Strive’s Bold SATA IPO Strategy: Funding Massive Bitcoin Acquisition

Strive drops regulatory subtlety—plans to launch SATA IPO specifically to amass Bitcoin reserves.

The Bitcoin Play

Forget traditional corporate treasury management. Strive's going straight for digital gold, using public market capital to build a Bitcoin war chest that would make MicroStrategy blush. The move signals growing corporate confidence in cryptocurrency as a primary reserve asset.

Market Mechanics

SATA shares become the vehicle, Bitcoin becomes the destination. Public investors essentially get exposure to Bitcoin through traditional equity markets—a clever workaround for institutions still hesitant about direct crypto ownership. The structure creates a regulated pathway for mainstream capital to flow into digital assets.

Because nothing says 'financial innovation' like using 20th-century capital markets to buy 21st-century magic internet money.

A hybrid between yield and Bitcoin exposure

The SATA issuance reflects Strive’s growing use of traditional capital instruments to finance its bitcoin strategy.

Strive is offering $SATA, a new Perpetual Preferred Stock via IPO, to select investors. $ASST pic.twitter.com/2wSkGm6REN

— Strive (@strive) November 3, 2025As outlined in the SEC filing, proceeds could also fund additional BTC purchases, a model similar to those pioneered by Strategy Inc. With roughly 5,957 BTC on its balance sheet as of October 27, Strive is positioning itself among the top 20 firms on Bitcoin treasury holdings, according to BitcoinTreasuries.

The MOVE aligns with a broader shift among Bitcoin-holding firms using preferred shares to raise capital.

Bitcoin expansion through acquisitions

The IPO announcement comes weeks after Strive revealed a major all-stock merger with Semler Scientific, valuing the deal at more than $90 per share. Together, the two companies now control nearly 10,900 BTC, following Strive’s $675 million Bitcoin purchase at an average price of $116,047 per coin.

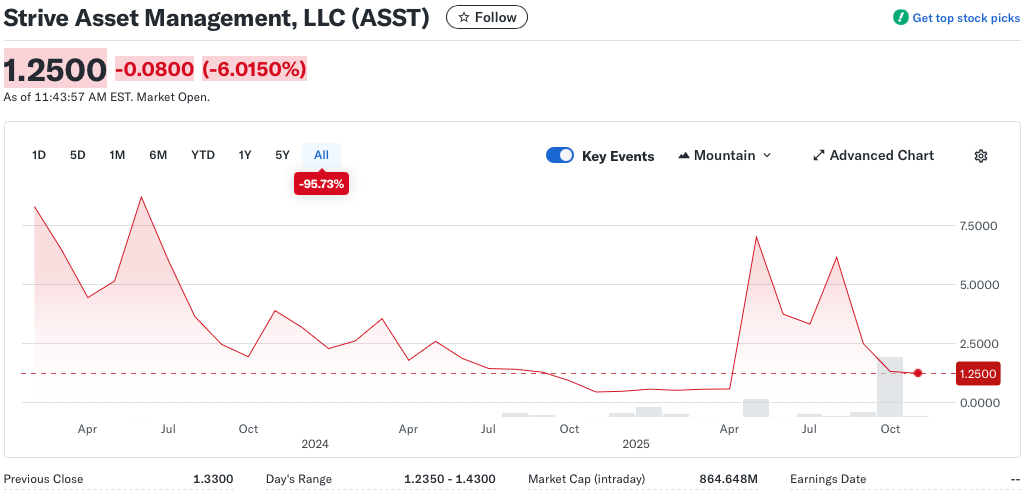

The merger unified two of the earliest public companies to adopt Bitcoin as a reserve asset, combining health technology cash flows with Strive’s investment operations. The company has adopted a “preferred equity only” model to fund growth without debt, relying instead on dividend-bearing stock. Meanwhile, Strive’s own shares have reflected market skepticism, trading at $1.25, down 52% from $2.50 last month.

A growing movement of Bitcoin treasuries

Strive’s transformation reflects a larger corporate trend toward Bitcoin-backed balance sheets, particularly in the U.S. public market. The firm joins peers like Strategy Inc. in repurposing conventional corporate tools to acquire and manage BTC. While such approaches have sparked debate over financial sustainability and volatility exposure, they represent an emerging model of hybrid treasury management in a high-inflation environment.

Whether investors buy in or not, the SATA launch marks Strive’s shift from ETF issuer to Bitcoin-focused holding firm blending yield, equity, and crypto finance.

Also read: Bitcoin Treasury Firm Sequans Transfers 970 BTC Worth $111M to Coinbase