a big way. Funds, banks, and even traditional asset managers are starting to treat bitcoin as a serious part of the financial ecosystem. It’s not just a curiosity anymore.

Another nearly *$500mil* into iShares Bitcoin ETF…

Starting to get ridiculous.

Inflows 30 of past 31 days.

Nearly $9.5bil in new $$$.

IBIT comfortably in top 5 ETFs by inflows this year (out of 4,200+ ETFs).

— Nate Geraci (@NateGeraci) May 29, 2025

Another factor is the current U.S. political climate. With clearer rules and a friendlier tone from regulators, the crypto space feels less like the Wild West. Investors are still cautious, but they’re not frozen with uncertainty like they were a couple of years ago.

And then there’s Bitcoin itself. The price recently hit an all-time high of over $112,000. That kind of momentum tends to attract attention, especially when more people can access it through vehicles like ETFs instead of going through crypto exchanges directly.

IBIT Is Leading the Pack

There are multiple Bitcoin ETFs in the U.S. now, but BlackRock’s IBIT is running ahead of the crowd. During a recent 10-day streak, IBIT pulled in 96 percent of all new money flowing into spot Bitcoin ETFs. Altogether, the U.S. Bitcoin ETF market brought in more than $9 billion over the past five weeks. At the same time, Gold funds saw over $2.8 billion in outflows.

It’s clear that some investors are trading in their gold for digital gold. That doesn’t mean everyone’s on board, but the trend is hard to miss.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Where Things Go From Here

IBIT’s massive growth is part of a bigger story. Crypto is becoming more integrated into mainstream finance, not just for tech-savvy traders but for everyday retirement accounts and institutions too.

Still, this is crypto we’re talking about. Things can change quickly. Prices swing. Regulations shift. Investors looking to jump in now should still do their homework and be ready for a bumpy ride.

For now, though, IBIT’s performance shows that Bitcoin is no longer standing outside the gates of traditional finance. With billions flowing into the BlackRock Bitcoin ETF, it’s clear that Bitcoin is being taken seriously on Wall Street. It’s pulling up a seat at the table, and apparently, it brought friends.

Key Takeaways

- BlackRock’s iShares Bitcoin Trust (IBIT) pulled in $6.2 billion in May, its highest monthly inflow since launch.

- The fund recorded inflows on 30 out of 31 trading days in May, signaling sustained investor confidence in Bitcoin exposure.

- IBIT now holds over $72 billion in assets, making it one of the 25 largest ETFs globally despite launching just last year.

- Institutional investors and favorable U.S. regulatory signals are contributing to IBIT’s rapid growth and appeal.

- During a recent 10-day stretch, IBIT accounted for 96 percent of all inflows into U.S. spot Bitcoin ETFs.