Bitcoin’s Make-or-Break Moment: Will May 2025 Deliver the Elusive $100K?

The crypto world holds its breath as Bitcoin approaches a critical inflection point—again. With institutional adoption accelerating and halving effects kicking in, analysts are split: rocket fuel for new ATHs or just another overhyped cycle?

Wall Street’s ’golden child’ narrative clashes with crypto-native skepticism. Meanwhile, retail traders eye leverage like 2021 never happened—because nothing teaches financial caution like getting liquidated twice.

Key factors in play: ETF flows (real demand or just fee-chasing?), miner capitulation (or lack thereof), and whether macro conditions will play along. One thing’s certain: volatility’s coming. Whether that means six figures or another ’buy the rumor, sell the news’ event remains the $100,000 question.

BTC Monthly Performance April 2025

The on-chain sentiment of Bitcoin token has recorded a positive turnaround over the last few days. This suggests an increase in the buying-over-selling pressure for it in the market. Let us now examine the technical data of Bitcoin.

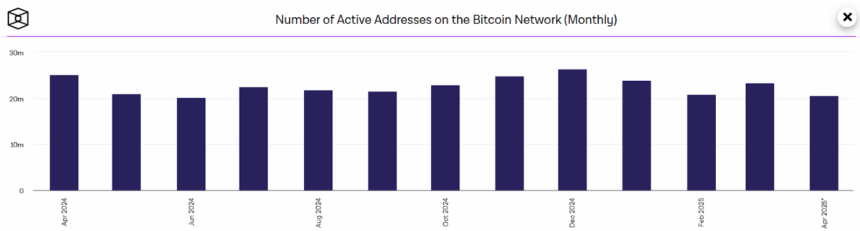

Despite a drop in the number of Active Addresses on the Bitcoin Network to 20.55 million in April from 23.28 million in March, the BTC price has recorded the highest gains during this month in 2025. This highlights increased whale activity for the largest crypto token.

While the price of BTC token is on a constant rise, the reserve of Bitcoin on exchanges is dropping to a new all-time low (ATL). This suggests an increase in the accumulation of this digital asset by its investors. As per the technicalities, lower exchange reserve often refers to more number of holders and investors in the crypto community.

The Bitcoin ETF has witnessed 20 active trading days this month (Till 29th April). During this period, the BTC ETF recorded 11 positive days, whereas 9 negative trading days, and zero neutral days. This brings a positive flow percentage to 55%. Notably, as the market experiences a rebound, the largest crypto fund has witnessed an inflow streak of 7 days.

When combined with the netflow of 9 negative days, the Bitcoin ETF lost $1,205.54 million. On the other hand, over the period of 11 positive Flow days, it added a total of $4,054.5 million. With this, the net flow of the Bitcoin ETF for April 2025 was +$2,848.96 million.

This highlights a significant rise in the bullish sentiment for the price of Bitcoin. Let us now understand the possible monthly BTC price prediction.

Bitcoin on The Path To Reclaim $100k Mark?

The price of BTC token has displayed a strong bullish reversal over the past week. Reportedly, the crypto industry had experienced a major setback during the first 3 weeks following the Trump tariff war with China. However, the Bitcoin price has added over 10% to its valuation, resulting in it concluding the month on a positive note.

The Relative Strength Index (RSI) continues hovering around the overbought range in the daily time frame. On the other hand, its average trendline is on a constant rise, suggesting a positive outlook for the Bitcoin price during the upcoming weeks.

The MACD indicator records a constant decline in the green histogram. However, its 12 & 26-day EMA trend levels witness a rising pattern in the BTC price chart. This hints at a potential bullish reversal for the largest crypto token by market capitalization.

How High Will BTC Rise?

Suppose, the bullish sentiment sustains during the month of May, this could result in the price of Bitcoin heading toward its milestone price of $100,000. Furthermore, if the bullish sentiment intensifies, it could prepare to retest its upper price target of $105,000.

Conversely, increased liquidations could pull the price of this crypto token toward its important support level of $90,000. Moreover, if the bears outrun the bulls or uncertainty increases, the BTC price may plunge toward its low of $86,000 or retest even further low during May.

Also Read: Bitcoin Could Reach $210K by 2025, Says Presto Research