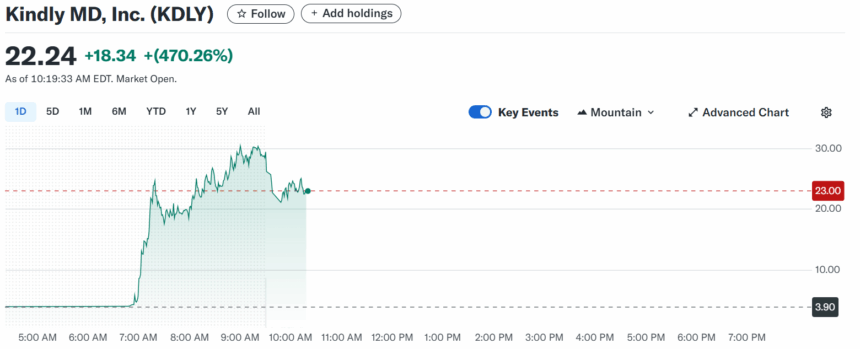

Trump Advisor’s Bitcoin Venture Sparks 600% KindlyMD Stock Surge—Because Nothing Says ’Healthcare’ Like Crypto Hype

Wall Street does love a good narrative—even when it’s stitched together with blockchain buzzwords and political connections. KindlyMD’s stock went stratospheric after announcing a merger with a Bitcoin firm linked to a former Trump advisor, proving yet again that markets will rally behind anything with a whiff of crypto.

The 600% pump-and-dump spectacle raises eyebrows: since when did healthcare and Bitcoin mining belong in the same sentence? But hey, in 2025, if you’re not pivoting to digital assets, are you even trying?

Cynics might call this a desperation play. Bulls see it as validation of crypto’s creeping dominance. Either way, the ticker tape doesn’t lie—until the SEC starts asking questions.

KDLY Price Chart | Source: Yahoo

KDLY Price Chart | Source: Yahoo

The merger includes $710 million in new capital, $200 million in convertible debt, and $510 million from a private investment in public equity (PIPE) deal, with the offering shares at $1.12 each. According to the press release, more than 200 investors participated in the PIPE round. Big names backing the raise include Van Eck, Arrington Capital, BSQ Capital Partners, Kingsway, and Yorkville Advisors.

KindlyMD said the company will keep its “KDLY” ticker for now, but will change its name and stock symbol after the merger closes. David Bailey, now the incoming CEO, said, “We believe a future is coming where every balance sheet – public or private – holds Bitcoin.”

Bailey is the founder of Nakamoto and co-founder of BTC Inc., the group behind Bitcoin Magazine and major Bitcoin conferences. He said Nakamoto’s goal is to build a global group of Bitcoin-native companies and push Bitcoin deeper into traditional markets.

“Nakamoto’s vision is to bring bitcoin to the center of global capital markets,” Bailey added in the announcement. The company plans to package BTC into products like equity, debt, and preferred shares that traditional investors can buy and understand. It says it wants to list these tools on every major stock exchange.

Tim Pickett, CEO and founder of KindlyMD, will continue to run the healthcare side. He said, “This merger represents a strategic leap for KindlyMD, allowing us to expand our mission.” Pickett confirmed the clinics will still focus on treating opioid addiction and offering holistic care.

The merger was approved by both companies’ boards but still needs approval from KindlyMD shareholders. Legal and financial advisors involved include Cohen & Company Capital Markets, 10X Capital, Reed Smith LLP, and Loeb & Loeb LLP.

Also Read: Ethereum’s Market Cap Soars 42% After Pectra Upgrade