Solana vs Ethereum: Sygnum Says the Battle Isn’t Even Close

Solana’s speed might turn heads, but Ethereum’s ecosystem still holds the crown—at least according to banking heavyweight Sygnum. Here’s why the smart money isn’t flipping... yet.

Ethereum’s network effects cut deep. Developers, institutions, and that sweet, sweet DeFi liquidity aren’t migrating en masse—no matter how many ’Ethereum killers’ VCs hype between yacht parties.

Solana’s outages haunt it like a blockchain ghost story. Five-hour downtimes don’t exactly scream ’global financial infrastructure’—unless you’re a trader who enjoys involuntary HODLing.

The closer: Maybe Layer 1 tribalism is a distraction. Real winners? The exchanges collecting fees every time some hedge fund intern FOMO-swaps between SOL and ETH.

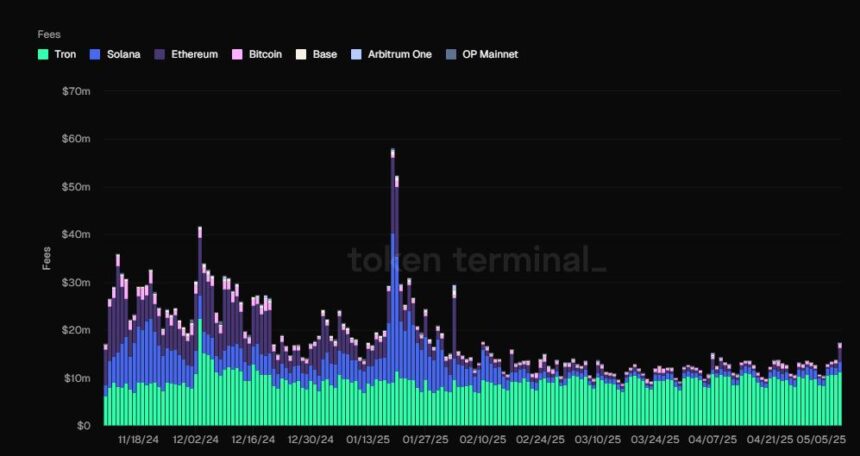

Source: Token Terminal

Source: Token Terminal

“We do not yet see convincing signs that Solana would be the preferred choice as Ethereum’s security, stability and longevity are highly prized,” the bank noted.

Sygnum pointed out that while ethereum is going through a phase of weak sentiment and slower mainnet activity, these factors are unlikely to dictate the future.

According to Sygnum, what really counts is where big financial institutions decide to build, and Ethereum still leads that race. It has a strong foothold in areas like tokenization, stablecoins, and DeFi, which are now a priority for both governments and regulators. That kind of backing gives Ethereum a serious edge over competitors.

Solana’s Overreliance on Memecoins a Concern

A major reason Sygnum is skeptical about Solana’s long-term strength is its heavy dependence on memecoins. While Ethereum earns from a wide variety of real-world use cases, Solana’s fee and activity volume are still too tied to speculative memecoin trends, which makes its revenue look shaky and short-term.

That makes its revenue stream appear more fragile and less appealing to risk-averse institutions.

Despite Solana recently taking the lead in Layer-1 fee generation, Ethereum still brings in 2 to 2.5 times more in overall blockchain revenue, according to Sygnum. The bank also noted that most of Solana’s transaction fees go to validators, not toward strengthening the value of the SOL token itself.

And even though Solana has the ability to tweak its tokenomics more easily than Ethereum, the community hasn’t shown much urgency to make those changes. For example, a proposal to cut SOL’s inflation rate was recently voted down — a sign that boosting long-term token value isn’t currently a top priority.

Solana’s DeFi Momentum Can’t Be Ignored

Sygnum acknowledged that the blockchain has made real progress in decentralized finance. The amount of value locked across Solana’s DeFi protocols has been climbing steadily. And if the network can build up stable, long-term revenue streams in areas like tokenized assets and stablecoins, it could start to seriously challenge Ethereum’s lead.

Ethereum might be getting ready for a comeback. The Ethereum Foundation has decided to focus again on improving its main network. Sygnum thinks this could help people trust the platform more. After falling behind Solana for the past two years, this new focus could give Ethereum the fresh start it needs.

In the end, Sygnum’s take is clear: Solana is growing, and fast — but it’s not quite there yet. Ethereum’s strong footing in critical institutional areas, along with its regulatory alignment and stable revenue base, continues to keep it firmly in the lead.

Solana may be on the rise, but for now, Ethereum still holds the top spot for traditional finance.

Also Read: Solana Overtakes Ethereum & BSC with $2.8B in Daily DEX Volume