Bitcoin’s Dip: Strategic Pause or Bearish Reversal? LMAX’s Joel Kruger Weighs In

Bitcoin's recent price stumble sparks debate: temporary breather or trend reversal?

Market Mechanics in Motion

Institutional flows show subtle shifts as volatility returns to crypto markets. Trading volumes spike while leveraged positions get trimmed across major exchanges.

The Professional Perspective

Seasoned strategists point to healthy consolidation patterns rather than fundamental breakdown. Market structure suggests institutional accumulation continues beneath the surface noise.

Where Smart Money Flows

While retail panics, whales reposition portfolios toward quality assets with proven track records. The great shakeout separates diamond hands from paper hands once again.

Remember: Wall Street always manages to buy when Main Street sells - some things never change in finance's cynical dance.

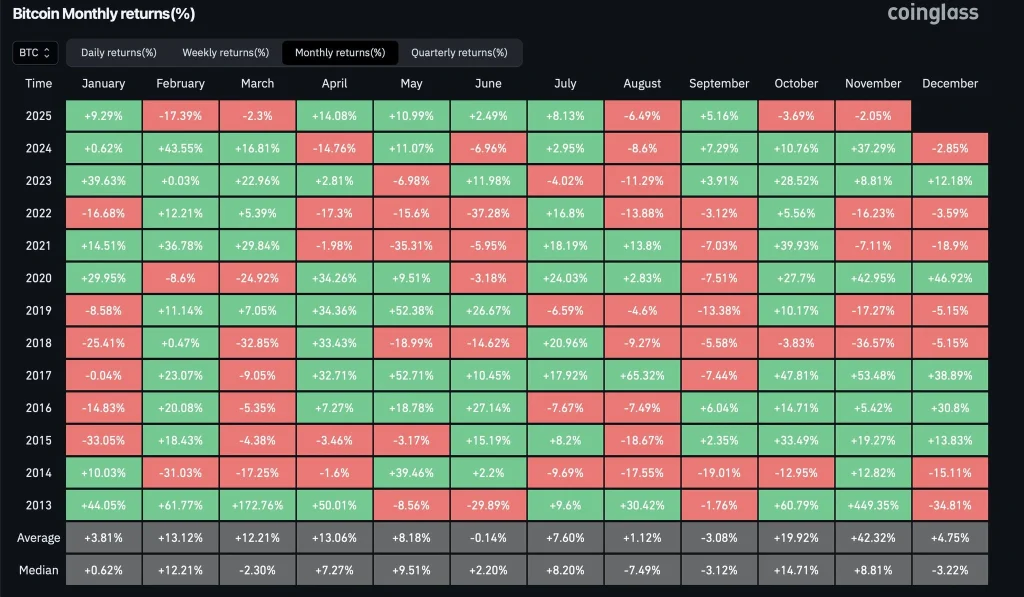

The bearish November start for Bitcoin (BTC) is not necessarily the end of the bull rally. According to Joel Kruger, a strategist with LMAX, the Bitcoin price may rebound after its first October bearish close in six years.

Kruger noted that the ongoing bitcoin price drop is likely a pause and not a reversal. Furthermore, Kruger pointed out that Bitcoin has accumulated robust fundamentals amid a historic bullish fourth quarter.

Why is Kruger Bullish on Bitcoin Price Amid Low Whale Demand?

BTC Price Falters Fueled by Low Demand from Whale Investors

Bitcoin price has been trapped in a choppy consolidation amid heightened fear of further crypto capitulation triggered by a bearish close in October. For the first time in six years, the Bitcoin price recorded a bearish October.

The midterm bearish sentiment has been exaggerated by the low demand from investors. For instance, on-chain data analysis from CryptoQuant shows long-term holders have offloaded over 400k BTCs in the past 30 days.

Meanwhile, the weekly report from CoinShares shows Bitcoin’s investment products recorded a net cash outflow of $946 million last week.

Technical Tailwinds Amid Robust Fundamentals

Macro BTC Price Uptrend Remains StrongFrom a technical analysis standpoint, the BTC/USD pair has been retesting a rising logarithmic support trend line. In the weekly timeframe, the BTC/USD pair has not experienced a euphoric rise akin to its prior bull run cycles since its bear market reversal.

As such, for as long as the BTC/USD pair remains above its weekly rising logarithmic support trend line, a potential reversal towards a new all-time high is highly probable before the end of this year.

Cumulative Fundamentals to ConsiderThe bitcoin market has accumulated robust fundamentals in the past year amid its choppy consolidation. For instance, the flagship coin has been adopted by dozens of companies, led by Michael Saylor’s Strategy, as a treasury management tool.

The mainstream adoption of Bitcoin has been bolstered by supportive regulatory frameworks in several major jurisdictions led by the United States.