Ethereum Price Surge: Bullish Momentum Accelerates for ETH in 2025

Ethereum breaks through resistance levels as institutional money finally discovers something more sophisticated than Bitcoin.

The Merge's legacy continues paying dividends as gas fees stabilize and staking yields attract traditional finance refugees.

Technical indicators flash green across multiple timeframes while Wall Street analysts scramble to update their outdated price targets.

Smart money accumulates during minor pullbacks—retail traders still busy chasing meme coins elsewhere.

Ethereum's ecosystem innovation outpaces regulatory scrutiny for now, proving once again that code moves faster than bureaucracy.

Technical Analysis

By Shayan

The Daily Chart

On the daily chart, ethereum is still moving inside a steep ascending channel, consistently printing higher highs and higher lows. After consolidating below the $4.8K resistance, ETH has pulled back slightly toward the midline of the channel. It is also staying above both the 100-day and 200-day moving averages, which reinforces the bullish macro structure.

As long as this channel holds, Ethereum is in a healthy uptrend. The RSI is also hovering around 51, reflecting a neutral momentum with potential for another leg up if bulls regain control. If buyers manage to break through $4.8K with volume, a move toward $5K and beyond would be imminent. However, a break below the channel could open the doors for a retest of the $4K or even the $3.5K support zone.

The 4-Hour Chart

On the 4-hour chart, Ethereum has been trading in a tight range between $4.3K and $4.8K, also forming a local ascending structure. The price has tested the lower bound multiple times, but each dip has been met with buying interest. This suggests that buyers are still active at these levels.

However, RSI on this timeframe has dropped to around 41, indicating weakening momentum. Therefore, if the price closes below the lower trendline or the $4.3K supply zone, the next area of interest WOULD be the purple support level around $3.8K. Until then, the overall structure remains intact with potential for continuation if ETH reclaims short-term resistance levels.

Sentiment Analysis

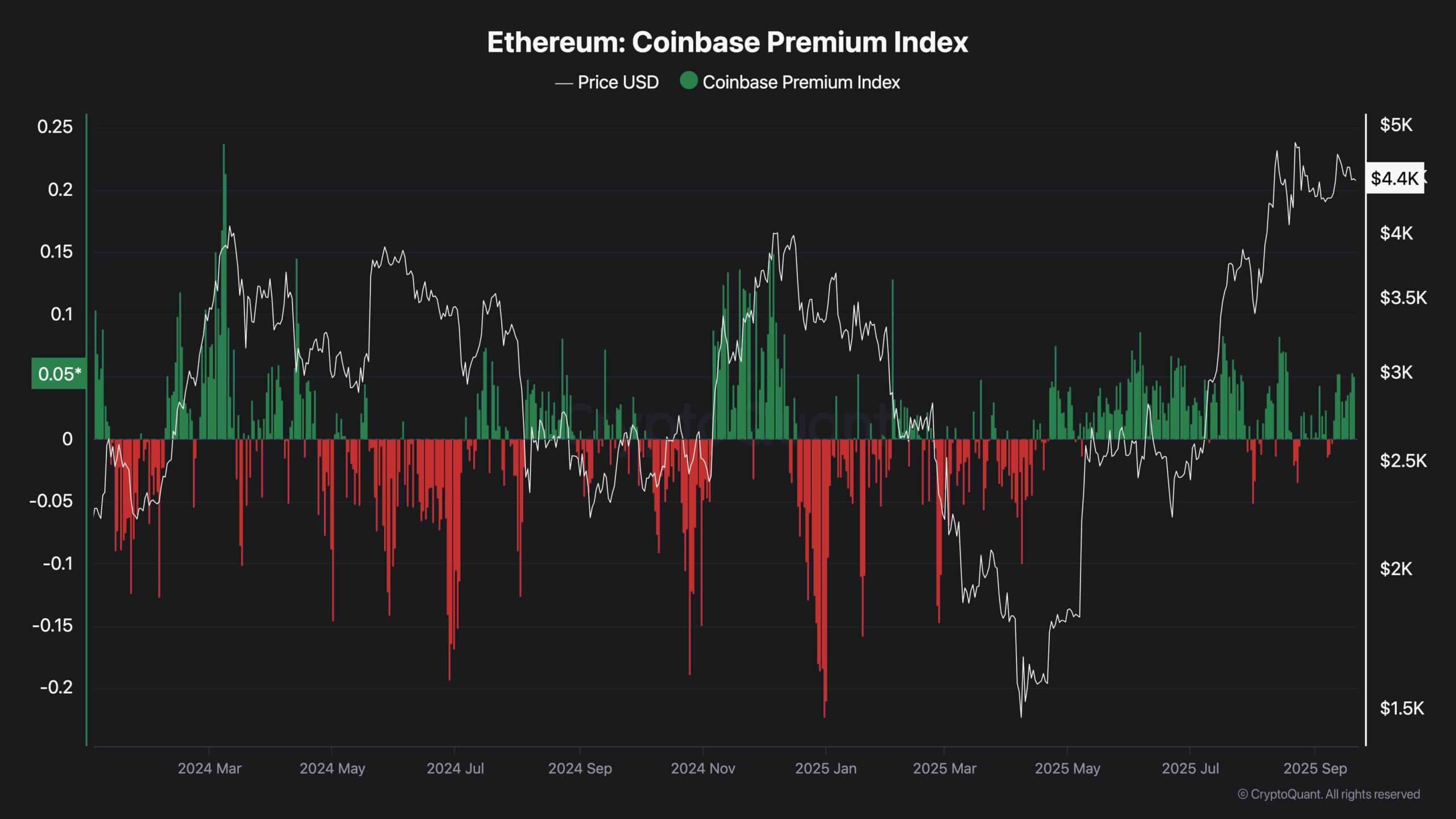

Coinbase Premium Index

From a sentiment perspective, the Coinbase Premium Index for Ethereum is showing a healthy amount of green activity, indicating positive spot demand from U.S. investors. This is often a sign that institutional and retail interest is supporting the uptrend.

Compared to past rallies, the current premium is not overheated, which means the market may still have room to grow. This positive premium has coincided with ETH’s move above $4K and its stability NEAR highs. It shows that despite the market cooling off in the short term, buyers continue to accumulate on dips.