MicroStrategy Doubles Down: $2.1B Stock Dump to Fuel Bitcoin Buying Spree

Wall Street’s favorite crypto-obsessed CFO is at it again—liquidating equity to chase the orange coin.

The big bet gets bigger

Michael Saylor’s MicroStrategy just filed paperwork to offload $2.1 billion in stock, with all proceeds earmarked for Bitcoin purchases. Because when your treasury holds 214,400 BTC already, what’s another few billion between degenerates?

Corporate finance or gambling addiction?

The move comes as Bitcoin flirts with $70K—proving once again that in modern markets, the line between ’treasury strategy’ and ’leveraged moonshot’ depends entirely on whether the trade works. Spoiler: Saylor’s unrealized gains currently outpace most hedge funds’ annual returns.

Bonus jab

Meanwhile, traditional asset managers are still trying to explain to clients why their ’diversified portfolios’ underperform a CEO who treats Bitcoin like a corporate expense account.

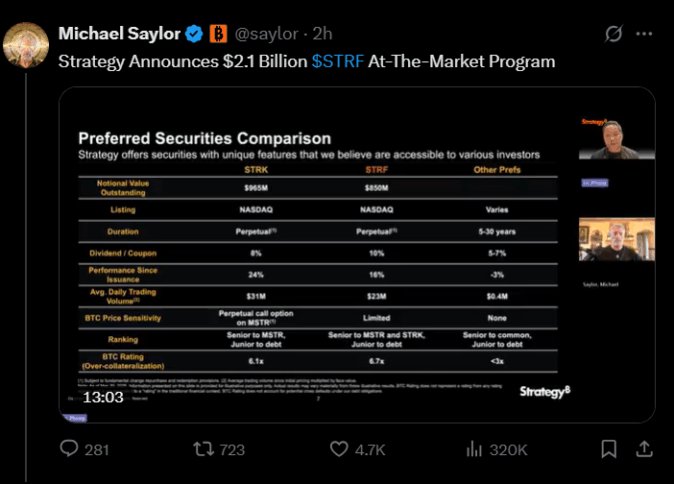

Michael Saylor announces plans to raise $2.1 billion | Source: X

Michael Saylor announces plans to raise $2.1 billion | Source: X

This means the shares will be sold bit by bit, whenever the timing and price feel right. The sales could happen as regular trades, big block trades, or even privately negotiated deals. The company says it plans to use the money for general corporate purposes, like growing its business, covering costs, and most importantly buying more Bitcoin.

The stock being sold is called “perpetual,” which means it doesn’t expire or mature. Investors get a 10% dividend, but the company doesn’t have to pay the money back like a regular loan. Strategy is doing this to achieve its goal of using capital markets to fund its Bitcoin purchases.

Meanwhile, the software company recently revealed that it had purchased 7,390 more Bitcoins between May 12 and May 18. The total cost for this batch was about $764.9 million, and the average price paid was $103,498 per bitcoin. The money for that purchase came from earlier sales of its class A common stock (MSTR) and another FORM of preferred stock called STRK.

Adding up with this latest purchase, Strategy now holds a total of 576,230 bitcoins, worth more than $64 billion. The company says it paid about $40.2 billion in total, including fees, putting its average price at $69,726 per coin. This means the company is sitting on about $23.8 billion in paper profits which is 2.7% of all bitcoin in circulation.

This new STRF stock program is also part of Strategy’s bold “42/42” plan. The goal is to raise $84 billion by 2027 through equity and convertible notes, which is double its original “21/21” plan. The previous equity sale program has already run out, which is why Strategy is now turning to STRF.

Also Read: This Public Company to Buy $100M Bitcoin Despite Strategy Lawsuit