Coinbase Stock Rockets 20% on S&P 500 Inclusion—$500 in Sight?

Wall Street’s latest crypto darling just got the golden ticket. Coinbase shares exploded after the S&P 500 announcement—because nothing legitimizes speculation like institutional approval.

Key drivers:

- Mainstream validation: S&P inclusion signals crypto’s grudging acceptance by traditional finance

- Liquidity surge: Index funds now forced to buy COIN, creating artificial demand

- Retail FOMO: Mom-and-pop investors piling in after the ’smart money’ moves first

The $500 question: Can this momentum outlast the next Fed rate hike? Remember kids—what the S&P giveth, the CPI taketh away.

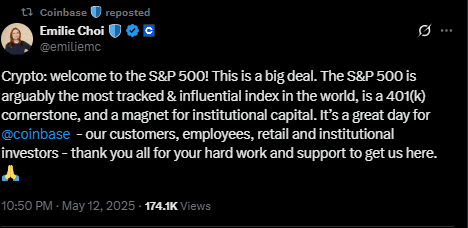

Coinbase COO confirms the listing on X | Source: X

Coinbase COO confirms the listing on X | Source: X

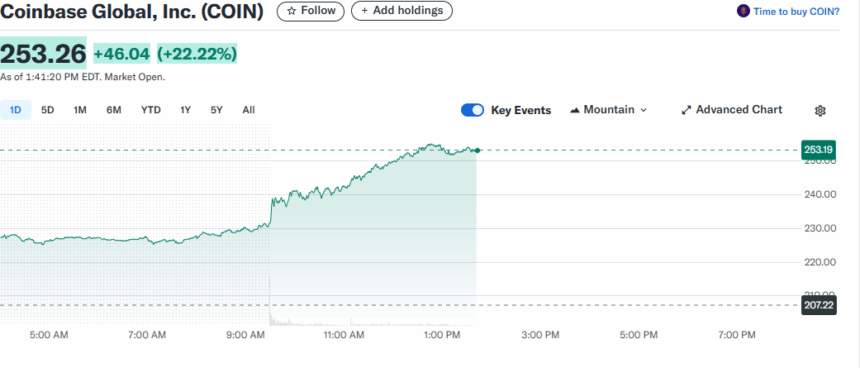

Following the news of the listing, the stock surged to $258 in pre-market trading today, which is more than 46% above its 2025 low of $145. It also crossed $225 in after-hours trading, gaining over 22% in 24 hours. But with this momentum, can COIN possibly reach $500?

Right now, Investors are rushing in because ETFs and index funds now have to buy the stock. That means more demand, which is pushing the price up. Crypto fans are calling it a big win for the industry.

In a post, Michael Saylor praised Coinbase CEO Brian Armstrong for reaching this “milestone.” Meanwhile, the boost comes even after Coinbase missed Wall Street’s Q1 revenue targets. The company reported $2 billion in revenue, a 10% drop from the last quarter.

The fall happened because crypto prices dipped in early 2025. Still, Coinbase’s business is growing in other areas. Transaction revenue went up to $1.26 billion. Subscriptions and services ROSE to $696 million. That includes money from stablecoins, interest, and blockchain rewards.

Moreover, Bitcoin recently broke $100,000, and ethereum jumped to $2,500. Right now, the prices are pulling back, but analysts expect a rebound soon. The U.S.–China trade truce could also help as many believe that crypto is entering another boom. Coinbase’s price often follows Bitcoin. So, if Bitcoin keeps rising, Coinbase might too.

Furthermore, the company just bought Deribit, a leading crypto options platform, for $2.9 billion. That’s the biggest crypto merger ever. This, in the long run, could help Coinbase attract more professional investors, and drive the price up further.

Is $500 a Possible Target for COIN Stock?

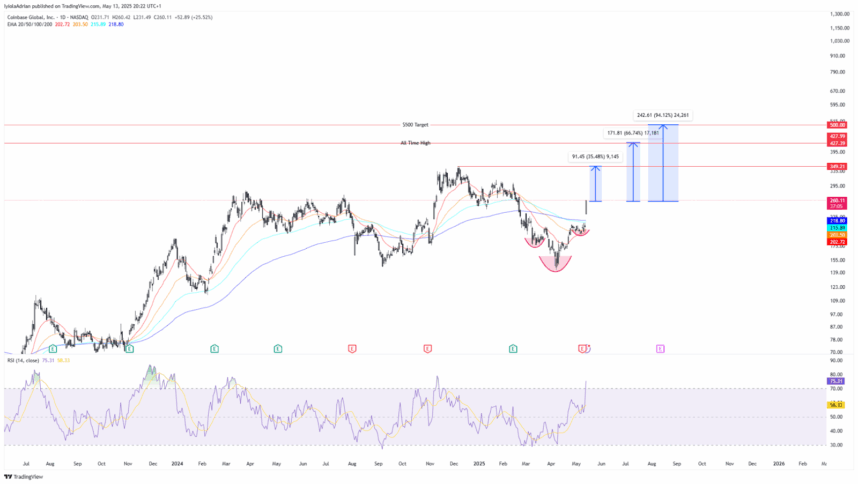

Technically, COIN is still flashing bullish signs. On the daily chart, the stock shows an “inverse head and shoulders” pattern., which is a classic setup for a breakout. The neckline is around $215–$218, but the stock has now moved above that.

Some traders now see $297 as the next target by measuring the pattern’s size from $145 to $215 and adding it upward. At the time of writing this report, $297 is 15% of the current price.

For COIN to reach $500, it will need to double its current price, which may seem optimistic in the short term. It is also 94% of the current price and sounds unrealistic. While $500 may be a stretch for now, $297 could be a more realistic near-term target.

Meanwhile, the chart also shows the price is above the 100- and 200-day moving averages. That adds to the breakout signal. However, the RSI, a momentum indicator, is at 75.26. This means the price might retrace soon, but WOULD probably be a short retracement.

Also Read: Former SafeMoon CTO Admits to Fraud, Exposes Insider Schemes