Bitwise Breaks New Ground: First U.S. NEAR ETF Hits the Market

Wall Street’s crypto-curious just got a new toy—Bitwise’s NEAR ETF storms in as the first of its kind in the U.S. market. Forget ’wait and see’—this is a full-throttle bet on Web3 infrastructure.

Why it matters: NEAR Protocol’s sharded, proof-of-stake architecture has been quietly eating Ethereum’s lunch in developer adoption. Now institutional money gets a backdoor entry.

The fine print: Fees aren’t disclosed yet (classic finance move), but expect the usual 1-2% vigorish for the privilege of not self-custodying. TradFi gonna TradFi.

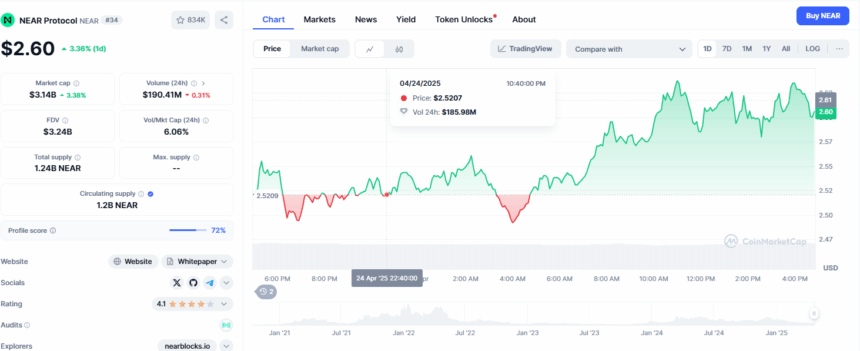

NEARUSD Price Chart | Source: CoinMarketCap

NEARUSD Price Chart | Source: CoinMarketCap

NEAR brands itself as a “blockchain for AI,” providing development tools that facilitate artificial intelligence work. If Bitwise gets the green light, this would be the very first NEAR-based ETF in the United States.

Bitwise had already created Delaware trusts for the other crypto ETFs, like Dogecoin and Aptos, and then filed with the SEC.

Similar to those efforts, the Bitwise NEAR ETF registration is expected to be a precursor to a formal S-1 application to the U.S. Securities and Exchange Commission. Moreover, these filings come as the SEC continues to review dozens of crypto-related ETF proposals.

Since January, the agency has dropped several legal actions against crypto firms and held public roundtables to explore industry-friendly policies.

Bitwise’s existing spot Bitcoin ETF (BITB), launched in January 2024, has grown to $3.6 billion in assets under management. The firm now manages over $5 billion in total assets and offers a range of crypto investment products.

Also Read: SEC Drops Dragonchain Crypto Lawsuit Over ICO