Lighter Defies Gravity: Perp DEX Volume Soars While Open Interest Lags

Another day, another decentralized exchange defying conventional market logic.

The Volume Anomaly

Lighter's perpetual futures platform is posting volume numbers that would make traditional finance quants scratch their heads—trading activity surging while open interest remains curiously subdued. The platform is moving more digital assets than competitors despite fewer outstanding positions.

Efficiency or Speculation?

High volume with lower open interest suggests either remarkably efficient capital utilization or day traders chasing quick profits like cats after laser pointers. Either way, it's creating a fascinating case study in decentralized market microstructure.

Traditional finance still can't decide whether this is revolutionary efficiency or just crypto degens doing what they do best—trading anything that moves while Wall Street analysts try to apply twentieth-century models to twenty-first-century markets.

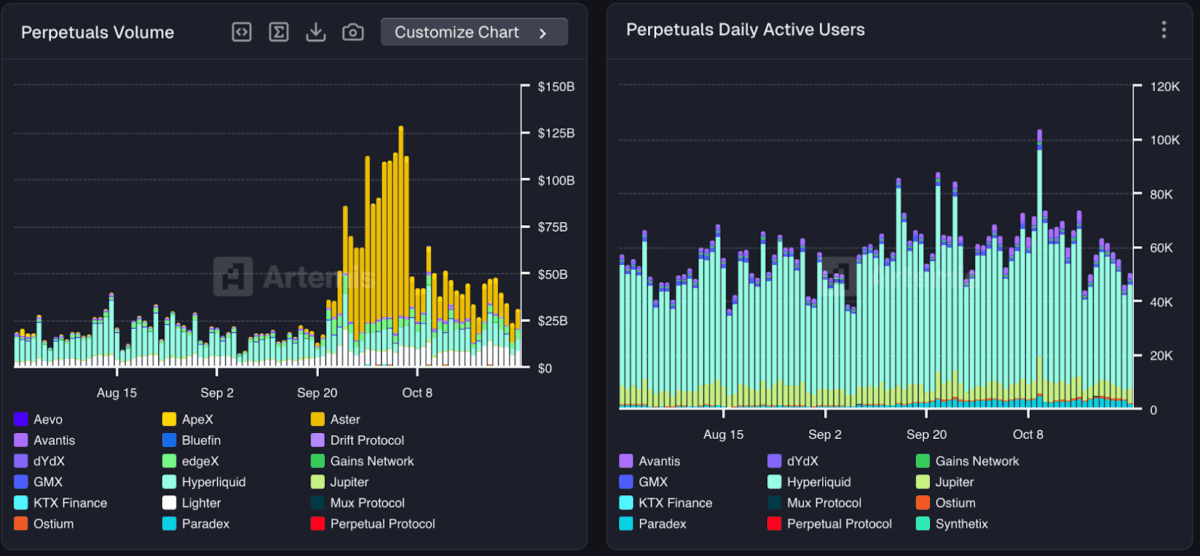

Perpetual Volume and Daily Active Users, Source: Artemis

Perpetual Volume and Daily Active Users, Source: Artemis

Besides volume fluctuations, daily active users remained consistent, with platforms like Hyperliquid, Paradex, and DYDX attracting 40,000–80,000 users per day.

Lighter runs on Ethereum using zk-rollup technology, which makes it faster and cheaper to trade perpetual futures. Its recent growth shows traders are still active, even though the overall crypto market has become less volatile.

Open Interest Trends and Market Dynamics

Open interest, a measure of how much capital is locked into open perpetual futures trades, increased during September and peaked almost to $30 billion at the beginning of last month. Hyperliquid took the biggest share, though ApeX, Aster, and dYdX also gained strongly in that peak.

However, after early-October highs, open interest normalized around $15–20 billion. Hence, even as Lighter leads daily volume, its smaller open interest suggests new participants or higher turnover, rather than long-term Leveraged positions dominating the market.

On October 27, Astros launched its perpetual DEX on the sui network, which now holds $2.6 billion in total value. “Perp DEXs have become the ultimate litmus test for a blockchain’s ability to handle real financial infrastructure,” said Jerry Liu, Astros founder.

Yesterday, Surf Protocol introduced TurboFlow, a fully on-chain trading platform that allows traders to use leverage of up to 1000x. It includes both traditional fee models and a fee-free profit-sharing option.

These shifts show how much perpetual futures have grown in crypto, now making up 26% of all derivatives trading and reaching around $1 trillion in monthly volume.

Lighter’s rise in daily trading shows more traders are joining, even if long-term positions stay small. The perpetual futures market keeps growing, and fast, low-cost platforms on new chains are driving DeFi forward.

Also Read: Coinbase Partners With Citi to Advance Blockchain Payments